Many people think of Bitcoin as an investment and rightly so, it has grown from being worth fractions of a penny to being worth thousands of dollars in mere years. Price fluctuations have made it a popular commodity to trade both in the spot and futures markets. Bitcoin's daily trading volume reaches many billions USD nowadays. This type of volume has driven a large need for liquidity in the market — essentially, bitcoin loaned to margin accounts so that active traders could increase the size of their positions. If you do not want to engage in speculative trading using bitcoin. Many popular exchanges now let their users offer

In this tutorial, you will learn how to loan bitcoin out to margin traders on some of the more popular exchanges. You will see the actual

Bitfinex

Bitfinex is one of the most established exchanges running today. It is composed of two legal entities — BFXNA Inc. and BFXWW Inc. Both are operated by a single parent company (iFinex Inc.), are registered in British Virgin Islands, and do business out of Hong Kong. It has a stellar reputation and lots of volume. Volume is the key to putting your bitcoin to work for you. The more trading people want to do, the more likely they are to borrow your funds to do so. Bitfinex has the volume to keep your bitcoin actively loaned and earning interest.

Getting started with Bitfinex

Setting up an account with Bitfinex is simple. You will be asked for a username, email address, and password of your choice. Enter this information, verify your account by following the link in the email Bitfinex sends, and then your account will become activated.

Once you have logged into your account, the homepage can be used to deposit bitcoin. The link is at the

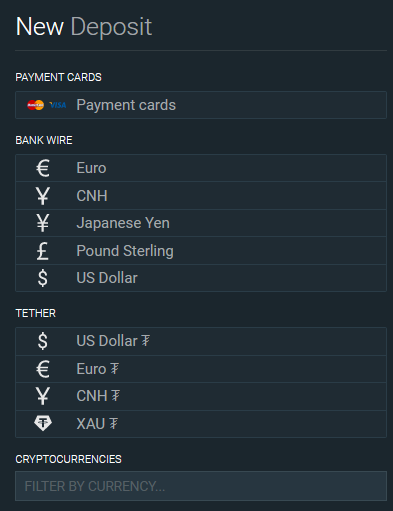

Bitfinex accepts deposits in bitcoin (and other cryptocurrencies) and in USD by bank wire transfer. Bitcoin or other crypto are preferable because they avoid the hassle and fees associated with a bank wire. Bitfinex requires a minimum of $50 to offer margin lending (called Funding in this exchange), so make sure you deposit at least that amount in bitcoin.

The money you wish to use in margin funding should be moved to the special Funding wallet within your account. There are three wallets in total for your account at Bitfinex: Exchange, Margin, and Funding. The last one is the one you need to use to earn by making loans.

Lending options

Bitfinex offers two interfaces for setting up your lending operations. The first one is the normal Funding page — it is easy to understand and is quite powerful on its own, especially if you aren't going to actively manage more than 10 loans simultaneously. The second interface is Lending Pro, which is aimed at big lenders. It allows optimization and automation of the lending process to maximize your potential profit. Both interfaces are interconnected — you will be seeing offers created via Lending Pro on the normal Funding page and you will be able to read detailed reports about funding provided via the normal interface on Lending Pro.

Basic funding

On the Bitfinex homepage, choose the Funding tab to the right of the logo. This will display get you to the margin funding page. Where the

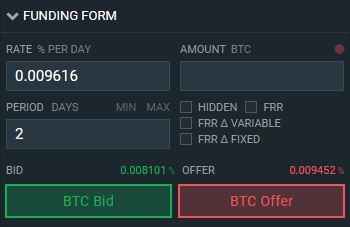

Select the currency you are lending — in this case, BTC. Then fill out the daily interest rate, loan amount, and loan period (2–30 days). Then you need to click the Offer button (e.g., BTC Offer if you are lending BTC).

You can take advantage of the Bitfinex Flash Return Rate (FRR) to help automate your loans.

If you turn FRR on, Bitfinex will automatically assign your loan an interest rate based on the average of the total fixed rate positions, weighted by the size of the loan and terms. FRR is not the optimal way to make money, as it will sometimes lead to your loan being offered at a rate that is not competitive enough. Letting your loan sit idle and not earning interest will cost you a lot of returns in the long run. There are three types of FRR on Bitfinex:

- Normal FRR — works just as explained above.

