If you are looking for a simple way to spot possible price reversals, you can plot the Relative Vigor Index (RVI) on your Forex charts.

This guide will teach you how to use crossovers and divergence to trade with the RVI. But first, we will explain to you exactly what the Relative Vigor Index is and how it is calculated.

What is the Relative Vigor Index indicator?

The Relative Vigor Index is an oscillator. As its name implies, its purpose is to help you visualize the relative vigor of the market.

You can use it to get a feel for what is taking place with a trend, and to try and gauge when a trend may be changing directions.

Key point:

The RVI shows you a market's relative vigor.

How is the Relative Vigor Index indicator calculated?

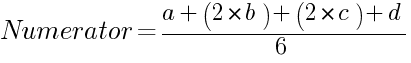

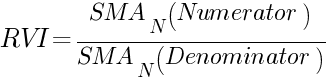

Below, we are going to show you the formula used to calculate the Relative Vigor Index. If you are mathematically-minded, you can follow it easily enough. If you are not, it might look daunting.

It helps to understand the basis for the Relative Vigor Index, which is the following set of observations:

- When price is trending upward, candles tend to close higher than they open.

- When price is trending downward, candles tend to close lower than they open.

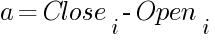

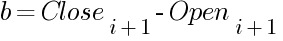

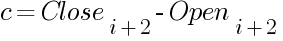

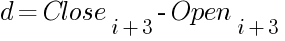

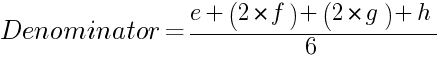

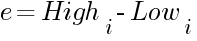

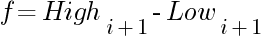

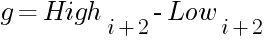

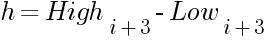

Where:

Where:

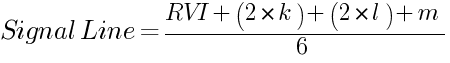

The formula for the indicator's main two lines looks like this:

Where:

You will be grateful to know you do not need to carry out any of these math calculations yourself. If you have MetaTrader 4, this software will take care of all of the math in the background for you when you plot the indicator on your charts.

Key point:

The RVI is calculated on the basis of how price usually closes in uptrends and downtrends.

What does the Relative Vigor Index show us?

When an uptrend is strong, the lines of the RVI also tend to be moving upward. When a downtrend is strong, the reverse is true.

If you see divergence, that means a trend may be weakening, which could precede a reversal.

Key point: The RVI helps you figure out how strong a trend is, and whether a reversal may be impending or occurring.

How to plot the Relative Vigor Index on your charts?

You can plot the Relative Vigor Index on your Forex charts in MetaTrader in just a few quick steps:

- In the top menu, navigate to Insert, Indicators, Oscillators, and then Relative Vigor Index.

- You can now set a period. By default, it is 10. You also can choose colors for the RVI and signal lines. By default, the signal line is red and the RVI line is green. You can adjust the minimum and maximum for the Relative Vigor Index scale in the Scale tab if you want. When you are done choosing the RVI parameters and settings, click OK.

- You will now see the Relative Vigor Index at the bottom of your chart. Normally, we would be done at this point. But if you do not see the 0 line, you may need to manually plot it.

Key point: It takes just a few quick clicks to add the Relative Vigor Index to your charts in MT4.

How to use the Relative Vigor Index while you trade?

Once you have plotted the Relative Vigor Index, you can use it to trade. Let's go over the two most common ways to use the RVI.

Crossovers

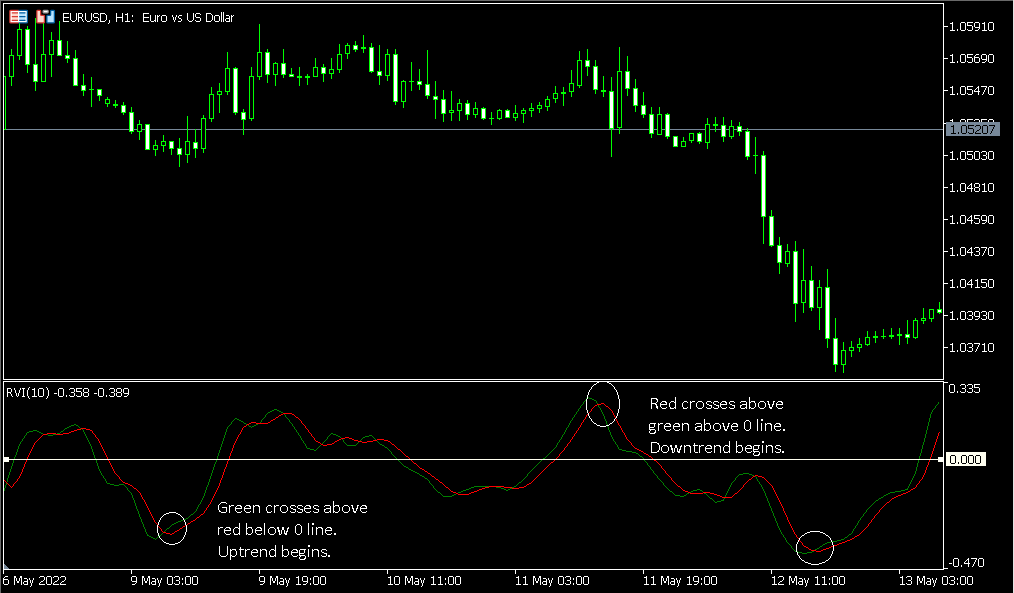

One way to trade using the Relative Vigor Index is to look for crossovers between the red and green lines.

- When you see the green RVI line cross above the red signal line, and this takes place below the horizontal zero line, that can signal the reversal of a downtrend and the start of an uptrend.

- When you see the green RVI line cross below the red signal line, and this takes place above the horizontal zero line, that can signal the reverse of an uptrend and the start of a downtrend.

Divergence

The other common way to use the Relative Vigor Index for Forex trading is to look for divergences between price movement and the indicator:

- If price has lower lows, but the RVI lines have higher lows, that is bullish divergence. It means that price may be about to reverse and trend upward.

- If price has higher highs, but the RVI lines have lower highs, that is bearish divergence. It means that price may be about to reverse and trend downward.

Key point:

You can use the RVI in your trading by looking for divergence or crossovers.

General tips for using the Relative Vigor Index

- Avoid using the Relative Vigor Index in ranging markets. The Relative Vigor Index produces its most reliable results in markets that are defined by strong trends. If you try to use it in a ranging market, you are more likely to be faked out by whipsaws.

- Use other indicators or price action. Because no indicator is 100% reliable, including the Relative Vigor Index, it is best to use this one in conjunction with one or more other indicators or tools. Alternately, you can use it in combination with price action. If the RVI and a price pattern are both giving you reversal signals, then you have established confluence and you have a potential setup.

- Always conduct tests. However you decide to use the Relative Vigor Index, you should conduct backtesting and demo testing before you trade real money. This also goes for any adjustments you make to the period or the maximum and minimum for the RVI scale.

Key point:

Like any other indicator, the Relative Vigor Index has its limitations. The tips above can help you work around them.

Conclusion

The Relative Vigor Index helps you get in on reversals. The indicator makes it easy to visualize the relative energy of the markets. By looking for crossovers or divergence, you can get in on new trends at reversal points.

For best results, use it in trending markets, look for confluence, and test your trading method thoroughly on demo before going live.

You can discuss the Relative Vigor Index indicator and its application in Forex trading on our forum for traders.