What is PMI?

There are many macroeconomic indicators that can help a trader in trading decisions, though some of them are more important than others. One of the most important of them is the Purchasing Managers' Index. It is an economic indicator that is derived from reports and surveys from private sector companies. The indicator shows whether the economic sector improves or deteriorates.

PMI is one of the most influential fundamental indicators and tends to have a big impact on the Forex market. Usually, when the PMI in a particular country improves the currency of that country gets a boost. For example, if the PMI in the eurozone (or one of the major eurozone economies) improves the euro experiences upward pressure. Conversely, if the PMI declines the currency tends to weaken.

There are some exceptions to the rule, though. Some currencies, like the Japanese yen, are tied more to the general market sentiment, not domestic data. They tend to largely ignore domestic PMIs. Furthermore, safe-haven currencies, like the yen and the Swiss franc, react negatively to improvements in PMIs of the world's major economies and positively to their deterioration.

There are two main types of PMIs: for the manufacturing sector (the manufacturing PMI) and for the services sector (the services PMI, also often called non-manufacturing PMI). There is also the third type — for the construction sector (the construction PMI), though it is reported less frequently.

PMI reports are usually released two times a month. At first, the preliminary estimate is released, followed by the revised report couple of weeks later.

One of the major advantages of the PMI over other important economic indicators is that it shows the most up-to-date information about the economy, allowing market participants to react to changes in economic activity in a timely manner. Most other indicators are lagging, delaying the information for a month or even longer.

Another advantage of the PMI is that it is based on hard data, not on sentiment and an opinion.

The main source of PMIs is the Markit Group which releases indices for over 30 countries all around the world. Major economies also have their own analytic companies that release PMIs for their specific countries.

What is included in PMI?

The headline manufacturing Purchasing Managers' Index consists of five survey indices:

- new orders

- output

- employment

- suppliers' delivery times (inverted)

- stocks of purchases

Depending on the specific producer of the PMI, the components can have their own weight in the index or have equal weighing. Most PMI producers assign the following weights to the sub-indices: new orders — 0.30, production — 0.25, employment — 0.20, supplier deliveries — 0.15, inventories — 0.10.

The Institute for Supply Management assigns the same weighting to all the component indices.

How PMIs are calculated?

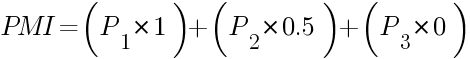

The Purchasing Managers Index is calculated using the following formula:

where:

- P1 is the percentage number of firms that reported an improvement

- P2 is the percentage number of firms that reported no change

The number of firms that reported a deterioration is not included in the calculation. To reflect this, the formula for the calculation of the PMI is sometimes written in the following way (with P3 being the percentage of firms that reported a deterioration):

What does the PMI figure mean?

If the Purchasing Managers' Index shows 50.0, it is a neutral reading, which means that the sector experiences no change, be it positive or negative. A reading above 50.0 means an improvement of the sector, while a reading below 50.0 means a deterioration. The higher the figure, the bigger the change.

The formula demonstrated in the previous chapter explains why 50.0 is the neutral reading. If 100% of respondents reported an improvement, the reading would be 100.0. If 100% of answers reported a deterioration, the reading would be 0.0. And if 100% of firms reported no change then the reading would be 50.0 (100% * 0.5).

PMI data producers

Markit Group, worldwide

IHS Markit is an information provider that was created in 2016 as a result of the merger between Information Handling Services (IHS) and Markit (initially Mark-It Partners). Its quarters are situated in London.

Markit provides data for more than 40 economies worldwide.

As for Purchasing Managers' Indices, it releases PMIs for various countries twice a month. Initially, Markit releases a flash report about three weeks into the current month. The report includes the manufacturing PMI, the services PMI, the composite PMI, and the manufacturing output index. The information provider releases an updated final estimate at the start of the following month. The manufacturing PMI is usually released on the first business day of the month, and the services PMI on the third.

Markit reports are very important and influential. They are especially important for countries that do not release their own PMI reports (at least to the general public). Also, the fact that the provider releases its reports in a big bunch over a short period of time means that their combined influence often has a big impact on markets.

Reports for major economies, like the United States and Germany, tend to affect the whole Forex market, not just the currencies of those specific countries.

Institute for Supply Management, United States

The Institute for Supply Management is the first and largest not-for-profit professional supply management organization in the world. It was founded in 1915. Currently, it has over 50,000 members across 100 countries.

