In Forex, we typically make money by getting in on upward or downward price trends and riding them for profits. But what about times when the market is ranging sideways? If you don't enjoy waiting out those ranging markets, you may be interested in a strategy developed especially for trading during those times. It's called grid trading. You can use it in ranging and trending conditions.

What is grid trading?

With an FX grid trading strategy, you set up a grid of pending orders above and below current price. As the price moves, these orders may be triggered. As more orders trigger, your position may grow gradually larger.

Grid trading may sound complicated at first. But once you check out a couple of examples, you will see that it is really quite simple.

The basic grid trading strategy

Here is how the basic grid trading strategy works.

- Identify whether the market is trending or ranging.

- Choose a reference price. This will be the set price you are placing your orders above and below.

- Create a grid of orders above the reference point. In most cases, you should space them evenly apart.

- Create a grid of orders below the reference point. In most cases, you should space these evenly apart as well.

- If the market is trending, place orders to buy above the reference price, and orders to sell below the reference price.

- If the market is ranging, place orders to sell above the reference price, and orders to buy below the reference price.

How large do you make the grid? What determines the highest price for a buy order, and the lowest price for a sell order? To determine those, take a look at the highest high and the lowest low for the recent period (you can decide how long that period will be). You can use those as your highest and lowest orders.

- Choose your position size for each order. This will take some careful consideration, as you will need to think about what you want your maximum possible exposure to be if all the sell orders or all the buy orders are triggered.

Key point:

Forex grid trading system is a unique strategy that involves setting a reference point, and then creating a grid of orders above and below it. Different versions of this strategy exist for trending vs. ranging markets.

Examples of the grid trading strategy

It is easiest to picture how the grid trading strategy works by looking at some examples.

Example 1: Ranging markets

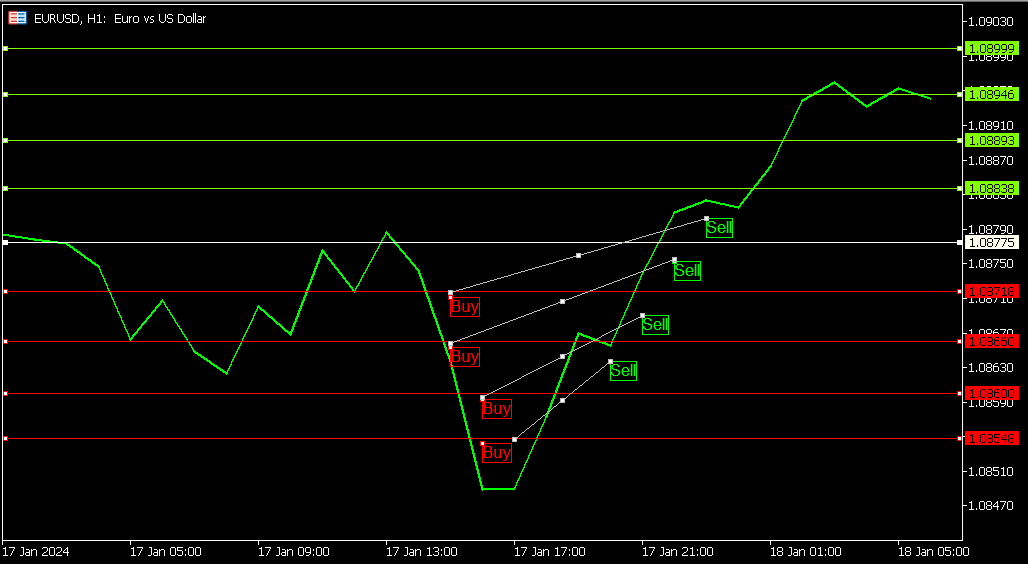

Here is an example of how you could carry out the grid trading strategy in a sideways/ranging market.

The gray horizontal line in the middle of the chart is the reference line. We have placed red and green lines below and above the reference line at roughly even intervals.

Price drops below the reference line. You have buy orders set to trigger every time price hits one of the red lines.

This may seem counterintuitive, because you are buying more and more of a currency pair as its price is falling.

But eventually, price reverses, and begins rising again.

You have sell orders set to trigger. These are also spaced roughly evenly. Each sell order corresponds with one of the buy orders, and is set at an interval above it so that you are taking profit for each one.

By the end, you have made up for all of your original losses, and you have come out ahead with a modest profit.

This is despite the fact that you initially were racking up losses.

Key point:

The grid trading strategy for ranging markets involves placing a series of buy orders as price is dropping, or a series of sell orders as price is rising. When price reverses, you have orders set at intervals to take profit.

