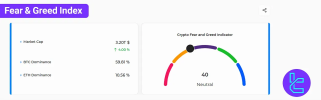

The TradingFinder Fear & Greed Index for Cryptocurrency measures crypto traders' sentiment on a scale from 0 to 100, providing insight into market emotions. This tool also displays key metrics, including market cap, its 24-hour change rate, and Bitcoin & Ethereum dominance.

The index categorizes market sentiment into five distinct ranges:

The TradingFinder Fear & Greed Index is a valuable tool for traders, especially when combined with other market indicators. It can be used for:

✅ Identifying optimal entry and exit points

✅ Risk management to avoid emotional trading

✅ Predicting potential trend reversals

✅ Confirming signals from other trading tools

The index is derived from five key factors:

Volatility – Measures market fluctuations

Trading volume & momentum – Analyzes buying and selling pressure

Social media activity – Tracks discussions on X (Twitter) & Reddit

Cryptocurrency dominance – Evaluates Bitcoin & Ethereum influence

Market trends – Assesses overall price movements

The TradingFinder Fear & Greed Index provides real-time sentiment analysis, helping traders make data-driven decisions. By combining multiple factors, this tool offers highly accurate market insights to enhance your trading strategy.

Fear & Greed Index Ranges

The index categorizes market sentiment into five distinct ranges:

- 0 to 19 (Extreme Fear): Traders fear a deeper market decline.

- 20 to 39 (Fear): The market is in a cautious state.

- 40 to 59 (Neutral): A balanced sentiment with no strong bias.

- 60 to 79 (Greed/FOMO): Traders are optimistic, chasing price increases.

- 80 to 100 (Extreme Greed/FOMO): Excessive buying driven by market hype.

Applications of the Crypto Fear & Greed Index

The TradingFinder Fear & Greed Index is a valuable tool for traders, especially when combined with other market indicators. It can be used for:

✅ Identifying optimal entry and exit points

✅ Risk management to avoid emotional trading

✅ Predicting potential trend reversals

✅ Confirming signals from other trading tools

How is the Fear & Greed Index Calculated?

The index is derived from five key factors:

Volatility – Measures market fluctuations

Trading volume & momentum – Analyzes buying and selling pressure

Social media activity – Tracks discussions on X (Twitter) & Reddit

Cryptocurrency dominance – Evaluates Bitcoin & Ethereum influence

Market trends – Assesses overall price movements

Conclusion

The TradingFinder Fear & Greed Index provides real-time sentiment analysis, helping traders make data-driven decisions. By combining multiple factors, this tool offers highly accurate market insights to enhance your trading strategy.