- FRR delta variable — you specify a delta that will be added/subtracted from the FRR. The FRR is continuously recalculated. Once the offer with that rate is matched, it becomes a normal fixed rate offer.

- FRR delta fixed — like the FRR with a variable delta, but FRR is calculated only once.

You can also make the offer Hidden. Hidden offers aren't seen among the funding order book, but will get executed once someone bids for the rate given in such an offer.

Rates on Bitfinex can move rapidly between 0.01% and 0.2% daily interest. It is in your best interest to keep a close eye on your loans to make sure they are competitive at all times.

Once you have set up the loan to your liking, hit the red Offer button. Your loan will then enter the lending pool and will be automatically assigned to a borrower who agrees to the terms. You can follow your loans on the Funding page.

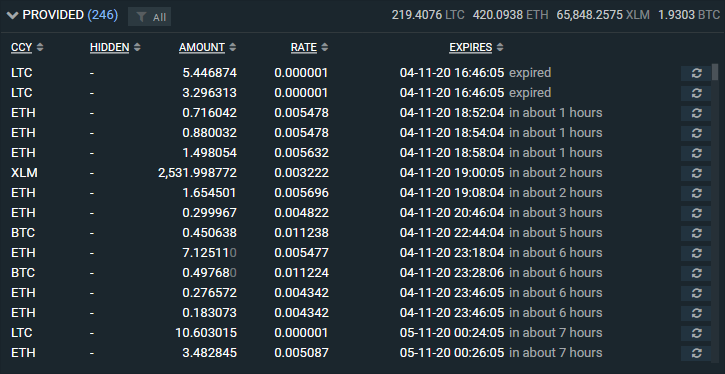

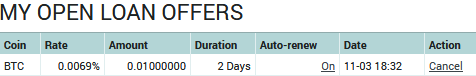

Your lending offers that have already been taken by traders get listed with along their expiration period:

Your active lending offers are listed below those and are open to modification and cancellation:

Lending Pro

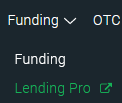

Lending Pro streamlines the process for providing cryptocurrency margin funding loans with maximum automation and at optimal rates. To start with Lending Pro, click the link in the Funding menu at the

This will get you to a dedicated lending interface with lots of reports. Even if you never used the Lending Pro interface but have made loans using normal Funding interface, the reports will already contain data.

You can turn on automated lending for any cryptocurrency via the Automation Settings button in the

For each cryptocurrency you are interested to lend in, you can configure lots of options:

The main setting is to Enable automation. Then comes the Lending mode: Dynamic (offers get

There, you can also set the Minimum rate, Reserved funds (funds will not be used for lending), Rate retention (to allow longer periods for higher interest rates), Fixed rate for fixed rate mode, Fixed amount (to make all offers fixed in size), Fixed period (to set a fixed period for all offers), Maximum offer amount (percentage of your funds to use by automated lending), Hide open offers, Undercut open offers (all offers created by the automation strategy will have their interest rate reduced by the percentage given here).

When you are done setting up automation rules for all your cryptocurrencies, you can return to the main page of the Lending Pro interface to observe the automatically created offers and see reports of your automated lending activity. In addition to usual tabs that you can see in the normal Funding interface, the following facilities are available here:

- Today earnings — a quick overview of what each crypto has earned you via lending today.

- Lending performance — see the average rate, period, and level of utilization as well as the status of automation for each of your

non-zero crypto wallet. - Distribution chart — it shows how your cryptocurrencies are distributed by amount, period, or rate.

- Lending rates — it shows best, average, and lowest rate.

- Provided loans — total number and value.

- Most active — the most active cryptocurrency with amount of funding filled.

- Assets managed today — how much total value was managed by Lending Pro today.

- Loans expiring — a distribution chart of your cryptocurrencies by their expiration.

- Provided stats — detailed stats for loans you are providing with estimated returns.

- Recently filled — the list of recently filled funding orders.

