The Forex market can be very profitable if luck turns your way, but the market can also be very dangerous if it does not. There are plenty of methods to protect yourself from excessive losses - stop-losses, diversification, etc. One such method is hedging. This article explains what hedging is, how it is different from netting, its benefits and drawbacks compared with netting, and how hedging works in MetaTrader 5.

What is hedging?

Hedging is the practice of opening a position in a direction that is opposite to your already existing position. But why would you want to do something like that? This is to avoid potential losses in case the market goes against you.

Let us look at an example. You opened a long position on a currency pair with the size of 2 lots. But what if the price of the currency pair goes down, not up? To protect a part of your capital, you open a short position on the same currency pair that is 1 lot in size. So, if the market does not go your way, your loss will be essentially halved. You can reduce your loss even more with the proper usage of stop-losses, timely recognition of a developing downtrend, or other methods that can suggest to you when it is time to close the long position.

Of course, if the market goes in the direction you were expecting, your profit will also be halved. But that is the price a trader should be willing to pay if they want protection from losses. And obviously, you can reduce that price by using the methods mentioned above that will suggest you close the short position in time.

It is important to remember that hedging involves opening separate positions that are managed completely independently even though they are using the same financial instrument (the same currency pair for example).

In essence, you can think about hedging as a sort of replacement for stop-loss, which helps you mitigate potential losses if the market goes against you. The benefit of this method is that you can close positions separately while they are still in green. So, for example, if the market was rising but then reversed its movement, you can close your long position while it is still profitable and start acquiring profits on your short position at the same time.

What is netting?

Netting also involves placing several orders on the same instrument. The difference from hedging is that those orders will be executed on the same position, not separate ones.

Let us look at the previous example where you have placed a long order with the size of 2 lots and a short order with the size of 1 lot. On a hedging account that will result in 2 positions, one long with the size of 2 lots and one short with the size of 1 lot. But on a netting account those order would be consolidated into one position, resulting in one long position with the size of 1 lot.

Take note that the opening price of the resulting consolidated position will be equal to the weighted average of all the opening prices of the orders that were consolidated.

Hedging vs. netting accounts: Advantages and disadvantages

Pros and cons of hedging accounts

The main advantage of hedging accounts is the flexibility they allow for executing your strategies and risk management. They allow you to have separate stop-loss and profit-taking levels for each position, letting you fine-tune your trading for the current trading conditions and promptly react to changes in those conditions.

You can use several different strategies on the same currency pair if you are using a hedging account. A hedging account also allows you to use several different expert advisors separately on the same pair.

The downside of hedging accounts is that they can be too complex for a newbie trader, especially if the trader opens too many positions or trades too many instruments at the same time. The overcrowded orders list can be difficult to manage and can slow your reaction to changes in the market.

Hedging accounts also have increased costs compared with netting accounts. This primarily materializes in the previously mentioned costs in the sense of hedging eating away your profits. However, there are other costs, such as the worse swap rates and increased margin requirements. As each position in a hedging account is tracked separately, your broker may impose margin requirements on each position separately. While this does not make you lose money outright, it will tie up your capital that you could have used for trading otherwise. You should remember, though, that different brokers have different rules, and some brokers allow long and short positions to offset each other.

Finally, not all brokers allow hedging accounts. In particular, hedging on the Forex market is banned in the United States. Therefore, US brokers will not offer hedging accounts for Forex traders.

Pros and cons of netting accounts

The biggest advantage of netting accounts is their simplicity. As only one position can be associated with each instrument at a time, you are unlikely to be overwhelmed by messages in the orders list unless you are trading a ton of instruments simultaneously.

Additionally, netting accounts cost less, as regardless of the number of orders on the same instrument, they will be executed on the same position, meaning you will pay costs for only one position. In the aforementioned example, with a long order with the size of 2 lots and a short order with the size of 1 lot, you will pay costs just for the one resulting long position. In the case of a hedging account, you would have to pay costs for the long position and the short position each.

