There are innumerable ways to approach Forex trading and to base your entries and exits on. Traders who aim to reach profitability upgrade their

Standard technical indicators (e.g., moving average, RSI, stochastic, etc.) are probably the most popular type of trading systems, especially for new traders who usually start to learn about technical analysis with basic indicators. Trading an EMA cross looks appealing when you add two exponential moving averages to a chart. Unfortunately, such trading strategies rarely work during backtests (unless some kind of blatant overoptimization is applied).

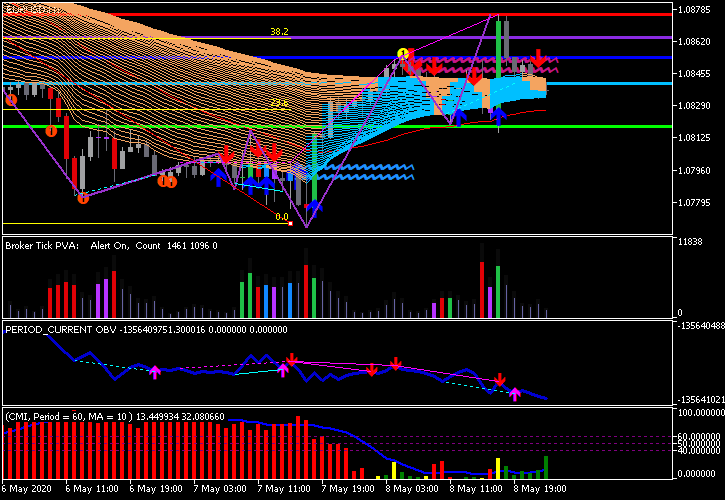

Custom technical indicators are another possibility to base a Forex trading strategy on. Custom indicators come in many flavors and there are thousands of them available online, and every trader can even build their own custom indicator for analysis and trading. Some custom indicators become legendary — like Better Volume or Fisher, or Currency Strength. It looks like a lot of traders actively trade using custom indicators. But the problem with these trading systems is that they are usually difficult to backtest due to their complexity. Of course, same as with standard indicators, custom ones can be very useful in combination with other methods of analysis. What important is not to get lost in the sea of custom indicators and know when to stop — otherwise, you risk ending up with charts like this:

Classic chart patterns (e.g., triangles, channels,

Japanese candlestick patterns (e.g., bearish/bullish engulfing, doji, hammer, hanging man, etc.) are also quite popular among Forex traders due to simplicity of the patterns — they rarely consist of more than 3 candles. Usually, backtests of purely candlestick pattern systems aren't very successful unfortunately.

Pure price action based system is a kind of a trading system that is very difficult to define. Normally, price action is understood as trading without indicators, and it often involves using all sorts of chart patterns — both classic and candlesticks. We could also define price action as trading off support and resistance levels and trend lines.

News trading is both a very attractive and very dangerous trading system to follow, especially if you are a newbie trader. Traders who want to capitalize on surprise releases of important economic news must be prepared to deal with widened spreads, considerable slippage, and delays in execution. It is for this reason that backtests of news trading strategies are more or less useless.

Based on sentiment indicators (e.g., CoT reports or sentiment indices provided by brokers) can serve as the basis for

Volume spread analysis / Wyckoff method is a subset of trading strategies that is based on the study of the market's supply and demand zones using combined information on volume, price, and time. If you have little experience with such systems and never backtested one, it might be worth looking at how experienced FX traders apply this or that form of VSA in their trading in educational videos.

It is possible to employ several trading strategies together. For example, one could use one based on classic chart patterns, one on news trading, and one on

If you want to share more details on the type of Forex trading system you employ, please feel free to do so using our forum.