If those aren't enough, you can also switch from the Lending page of the Lending Pro interface to the Earnings page via the

The Earnings page consists of highly customizable reports and charts that let you understand easily how your lending performs with different cryptocurrencies over time. You will find here the main earnings chart, average daily earnings number, top earning crypto (plus

Risks at Bitfinex

Margin traders are eligible to borrow an amount of 5 times their margin balance (1:5 leverage). This is important if the market makes a fast significant move against the position traders have taken. It is possible that the margin call will not be fast enough and you will lose both your interest and some of your principal. This does not happen often as Bitfinex will automatically attempt to liquidate a margin trade if it falls to the value of the borrows collateral balance, but with the 3⅓ leverage it can definitely happen. With higher interest rates comes higher risk.

Being hacked or internal issues are also a risk, as with any exchange. Only invest what you can afford to lose.

On August 2, 2016, Bitfinex has been hacked with a resulting loss of $72 million worth of BTC. The company imposed a 36.067% haircut on all participants. Even though, the lacking funds have been replaced by the special IOU tokens (BFX), the hack incident has proven that margin lending poses its own significant risks. Since then, the company has returned the value of the lost funds to their members using various

Poloniex

Poloniex is a formerly

Getting started with Poloniex

To begin earning interest on Poloniex, click the Sign Up button on the homepage to create your account. Poloniex asks for your first and last name, your country of residence, an optional phone number, email, and password of your choice. The verification process is then completed by checking your email and following the verification link sent to you by Poloniex.

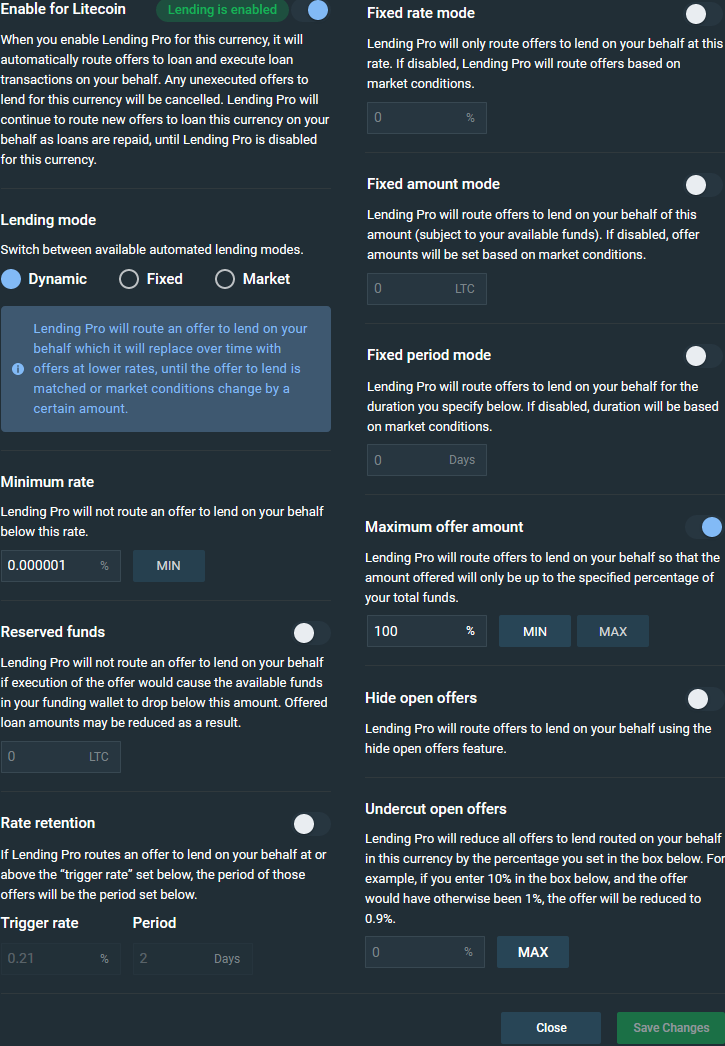

From the homepage, choose the Lending tab at the top of the page, to the right of the Poloniex logo. From there, you can deposit bitcoin and get started loaning. The minimum loan amount is 0.005 BTC at Poloniex. Look at the top right of the Offer BTC box near the top of the page. In the upper right corner, there is a link to deposit bitcoin:

