One of the most important issues in Forex chart analysis is the validity of using the Open/Close values in daily and intraday charts. As you know, majority of FX traders use either candlesticks or bar charts. It has probably already come to your attention that each bar and candlestick consists of only four values — Open, Close, High and Low. In candlestick pattern analysis, Open and Close levels are very important. For example, a doji pattern requires Close level to be the same as Open. Many expert advisors and indicators rely on open and close levels. For example, standard moving averages are applied to Close price.

The problem is that Open/Close levels do not mean much for D1 (daily) or lower timeframes in the foreign exchange market. While daily Open/Close levels are very important in stock market, there is nothing special about daily Open/Close in Forex (except, maybe, Monday Open and Friday Close at the UTC time zone). It becomes obvious when you consider the fact that different traders operate in different time zones and actually look at bar charts with their own daily Open and Close levels.

Moreover, as there is no global daily sessions in Forex, nothing special is happening at the end of a daily bar or at the beginning of the new one. Intraday timeframes give even less significance to Open/Close levels. The only factor that makes them valuable is that many traders look at the same timeframe and see the same picture.

While High/Low values may fluctuate similarly depending on the time zone, they are more meaningful as they show actual mathematical maximum or minimum for a period whereas Open and Close are just prices at some conventional but insignificant moments of time. That being said, Open/Close levels are not going anywhere and even though all FX traders are aware of their disadvantages, they still use them in trading. At the same time, it is prudent to base strategies on immediate price or High/Low instead of Open/Close whenever possible.

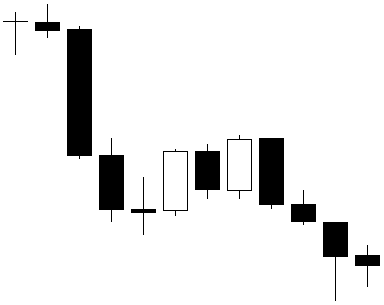

It is also worth noting that Open/Close levels are completely valid and are very important on weekly timeframe as the Forex market is characterized by fairly well-defined weekly trading sessions. This comes with one caveat though: there are brokers, whose charts includes Sunday candles which make unwanted confusion like 'possible morning star forming'. These candles are shown because of different opening/closing time (time zone UTC-X) and consist of first hour of trading after the weekend. The same could happen with Saturdays at some brokers (with time zone UTC+X, where X is greater than 3). That is why it is important to do your technical analysis at brokers with charts that open on Monday and close on Friday.

If you have something to say about advantages or disadvantages of using High/Low values vs. Open/Close values in currency trading, you can proceed to our Forex forum.