Imagine thinking that you had found a special Forex investing opportunity through your connections in your community only to get scammed out of everything you invested. That was what happened to an estimated 700 victims who collectively lost over $80 million to a Forex scam called OASIS.

Below you will read on what this scam was, how it worked, and how you can avoid falling prey to similar Forex scams.

How the OASIS Ponzi scam worked

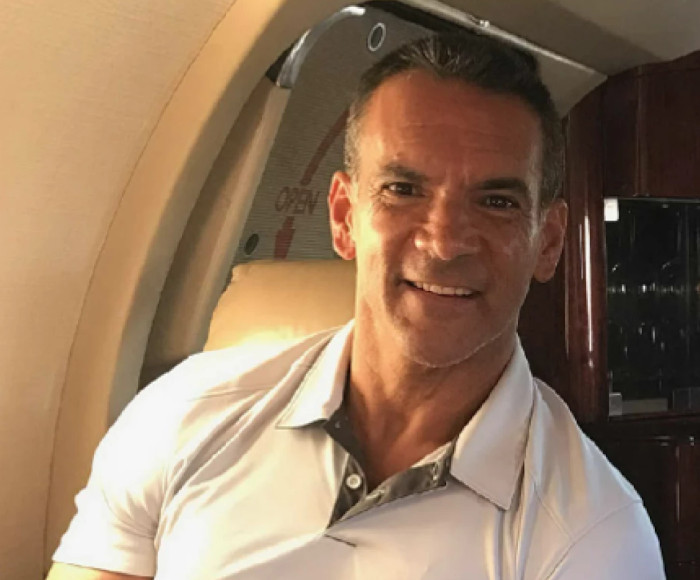

The OASIS scam was run by a 57-year-old man from Sarasota, Florida, named Michael J. DaCorta. His investment company's formal name was Oasis International Group, Ltd. But it was usually just referred to as "OASIS".

DaCorta lured in his victims by telling them that OASIS was a "market maker" that was able to collect the "spreads" of Forex trades. He claimed that because OASIS was (supposedly) profiting on the spreads of Forex trades, that investing in OASIS was a risk-free way to earn passive income.

In reality, OASIS was operated as a Ponzi scheme. That means that rather than paying investors from "spreads" or trading revenue, OASIS was simply paying the old investors out of the funds that were deposited by the newer investors.

Running a Forex scam as a Ponzi scheme isn't ultimately sustainable. But it allows a scammer to create an illusion over an extended period of time that the firm and its investors are profitable. This holds off suspicion and keeps customers investing.

What did DaCorta do with the money?

Some victim funds were used to pay other victims, as discussed above, keeping the Ponzi scheme going. But DaCorta spent much of the money on himself.

His purchases were well in line with what is typical among Forex scammers. He purchased homes in Florida worth millions of dollars, vehicles for family members, and memberships in country clubs. He also took luxury vacations to locations around the world, flew on private jets, and funded college education for members of his family.

In addition, he hosted lavish parties over the holidays, to which he invited his investors. As we will discuss later, this was part of what contributed to the false impression of trust and success he had built.

How DaCorta was taken down

Eventually, the Commodity Futures Trading Commission (CFTC) began to figure out that something was off about OASIS. As they looked into it, they discovered that it was likely to be a Ponzi scheme. From there, they handed over the investigation to the FBI and IRS.

During the investigation, FBI agents dug into the accounts to trace how money was being moved around. They also had to analyze trading activity.

Eventually, the FBI and IRS sent an agent undercover. Pretending to be an investor, the agent collected additional information and evidence against DaCorta.

The investigation revealed two things:

OASIS was losing money with its trading activities, and reporting the opposite to investors.

DaCorta was the one profiting from the scheme.

Interestingly enough, the National Futures Association (NFA) had actually gone after him in the past. The NFA had banned him from soliciting US citizens to participate in Forex. But the NFA ban was not public, so even investors doing their due diligence could not find out about it.

Finally, the IRS and FBI had enough evidence on DaCorta for his arrest, which took place in December 2019. In October 2022, DaCorta was found guilty and then sentenced to 23 years in prison.

How did DaCorta gain his victims' trust?

The OASIS case is an interesting one, because the FBI and IRS investigation offered a lot of insights into how DaCorta was able to manipulate his victims.

- Community connections: DaCorta was involved with his local community, and became very well-connected.

FBI agent Rick explained:

One of the biggest things was it was pitched as a family- and friends-only type thing. So, the people that were victimized got other close friends and family relatives to also invest. And so, by doing that, there was a sense of trust that my, you know, brother or coworker or father or family members had already invested in, so therefore, I'm going to trust them a little bit more in that it's a closely held thing. So, there's some familiarity and security, or sense of security, from that.

- Lavish lifestyle: Because DaCorta had lots of luxury items (i.e. mansions, vehicles, etc.), he gave the impression of success to investors and community members. They just did not realize that what he was successful at was conning, not trading.

- Social events: DaCorta threw expensive parties for investors, making them feel like they were a part of his success.

- Past work history: Before he became a Forex scammer, DaCorta worked on Wall Street as a stockbroker. This gave him an existing professional reputation that inspired trust. It made it easy for investors to believe he possessed the expertise that he claimed he had.

- Customers could withdraw (at first): During the early stages of a Ponzi scheme, a scammer can maintain the illusion that all the funds are accessible and can be withdrawn at any moment.

Rick explained how this worked:

People would invest smaller amounts of money at first to test the waters and see if this was real or not. So, they might put in $50,000 or $10,000, and after several months, they would take a portion of the money out, or all of the money out, and they would receive some interest payments.

And so, even though this was just taken from other investor money ... for the victim, it gave a sense of security that, 'Hey, I put in $10,000. I was able to take it back anytime I want. So now I'm going to move forward with my 401(k) or my retirement or, you know, whatever it might be, and invest $100,000 or $200,000,' because they had that sense of, 'This must be legit because I received some interest payments already.'

Lessons we can learn from the OASIS Forex scam case

Now that you know the details of the OASIS scam, we can discuss some important lessons we can take from it.

- One of your main takeaways should be that the OASIS victims were not stupid. Many of them looked up the company and DaCorta's background, and even cautiously tried to test the legitimacy of the company with smaller initial investments. But they still ended up getting scammed. So, never assume you are "too smart" to get scammed. Anyone can fall for a scam, even while being cautious.

- "Friends and family" are not always trusted sources for investment opportunities. For starters, some "friends" are not your real friends. DaCorta was very good at convincing people he was their friend, even going so far as having his children play with their children. But he was only there to scam them. As for family and friends that are real, do not forget they may have been scammed themselves.

- Being able to withdraw funds is a good sign, but it is not proof that you are in the clear and not dealing with a scammer.

- Beware of that "too good to be true" feeling you might get about a Forex investment opportunity. If something seems like it is too good to be true, it likely is. Do not get carried away by unrealistic hopes.

As we mentioned before, some investors did check into DaCorta's background, and missed the NFA decision since it was not public. But you should still conduct a thorough background check before you invest with anyone. Check for past lawsuits, bankruptcy filings, court filings, etc.

Finally, the FBI reminded investors in their post about OASIS that if they suspect that there is a scam afoot, they should contact the FBI to report it. There is no harm in doing this, even if you do not have proof. And if you are suspicious at all, you should not invest your money—or you should withdraw everything you can as soon as possible.

PS: It appears some party related to the OASIS company has created a dedicated website attempting to represent the entire case as an unlawful act by government agents. Whether it is a particularly interesting case of Stockholm syndrome or an attempt to restore DaCorta's reputation is for you to judge.