ISM Purchasing Managers' Index reports are collectively known as ISM Report on Business.

ISM manufacturing PMI is based on a survey of more than 300 manufacturing firms, while the non-manufacturing (services) PMI is based on reports from more than 400 services companies.

The manufacturing report is usually released on the first business day of the month, while the services report is usually released on the third business day of the month. There are no preliminary (flash) versions of the reports.

The ISM Report on Business is considered one of the most important reports for the United States. It tends to have a strong impact not just on the US dollar but other currencies as well.

Chicago PMI, United States

ISM-Chicago is a non-profit association affiliated with the Institute of Supply Management.

The Chicago Purchasing Managers' Index, also known as Chicago Business Barometer, shows manufacturing and non-manufacturing activity in the Chicago Region.

The report is released on the last business day of the month.

Market participants and analysts are interested in the report because business activity in the Chicago Region often mirrors that of the whole United States.

Markit PMI for Germany and France

Markit releases Purchasing Managers' Indices for Germany and France as well as for the whole eurozone.

For the eurozone, Markit releases the report by itself.

For Germany, Markit gets help from the BME — the German Association for Supply Chain Management, Procurement, and Logistics. The BME was founded in 1954. It currently provides services for around 9750 individual and corporate members, including small and medium-sized businesses as well as Germany’s top 200 companies.

For France, Markit works with Conseil national des achats (CNA) — National Purchasing Council. The CNA is a non-profit making, non-union trade association, gathering individuals, and people actually involved in the purchasing activity of companies or public services.

All PMIs in the eurozone can affect the euro. But reports from Germany tend to have the biggest impact on the currency, often overshadowing even data for the whole eurozone.

Ifo Institute for Economic Research, Germany

The Ifo Institute for Economic Research is a research institution based in Munich, Germany. Ifo is an acronym that stands for Information and Forschung (research).

Ifo Business Climate Index is a composite index based on surveys of about 7000 companies in the manufacturing, construction, wholesaling, and retailing sectors. In 2018, the Ifo Institute added services industries to the survey.

Unlike other PMIs, the Business Climate Index is more subjective than objective. That is because the result is derived from asking the firms' assessment of their current business situation as well as their six-month business outlook. The business climate index is a balance between the current situation and the outlook.

The base value for the index is 100. It is the level the index had in January 2005.

The survey is released monthly since 1972. It is usually released in the third week of the month.

While the Business Climate Index is considered to be somewhat less important than Markit PMIs, it is still considered one of the most important leading economic indicators for Germany — the biggest economy in Europe. Thus, it is rather important for traders who are trading in the euro.

Markit PMI for Great Britain

For the survey in Great Britain, Markit uses the help of the Chartered Institute of Procurement & Supply (CIPS). The CIPS claims to be the largest procurement and supply professional organization in the world. It employs around 200,000 people in over 150 countries, including senior business people, high-ranking civil servants, and leading academics.

As one can expect, the report is especially important for the Great Britain pound.

Markit PMI for Japan

Markit uses help from the au Jibun Bank for the survey in Japan. The au Jibun Bank is an internet retail bank established in 2008 that is focused on providing financial services via smartphones. It was established as a joint investment of KDDI — a major telecommunication service provider — and MUFG Bank — Japan’s largest bank. The au Jibun Bank is a member of the “au Financial Group”.

Bank of Japan, Japan

The Bank of Japan (BoJ) is the central bank of Japan.

The BoJ releases the Tankan Index at the end of each quarter.

Tankan is a Japanese abbreviation for Tanki Keizai Kansoku Chousa — the Short-Term Economic Survey of Enterprises in Japan.

The survey covers approximately 10,000 companies, though most analysts and market participants are interested only in large enterprises. Even then, both manufacturing and non-manufacturing indices cover more than 1,2000 large businesses each.

Unlike the regular PMIs and similar to the Ifo Business Climate Index, the Tankan Index is more subjective as the survey asks respondents their assessment of the current business conditions as well as their outlook.

The neutral level of no change for the Tankan Index is 0.0. A reading above 0.0 means that business conditions are improving, while a reading below that level indicates that conditions are worsening.

The Tankan index is considered to be somewhat less important than PMI reports from Markit. The fact that it is released less frequently, only once a quarter, is one of the most obvious reasons for that.