Loans have an

If loan interest rates jump up during the course of the previous loan, you do not want to offer the same lower interest rate as you did previously. Instead, you will want to manually

If interest rates drop, then the borrower will likely decline to renew the loan to take advantage of the new lower rates, leaving your bitcoin unused and not earning for you. You will want to manually

The

Loan duration and rate

The typical loan on Poloniex is

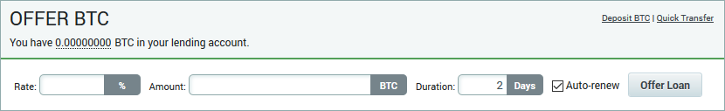

Typically, the daily interest rate your bitcoin can earn on Poloniex moves from 0.0001% to 0.2%. This rate can move to either extreme within a day or two if there is a large spike in buying or selling. Remember that price drop is also a time when margin accounts will be active due to traders attempting to buy the dip or average down on their positions.

Poloniex takes a fee of 15% of your earned interest from each loan completed. This is done automatically at the completion of each loan before your loan and interest are returned to you.

On the Lending page, all the current loan offers are displayed by their interest rate, amount, and duration. This is pictured below. You can use these rates as a benchmark for setting your own. Your aim should be to keep your loans offered at a very competitive interest rate.

When you have made all the decisions about your loan amount, rate, and

Risks at Poloniex

Poloniex relies on margin calls to keep risks at a bare minimum. Leveraged traders are the people you are lending to. They are asking to borrow money, so that they can increase the size of their positions. On Poloniex, margin traders can borrow up to 2.5 times the amount they have in their margin account (i.e., 1:2.5 leverage). A margin call is executed if the margin position loses more than the amount the borrower is using as collateral. If a margin call occurs, Poloniex closes the position and returns your

Even though the probability of a margin call failure that could cause the loss of margin lender's funds is low, this has already happened at least once on Poloniex. On May 27, 2019, Poloniex margin lenders incurred a loss of 16% of total BTC lent as the exchange's margin call system failed to react to an abrupt price crash in the CLAM vs. BTC crypto pair. This shows that margin lending should not be considered a

Huobi

Huobi is a

Getting started with Huobi

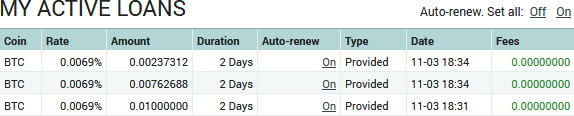

The Sign Up page for Huobi is pictured below. To open an account with this exchange, you have to provide your country, email address (or phone number), a password, and agree to their terms of service. After confirming your email address (or your mobile phone number), your account is live.

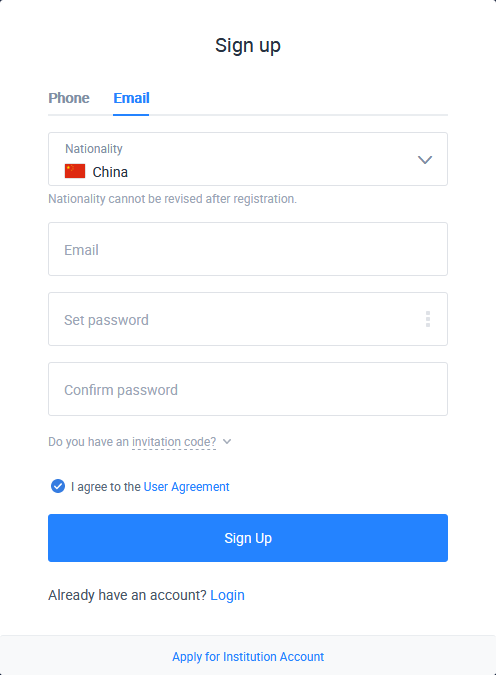

You can deposit funds using the Exchange Account (Deposit and withdrawal) link in the Balances menu in the

Lending options

To start lending, pick the C2C Lending option in the Wealth Management menu in the