Example 2: Trending markets

Here we have an example of how you could execute the grid strategy in a trending situation. In this image, we see EUR/USD in a downtrend that extends for most of a week.

Once again, the white line represents the reference line. You then make a grid of lines below it.

Note:

If you are not sure if the market is about to break out up or down, but you expect it to trend, you could also have created a corresponding set of lines above the reference line, as we did in the first example.

Instead of buying at intervals when price drops below the reference line, as you would in a ranging market, you instead sell at those intervals. Your position grows, but in a way that is more and more profitable.

At the end, you simply get out of the trades, closing all the positions. There is no need to wait for a reversal as in the ranging example.

What about stop-losses? Good question. There are two common approaches:

- Fixed stop-loss: Some traders simply set a fixed stop-loss on the other side of the reference line.

- Trailing stop-loss: Other traders choose to trail their stop-loss as the trend continues.

As with any other type of trend trading, you can either get out when you feel satisfied or are concerned there is going to be a reversal, or you can try to ride out the trend for as long as possible.

Some people choose not to keep all their orders open as the trend progresses. Instead of accumulating a progressively larger position, they instead close each of their orders every time they open a new one. This keeps them trading the trend, but locks in some gains along the way (assuming they continue to appropriately use stop-losses).

Key point:

There is also a grid trading strategy for trending markets, where you open your trades in the same direction price is moving.

Best practices for the grid trading strategy

Here are a few quick tips to help you get the most out of using the Forex grid trading strategy.

- Do not go overboard with the density of your gird! If you do, you will trigger so many orders that you will be drowning in transaction fees. That means you will need higher profits to offset them.

- There are multiple approaches to how you can determine the grid intervals. Some traders like to calculate the intervals using the Average True Range (ATR). Whatever method you use, however, you should try to space them roughly evenly from each other.

- Always have some kind of a stop-loss set up. Remember, if you have multiple open positions, then you will need to have stops set up for all of them.

- Pay close attention to market context before you start setting up a grid trading session. Try and use this strategy in the situations where it is most likely to generate a profit, and do not mix up the approaches that are suited to ranging versus trending markets.

- Adding take-profits to automate favorable exists might be a good idea in both ranging and trending types of the grid trading system.

- As with any other strategy, you will need to thoroughly study grid trading strategies, and then follow that up with backtesting and demo testing. Do not start trading using the grid strategy live with real money until you are profitable in demo.

Key point:

Following the best practices recommended above will maximize your chances of success using the FX grid method.

Advantages and drawbacks of the Forex grid trading strategy

To help you understand what you have learned, let's go over the pros and cons of trading with the foreign exchange grid strategy.

Grid trading strategy benefits

- You can profit from grid trading in ranging markets where many other trading methods do not work. But you also can profit from it when markets are trending up and down.

- You do not need to know which direction price will go to profit from grid trading.

- You can automate grid trading with minimal effort.

- Theoretically, you can eventually recoup your losses through grid trading, and then come out ahead.

- You can combine grid trading with other strategies. For example, you could use technical analysis or price action to determine that a trend is likely to start, and then you could use the grid trading strategy to enter and manage your trade.

- Grid trading is unlike any other system. It involves a completely different way of looking at Forex trading and approaching it than most traders are used to. That alone can be quite a draw.

Those are some compelling benefits. Just keep in mind that you absolutely must make good use of stop-losses. This point cannot be emphasized strongly enough. If you do not use stop-losses, you could find yourself with potentially devastating losses.

Key point:

The grid trading strategy is an interesting method that can potentially help you profit in ranging or trending markets, with or without guessing the direction price will go.

Grid trading strategy risks

- The grid system can get to be complicated, especially if you have a large grid. Keeping track of and managing your positions can become a convoluted process. You may find yourself struggling to understand what is going on with your money, and what the implications would be of different possible outcomes (i.e., getting out now, versus after the market moves in a particular direction).

- Without the proper use of stop-losses, it is easy to lose a lot of money with grid trading, and it can happen very quickly.

- While automating grid trading can be efficient and effective, a system involving so many orders has a lot of potential to "misfire". Leaving your trading bots unmonitored can heighten your risks, as there are so many potential ways they could perform differently than you tried to program them to.

- Sudden volatility in the markets could wipe you out pretty quickly, and/or stop you out of multiple positions unexpectedly.