Nevertheless, the index is still viewed as an important indicator of Japan's economic health, therefore it is carefully watched by traders interested in the Japanese yen and investors in Japanese assets. That said, the yen tend to have a muted reaction to domestic news, therefore the Japanese PMI is considered less important than PMIs in other major economies.

Australian Industry Group, Australia

The Australian Industry Group, also known as Ai Group, is an employers' organization that covers a wide range of industries. Its members employ over 750,000 people throughout Australia. The Ai Group monitors and analyses developments across the Australian economy and collaborates with various institutions, such as the Housing Industry Association, to produce surveys about industries it represents.

The Ai Group provides three PMI reports. The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI) is usually released on the first business day after the month ends. The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (Australian PCI) is usually released on the third business day after the month ends. The Australian Industry Group Australian Performance of Services Index (Australian PSI) is usually released on the fifth business day after the month ends.

Each index is derived from surveying about 200 companies from each respective sector.

The Australian PMI is a composite index derived from a weighted mix of the diffusion indices for production, new orders, deliveries, inventories, and employment. The Australian PCI is a seasonally adjusted composite index based on the diffusion indexes for activity, orders/new business, deliveries, and employment with varying weights. The Australian PSI is a seasonally adjusted composite index calculated from the mix of the diffusion indices for sales, orders/new business, deliveries, inventories, and employment with varying weights.

As it is evident from the components of the indices, the Ai Group indices are objective as they use hard data in their calculations.

As usual with other PMIs, 50.0 is a neutral level of no change, with readings above or below it representing respectively an expansion or a contraction of business activity.

While the Ai Group indices are considered to be somewhat less important than PMIs for other major economies, they are still a nice addition for Markit reports that allows traders and investors to gauge the health of the Australian economy.

The report is important to those Forex traders who want to trade in the Australian dollar.

Ivey Business School, Canada

Ivey Business School, or simply Ivey, is the business school of the University of Western Ontario, which is located in London, Ontario, Canada.

Ivey releases a single Purchasing Managers' Index, called Ivey PMI. It is an economic index that measures the month-to-month variation in economic activity. The index is a result of a survey of about 175 purchasing managers across various industries in different regions of the country.

The Ivey PMI has several significant differences from the similar indices provided by the Institute for Supply Management and other producers. For starters, it includes not just the private sector but the public as well. On top of that, the survey includes all sectors of the economy, not just the manufacturing and services industries. That allows the index to cover the whole Canadian economy. Also, the survey asks Canadian purchasing managers just one question: "Are your purchases (in dollars) higher, the same, or lower than the previous month?"

Similar to most other PMIs, 50.0 is a neutral value for the Ivey PMI, though the formula used in the calculation is a bit different. The survey subtracts the number of managers that reported a decrease in purchases from the number of managers that reported an increase, divides the resulting number by two, and then adds it to 50. The number of managers that reported the same level of purchases as in the previous month is not used in the calculation. Therefore, if the number of managers reporting an increase in purchases is equal to the number of those reporting a decrease then the index will be at 50.0.

The index is usually released on a third or fourth business day after the month ends.

The Ivey PMI is considered to be a fairly important index, especially because it includes the whole range of industries and therefore gives a good indication of Canada's economic health.

As a result, Forex traders who are interested in the Canadian dollar should pay attention to the Ivey PMI.

Procure, Switzerland

Procure.ch is the site of the Trade Association for Purchasing and Supply Management. The association includes about 1,100 companies from different sectors and of various sizes, as well as 500 private individuals.

Procure.ch started to report the Swiss Purchasing Managers' Index in 1995 in collaboration with Credit Suisse.

The Swiss PMI is created by surveying more than 300 purchasing managers in the manufacturing and services sectors.

The survey asks purchasing managers about their assessment on the following topics:

PMI Industry:

- Production/output

- Order volume (customer orders)

- Purchasing volume

- Purchasing prices

- Delivery dates (longer, same, shorter)

- Backlogged merchandise (as a list)

- Inventory of purchased raw materials, semi-finished goods, components

- Inventory of finished goods

- Number of employees

PMI Service:

- Business activity

- New orders

- Order volume (customer orders)

- Purchasing prices

- Sales prices

- Number of employees

The Swiss PMI is a seasonally adjusted weighted index that consists of five components.

The Swiss PMI is usually released on the first business day after the month ends.

The Swiss PMI is considered to be of relatively low importance to Forex traders because the Swiss franc reacts mostly to the market sentiment and not domestic macroeconomic data.

