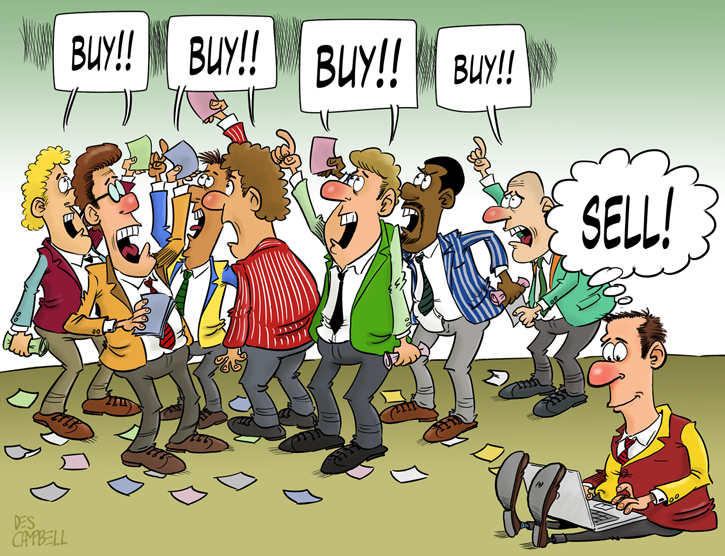

Do you trade with the crowd or against the crowd? The question is not as simple as it might look at first glance and actually depends not only on your personality as a trader but also on your approach to sentiment analysis. More than half of this website's visitors use the Commitments of Traders report, which is the best-known sentiment analysis gauge out there. This means that traders give at least some consideration to what others are doing. Even if you are trading without looking at what other traders are doing, there is no denial that many traders look for confirmation of their trades in sentiment indicators or try to bet against the crowd by looking at the same indicators. Nowadays, there are many ways to be aware of other traders' positions —

The main idea of being in the same direction as the majority of other market participants is to be buying when everyone else is buying and to be selling when everyone else is selling, which means that you will not find yourself on the wrong side of a major trend. From watching your trade being aligned with other traders' positions, you might also get confirmation of the validity of your

Setting up a position, which goes against the prevailing market sentiment, has its merits too. After all, about 75% of all retail traders are losers, so why would you want to be doing what they are doing? Straightforward trading against the crowd (against retail crowd, of course) is a

Even if you aren't a fan of a sentiment analysis (due to how difficult it is to apply it in real life), you can sometimes use sentiment indicators (mainly brokers' order/position ratios) to assess whether some of your

If you want to say something about how you use information about other people's trades in your own analysis, please do so using our Forex forum.