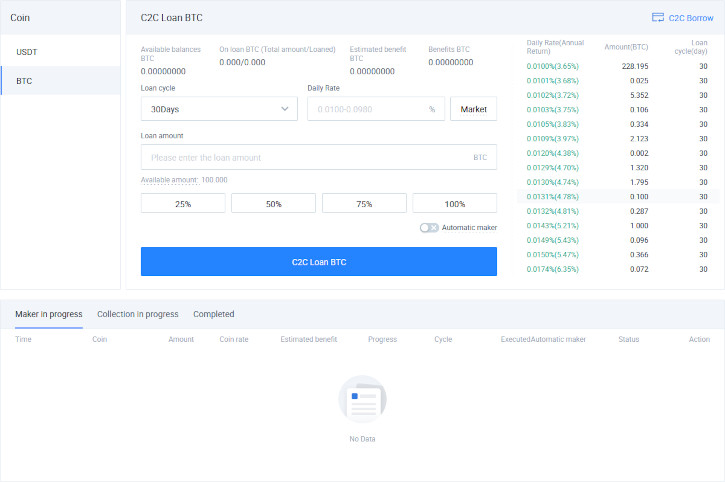

This will get you to the actual lending interface:

As you can see, Huobi allows lending operations only in USD and BTC. The exchange also sets the minimum (0.01%) and the maximum (0.098%) interest rates. The loan duration is also less flexible than at Bitfinex or Poloniex — you get 30, 20, or 10 days. The minimum size of loan for bitcoin is 0.001 BTC. You can also turn on Automatic maker switch, which will automatically resubmit your offer after it has been repaid.

The loans you make to Huobi margin traders are used for trading with a leverage of up to 1:3. Margin trading is only allowed in BTC/USD currency pair at Huobi. This significantly limits the risk of a market crash leading to negative balances in traders' accounts and thus to the loss of margin lenders.

The platform's service fee on margin lending profit is 18%, which is quite high compared to competitors.

Risks at Huobi

Normal margin lending risk of failed margin calls is partially mitigated by the restriction of leverage to BTC/USD crypto instrument only. This makes margin lending at Huobi somewhat less risky than at exchanges that allow leveraged trading in exotic coins and tokens.

Like every exchange, Huobi is at risk for hacking or internal problems that could result in the loss of all of your funds. Only invest what you can afford to lose.

Automating the Process with Bots

Margin lending bots exist to make the process of earning interest as

Poloniex Lending Bot

Mika Lending Bot was developed to automate Poloniex lending using Python language. The margin lending returns seem to be much better than other forms of P2P lending, but it is a lot of work to lend manually because of the sheer volume of loans produced by this style of lending. The automation is designed to remove all the hassle from the lending process and turn it into a

Mika Lending Bot is a completely free

How it works

The purpose of employing an automated lending bot is to make the process

Poloniex spreads out your loans to dozens or even hundreds of different borrowers. This can be handled partially by their

The service automatically differentiates between loans initiated with the bot and those done manually, so you can continue to offer manual loans at the same time you are employing the bot if you choose to do so.

Keeping your bitcoin loaned out as often as possible is crucial to maximizing your returns, so even if you have to rent a VPS to host the bot, it will often pay for itself with its ability to get loans out on a constant basis.

Further development

Currently, the bot can also work with Bitfinex exchange, however, it looks like the specialized BitfinexLendingBot by Andrius Sutas (described below) is much more effective with that platform.

Risks

In order for the bot to place your loans, it has to have access to your account. This is a real security concern. In order to alleviate this concern, the Poloniex Lending Bot limits its own access to your account. The bot is only given restricted API access to your account, disabling both trading and deposit/withdraw options. The restricted access means that the bot's creators could only potentially gain access to your lending activities and wouldn't be able to steal your funds.

The fact that this is a popular

Using a bot does not alleviate any of the concerns you would have doing business on an exchange in general. There is still a chance of a late margin call due to a sudden crash in a cryptocurrency's price, or Poloniex becoming insolvent.