BusinessNZ, New Zealand

Business New Zealand Inc., called BusinessNZ, is a New Zealand business-advocacy body with headquarters in Wellington.

The BusinessNZ Performance of Manufacturing Index (PMI) is a monthly survey that provides an early indicator of levels of activity in the New Zealand manufacturing sector. It is a composite index based on the diffusion indexes for production, new orders, delivered, inventories and employment.

As with most other PMIs, a reading above 50.0 indicates an expansion of the sector, and a reading below 50.0 means contraction.

The BusinessNZ PMI is usually released about 13 days after the month ends.

Due to the relatively late release date and the limited scope, with the index only covering the manufacturing sector, the BusinessNZ PMI is less interesting to market participants than most other PMIs. Still, it can provide valuable insights into the state of the New Zealand economy. Therefore, it has some value to traders who participate in trading the New Zealand dollar.

China Federation of Logistics & Purchasing and National Bureau of Statistics, China

China Federation of Logistics & Purchasing (CFLP) is the logistics and purchasing industry association approved by the State Council. It was established in Beijing. The National Bureau of Statistics (NBS) is an agency directly under the State Council in China which is responsible for the country's statistics.

CLFP and the NBS jointly publish China Manufacturing Purchasing Managers' Index (PMI) each month. It is a leading indicator that provides an early view of economic activities in the Chinese manufacturing sector.

China PMI is produced as a result of a survey of 3,000 manufacturing enterprises in 31 industries across China.

The survey consists of 13 sub-indicators:

- Output

- New Orders

- New Export Orders

- Backlogs of Orders

- Stocks of Finished Goods

- Purchases of Inputs

- Imports

- Input Prices

- Stocks of Major Inputs

- Ex-factory Prices

- Employment

- Suppliers' Delivery Time

- Business Expectations

The PMI is a composite index that is based on the seasonally adjusted indices for five of the sub-indicators, each assigned its own weight.

As with other PMIs, a reading above 50.0 indicates expansion, and below 50.0 means contraction.

China PMI is released on the last day of the month.

China manufacturing PMI tends to have a big impact on markets due to the size of the Chinese economy and its influence on the global economy. Some analysts distrust the government data from China, putting more faith in the private Caixin manufacturing PMI. But the official report is released ahead of the private one, thus it tends to have a bigger impact.

Caixin, China

Caixin Media is a Chinese media group located in Beijing.

IHS Markit releases the Caixin China General Manufacturing Purchasing Managers' Index (PMI) and the Caixin China General Services PMI jointly with Caixin.

The Caixin manufacturing PMI is compiled from responses of about 500 private and state-owned manufacturers, while the Caixin services PMI is produced by surveying around 400 private and state-owned services companies.

The indices are derived by adding the percentage of respondents reporting higher business activity compared with the previous month and half the percentage of respondents reporting no change. As a result, the indices vary from 0 to 100, with 50 being a neutral number of no change. The number of respondents reporting lower business activity is not included in the formula.

The Caixin manufacturing PMI is a weighted average of five indices.

The Caixin manufacturing PMI is usually released on the first business day after the month ends, while the Caixin services PMI on the third. Markit stopped releasing flash versions of the indices in September 2015.

The Caixin PMI reports usually have a significant impact on markets due to the sheer size of the Chinese economy. The Australian and New Zealand dollars as well as copper tend to react especially strongly to the report. Yet the private report usually has a somewhat lower impact than official data that is released beforehand.

Do PMI reports affect the market?

The question remains: how much do the PMI reports affect the market if they do at all? After all, it does not make sense to make a trading decision on a fundamental indicator if its impact is negligible or does not exist at all.

To answer the question, we used a custom indicator in the MetaTrader 4 platform that overlays the PMI level over a currency pair chart. That way, it is easy to see whether changes in the PMI level affect the currency pair and how exactly they affect the exchange rate if they do.

In the pictures below, the red line shows the PMI level. The indicator used 10 years' worth of data unless the specific index existed for less than that. We looked at how the currency pair reacted to the changes in the PMI as well as looked at the correlation between the general trend in the PMI and the currency pair's moves.

Flash Markit US Services PMI

Due to the United States being the largest economy in the world it makes sense to look at the US reports first.

We have chosen flash reports from Markit as they are released earlier than the rest of the PMI reports and thus should have the biggest impact.