The disadvantage of netting accounts is the lack of flexibility. If you place a short order half the size of your long order, as in the previous example, your profits from rising prices will be halved no matter what. Yet, in the case of a hedging account, you would have a chance to close the short position early if you catch the developing uptrend in time and protect your profits with stop-losses and other methods that will not eat away at your profits.

Employing different trading strategies or different expert advisors on the same currency pair isn't feasible using a netting account. Traders usually counter that restriction by opening multiple netting accounts.

Hedging accounts in MetaTrader 5

Initially, when MetaTrader 5 was released in 2010, it allowed only netting accounts. Hedging accounts were added in 2016, and now you can easily open a hedging account, provided your broker allows it.

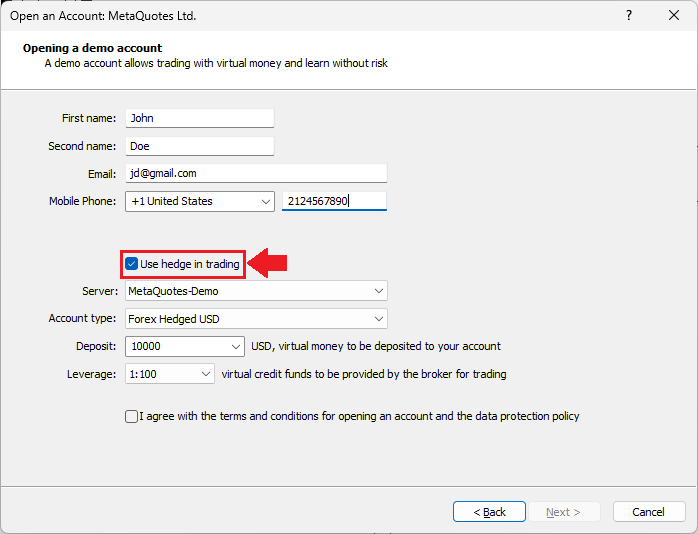

Opening a hedging account in MetaTrader 5 is fairly easy. Usually, you will just need to tick the Use hedge in trading checkbox.

Some brokers may require additional steps or special permission to allow you to use hedging on your account. You would need to contact them beforehand if that is the case.

If you are not certain whether hedging is enabled on your account, look at the terminal window header. It should have Hedge in its title if hedging is enabled.

Additionally, you can look at your trading Journal. It will mention the hedging mode somewhere close to the beginning:

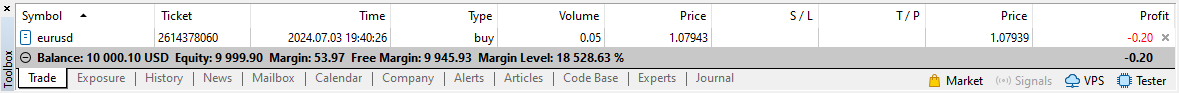

If you open several positions on the same instrument in a hedging account, your Trade tab should show them separately:

If they are combined into one, you have a netting account.

Netting accounts in MT5

If you want to open a netting account, you can do it the same way as you would open a hedging account, the only difference being that you need to untick the Use hedge in trading checkbox.

To be certain that you are trading on a netting account, look at the title of your terminal window. You should Netting instead of Hedge:

In the example with a hedging account in the previous section, we have opened a long position with a size of 0.1 lot and a short position with a size of 0.05 lot. This resulted in two separate positions displayed in the Trade tab. If we perform the same actions on the netting account, we will see a single long position with the size of 0.05 lot instead:

Conclusion

Both hedging and netting accounts allow traders to mitigate losses in case of losing trades. Netting accounts are less complex and are recommended for new traders. Hedging accounts allow more flexibility in executing trading strategies and tackling risk management and are more suited for experienced traders.

Opening a hedging account in MetaTrader 5 is very easy. But you should consult with your broker first to learn whether they allow hedging. If you trade with a US broker, you will not be able to use hedging.