Bitfinex Lending Bot

Even though Bitfinex has gone through a rather rough period due to its hacking episode, the platform is currently actively used by traders. It is also suitable for margin lending investment. A number of lending bots are available for Bitfinex. The most

Basic information

BitfinexLendingBot (or BLB for short) is distributed in the form of source code written in Go. This means that you can run BLB on any platform (Linux, Windows, Mac), but you need to compile the source code on that platform. The process is straightforward and is thoroughly explained in the project's description. The main steps are downloading and installing the Go compiler, downloading the source code files, compiling the code, setting up the API access on your Bitfinex account, configuring and running the BitfinexLendingBot application.

The bot can lend in USD, BTC, ETH, and other cryptocurrencies traded on Bitfinex. It is completely free, but you are encouraged to donate to its author to support further development.

How to use it

One of the most important steps to use BitfinexLendingBot successfully is setting up API access for it to participate in margin funding with your account. This allows the bot to offer your cryptocurrencies and USD for funding without it being able to trade, exchange, or withdraw funds. After you log into your Bitfinex account, you can create an API key via the Account->API link. When you create a new API key, the only permissions you should set are Margin Funding Read & Write and Wallets Read. Make sure to write down the API Key and API Secret values to configure the BLB.

In addition to setting the API key, you can configure the bot's lending parameters. It is done via the same default.conf and is described in details on the bot's GitHub page. The bot can use two strategies:

- MarginBot — a complex lending strategy with multiple parameters making it very flexible. The defaults work great, but you can play around with the parameters to get higher rate for

long-term lending for example. You can also spread your funds across a range of rates. This will help if you have a big enough account to influence the market seriously when lending everything as a lump sum. - CascadeBot — a simple lending strategy that starts at some initial rate and reduces it gradually until the offer is taken.

Running the bot with --updatelends --dryrun keys will test it without actually sending any lending offers to the market.

You can set up either a crontab (on Linux) or Task Scheduler (on Windows) to run the bot every 30 minutes or so.

Using the key --logtofile when running the bot will switch it to write its output into a log file rather than to the screen. This is particularly useful when using BLB in a fully automated mode (and why else would you need a bot?).

Expected returns from margin lending

Interest rates on your margin loans are calculated daily. This is why having your bitcoin loaned out as often as possible is crucial to maximizing your returns.

On most exchanges, bitcoin lending rates move in between 0.0001% and 0.2% daily interest. Compounded over the course of a year, this can add up to a high return on your investment. Remember that you will be paying 15% of your earned interest to the exchange when you are trying to calculate your investments.

Right now, the risk is minimal in the markets, but cryptocurrencies are volatile assets and there is a risk that you could lose your entire investment if the price of the traded cryptocurrency falls dramatically. As stated before, do not invest more than you can handle losing.

Shop around for better yields

One important step that is often overlooked by the newbie margin funding providers is comparing yield rates between exchanges. While the difference between BTC interest rates may be quite small, the lower volume on altcoins causes the yields to diverge between exchanges. For example, as of November 5, 2020, the gain on BTC at Bitfinex was 0.01% per day — significantly higher than the gain at Poloniex (0.007%).

However, when choosing a better interest rate for your investment, you have to consider the following factors:

- Deposit/withdrawal time — if withdrawing the cryptocurrency from one exchange and then depositing it to another one will take a few days (for example, due to long confirmation or processing time), it is probably better to remain with your current facility. Do not forget that most exchanges offer possibility of withdrawing coins directly to a deposit address at another exchange.

- Transfer fees — if the cost of a withdrawal transaction exceeds the size of potential earning on the interest rate difference, postpone the transfer for better times.

- Exchange security — sometimes, bitcoin exchanges get hacked or experience some other troubles (like withdrawal problems). It is useful to take into account these issues when you decide to hunt for higher rates. Finding a higher interest rate on some shady exchange is not worth losing all your

crypto-funds . - Rate stability — as you have probably noticed, interest rates on all cryptocurrencies fluctuate significantly. Make sure that the rate is higher

long-term on a new exchange. It would be a disappointment to waste time and money on transfers to find out that it was just a temporary spike in the interest rate.

If you have any questions about investing your bitcoin as safely as possible or if you want to share your own BTC investment strategy (in margin lending or otherwise), you can start a thread on our crypto forum.