We checked the changes in the indicator versus moves of the Dollar Index — the index that tracks the performance of the US dollar against a basket of six major currencies.

For the most part, the PMI was doing a good job leading the market. For example, if look at the beginning of 2020, changes in the indicator were clearly reflected in moves of the Dollar Index.

Yet the correlation between changes in the flash US Markit services PMI and moves of the Dollar Index was not constant. Looking at the chart, we can see that the PMI made big moves in August and September of 2017, yet the Dollar Index almost completely ignored them.

And sometimes the Dollar Index and the PMI were moving in completely opposite direction. For example, in June-July 2020 the PMI was moving upward yet the Dollar Index was falling.

Flash Markit US Manufacturing PMI

Turning to the flash Markit US Manufacturing PMI, we see a much lower correlation. Quite often the Dollar Index either ignored the changes to the indicator or moved in the opposite direction, like at the start of 2016.

Even when the Dollar Index and the manufacturing PMI were moving in the same direction, it looked like the PMI was a trend follower rather than a trendsetter. To see an example of this, take a look at the Dollar Index chart at the end of 2016.

Flash Markit German Services PMI

Turning other attention to the other side of the pond, let us look at European data, specifically the flash Markit German services PMI, and its impact on the EUR/USD currency pair.

It looks like the influence of the German services PMI on the euro is weaker than the US services PMI on the dollar. Sometimes, the PMI was having a noticeable impact on moves of EUR/USD, like in October and November 2013.

But more often the changes in the PMI were completely detached from the movement of the currency pair. Take a look, for example, at the chart of EUR/USD in the period of May-July 2014.

Flash Markit German Manufacturing PMI

In the case of the impact of the flash Markit German manufacturing PMI on EUR/USD, the results were inconclusive. It was easy to find instances of a correlation between the moves of the currency pair and the Purchasing Managers' Index. Take a look, for example, at the chart showing a part of 2020.

Yet it was almost as easy to find examples of changes in the German manufacturing PMI and moves of EUR/USD being completely detached. For example, the currency pair extended its decline in June 2021 despite the increase in the PMI, reversed its rebound in July 2021 shortly after the release of the index, but managed to rebound in August 2021 despite the sharp drop in the PMI.

Overall, though, it looks like the German manufacturing PMI has a better correlation with EUR/USD than the German services PMI.

German Ifo Business Climate

To mix up things a bit, let us look at something different than Markit reports. The German Ifo business climate looks like a good candidate.

Germany is the biggest economy of the eurozone, and it seems reasonable to expect that the index that shows its economic health should have a noticeable impact on EUR/USD. But it is not the case.

While the wider trends of the index and the currency pair look to be more or less in sync, the specific changes in the index usually do not have a material impact on the currency pair. Sometimes, the index and the currency pair were even moving in opposite directions. As an example of this, we can look at the big drop of the EUR/USD pair in June 2016 that followed an increase in the index.

Conclusion

While Purchasing Managers' Indices and currencies seem to usually have a correlation in terms of a general trend when it comes to the impact of specific releases on the market the situation is far less clear.

When we look at the US reports, it looks like the services PMI has a better correlation with the movement of the US dollar and tends to lead the currency. The manufacturing PMI, on the other hand, has a weaker correlation and tends to follow the movements of the dollar. That can be explained by the fact the exchange rate can affect the manufacturing sector by influencing import and export prices. The services sector is far less dependent on the exchange rate.

In the eurozone, the situation is the opposite — the manufacturing PMI seems to be closer tied to the moves of the euro than the services PMI. The German Ifo business climate looks much more unreliable in terms of predicting currency moves than any of the aforementioned indices.

So, what does it all mean to the Forex traders? The biggest takeaway is that you cannot rely solely on the PMI reports as there is no guarantee that they will impact the market in an expected manner if at all.

Does it mean that PMI data is completely useless in trading? Not at all. But, as any indicator — be it fundamental or technical, it should not be used alone.

PMI reports with a decent impact on markets, as those released by Markit, can be used in conjunction with other indicators to make a trading decision. For example, if the PMI figure of a country is better than expected, then the currency of that country is likely to get a boost. One FX strategy where PMI can be successfully incorporated is the buy-and-hold trading strategy. Traders then can use other indicators to decide whether they should buy the currency, sell after it jumps if they have bought it ahead of the report, and when to enter the market.

If you have a question about various PMI indicators and their use in currency trading, please join a discussion on our Forex forum.