- This method involves a lot of visual "noise." We have kind of touched on this with respect to the complexity of grid trading. But even just from a sensory standpoint, some traders may find it overwhelming. You could understand what you are looking at, but feel overloaded and have a hard time focusing.

- The method requires patience in order to be successful. You are stacking up a lot of small profits, and you may also sustain some heavy losses on your way to becoming profitable.

- To weather the large losses that are possible with grid trading, you need a ton of capital. Otherwise, margin calls and stop-outs may ensue.

- Grid trading in ranging markets as we discussed in our first example is similar to the Martingale strategy. The Martingale strategy is notorious for wiping out investors and gamblers. We will discuss this in detail below.

Key point:

The grid trading strategy has some significant potential drawbacks, including the need for a large amount of capital and a low risk-to-reward ratio.

How the grid strategy is similar to the Martingale strategy

You may be familiar with the Martingale strategy, especially if you have a background in playing casino games or betting on sports. If so, you probably realized at some point during our discussion that the ranging market grid strategy has a lot in common with Martingale.

If you are not familiar with Martingale, it is a strategy where every time you lose a bet, you increase your stake size for your subsequent bet. You continue to do this until you win a bet. At that point, in theory, your last bet will have been large enough to offset all of your previous losses, plus give you a profit on top of that.

The Martingale strategy appeals to bettors and investors because it makes winning seem like a sure thing. You just have to last long enough, and eventually, the theory goes, you will get there.

There are several problems with the Martingale strategy, however:

- The Martingale strategy assumes that you have an unlimited amount of money in your trading account. If you have anything less than infinite funds, the strategy will fail over time.

- Losses usually stack up very fast with Martingale, blowing you through your account more rapidly than other approaches.

- You have to risk a lot of money in order to potentially win a comparatively much smaller amount of money.

- Eventually, you could run into walls with maximum trade size/leverage.

Now let's loop back to discussing the grid trading strategy for Forex. Specifically, let's focus on the grid trading strategy for ranging markets. When you execute this strategy, you are buying as price drops, or selling as it rises. With every new order you place, you are adding to your overall position size, while the market continues to move against you.

If the market eventually turns around and moves in the opposite direction, you will then buy or sell as needed to exit each individual position at a profit.

But what if that doesn't happen — or does not happen in time? What if you just keep increasing your overall position size while your losses keep piling up? Before you know it, you could find yourself facing a margin call.

By using the grid trading strategy, you are exposing yourself to the same types of risks you would be by using the Martingale strategy, or similar progressive position sizing systems.

Key point:

The grid trading strategy used in ranging markets involves increasing your position size while price moves against you. It is similar to the Martingale strategy, a notoriously unprofitable money management system.

Should you use the grid trading strategy?

You now should have a pretty good idea of what the grid trading strategy is, how it works, and its pros and cons. The next question is, should you use it?

That depends on your individual goals and your appetite for risk.

At least in the short term, there are investors who seem to see good results with grid trading. If you are carefully following all best practices and making sure you are capping your risk, there is no reason you cannot give it a try.

In particular, the grid trading strategy for trending markets, may not be as dangerous as the one used for ranging markets. You are buying/selling in the direction price is moving, rather than against it.

But in the long run, there are some pretty good reasons to avoid the ranging market strategy we have discussed for Forex. As we explained, you do not have an infinite bankroll at your disposal. If you want to use the version of grid trading designed for ranging markets, it is likely going to bust you out of the market. It may not do this immediately, but over time, it probably will.

Plus, it just does not make a whole lot of sense to risk a great deal of money in order to have the chance to make a relatively small amount of profit. There are other Forex strategies offering a better risk-to-reward ratio.

Key point:

It is up to you whether to use the grid trading strategy or not. Just make sure you are aware of its significant risks before you consider proceeding with it.

Summary

When you first encounter grid trading, it may seem pretty strange and incomprehensible. But once you learn the basics, you will start to see how you could potentially apply these strategies in ranging and trending markets.

Grid trading offers some benefits. It is easy to automate, and you can trade without knowing which direction price is going to go. It can be used in conjunction with other strategies, and in a variety of market conditions, making it versatile. Hypothetically, if you can last through your losses, it could produce reliable gains.

But grid trading can also have pitfalls. Careful use of stops can help you avoid sudden, large losses when buying or selling in the direction of price movement during a trend. But the Forex grid strategy for ranging markets presents other potential pitfalls, as it features a high risk-to-reward ratio, and is similar to the unprofitable Martingale strategy.

Ultimately, whether you trade using the Forex grid strategy is up to you. Just make sure that if you do, you approach it with an abundance of caution.