While you are comparing Forex brokers and trying to decide where to trade, you may encounter some brokers offering Forex rebate programs.

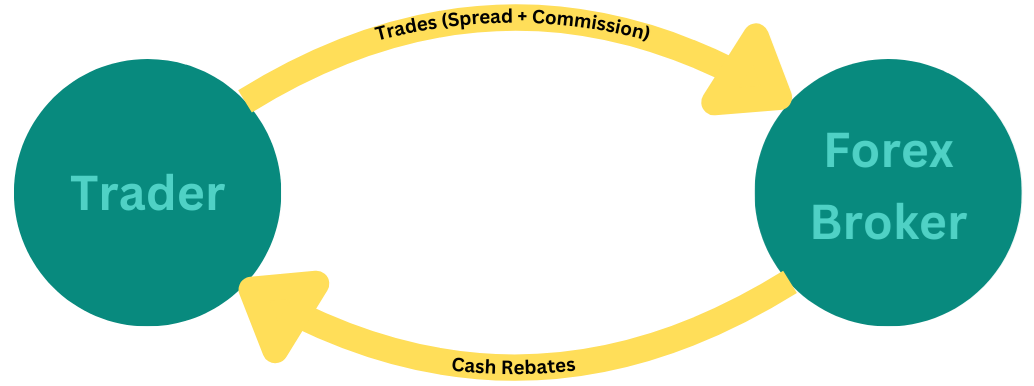

A Forex rebate program is a cashback program that rewards you for trading. It is similar to cashback programs you may have participated in with retailers, online sportsbooks, or other companies or services.

The more you trade, the more cashback you can earn. Over time, this cashback can help you offset some of the costs of trading, i.e. the spreads and commissions you are paying.

In this guide, we will explain the different types of Forex rebates, how they work, and the pros and cons of each. That way, you can make an informed decision about whether to participate in Forex rebate programs.

The two types of Forex rebates

Forex rebate programs come in two main varieties:

- Rebates provided directly by Forex brokers

- Rebates provided by third party affiliates (Introducing Brokers)

As these two types of Forex rebate programs work differently, it is important to learn more about them.

How Forex rebates are paid out

Rebate programs can pay out in any of the following ways:

- You receive lump sum cash payments into your account on a set schedule.

- You receive a spread rebate where spreads are lower (anywhere from 0.1 to 1.3 pips reduction is common).

- You receive a commission rebate (a typical range of reduction is $1-4 per lot).

Rebate rates can be flat, or there may be a tiered structure where traders can earn higher rebates based on their trade frequency or trading volume.

Tiered structures may be beneficial if you would fall into one of the higher-paying brackets. Otherwise, in some cases, a flat rate might be more profitable.

Forex rebates provided by a broker

Some Forex rebate programs are provided directly by the broker you are trading with. Here is how they work.

- You open an account with a Forex broker.

- You make your first deposit and start trading.

- As you trade, you earn cashback at whatever rate the broker has set.

- The broker will pay you your cashback rewards on whatever schedule the program follows.

Forex rebates provided by an IB (affiliate)

A lot of Forex rebates programs are administered by a third party. This third party is an Introducing Broker (IB), which is a type of affiliate.

A Forex rebate program provided by an IB like this:

- The IB helps you discover a Forex broker by referring you to that broker. Perhaps, for example, they shared a link with you, or you discovered the broker in a review on their website.

- You sign up for an account with the broker through the IB.

- You make your first deposit, and begin placing trades.

- You earn cashback rewards as you trade.

- The broker pays the IB/affiliate when you trade.

- When it comes time for you to collect your cashback rewards, the IB will pay you the rewards. These rewards are a percentage of the funds that the broker paid the IB.

This may appear complicated at first glance. Why does the broker pay the IB? And why does the IB then pay you?

Here is how every party participating is benefiting:

- The IB is helping to promote the broker, and is bringing them active customers. As this benefits the broker, the broker pays the IB.

- The IB obviously benefits from the profits they are earning from the broker. Even after they pay you, they still have plenty of profit left over.

- You benefit from the rebate for obvious reasons. Receiving money back helps you to reduce the overall costs of trading Forex.

Advantages of Forex rebate programs

- Your overall costs of trading go down. Whether you are paying spreads or commissions, your cashback rewards put some money back in your pocket.

- Rebates are paid out to traders whether they win or lose.

- Although traders need to resist the urge to take subpar trades, there may be situations where rebates give you the flexibility to take trades you would otherwise have missed out on due to the cost of commissions or spreads. If you are looking at a strong enough setup, it might pay off.

- Scalpers can lose a lot of money through commissions because they have to take so many trades. High-frequency traders can rack up rebates quickly, helping them offset the high price of commissions.

- With the improvements that rebates bring to your ROI, you can build up the money in your Forex account more quickly.

- It is pleasant to get rebates, which can help to reduce some of the stress involved with Forex trading.

Disadvantages of Forex rebate programs

On their own, it is hard to name many disadvantages of Forex rebates. Conceptually, they benefit everyone involved. But depending on the decisions you make as a trader tied to Forex rebates, it can be argued there are some possible drawbacks.

- There are many safe and trustworthy brokers that offer rebate programs. But Forex rebate programs may sometimes attract traders to brokers that are not legitimate or financially stable. You can avoid this pitfall simply by thoroughly researching the broker before you sign up for an account.

- Getting cashback is reassuring. But some traders may be tempted to let their financial management rules slip, or to take sub-par setups. You can get around this pitfall too. You just need to develop the discipline not to break your trading rules, and have the perspective to know that those rules are still important, even when you are receiving Forex rebates.

Again, these are not necessarily drawbacks of Forex rebates. They are just mistakes that some traders are more likely to make when they are participating in a Forex rebate program.

That said, some believe that rebates incentivize overtrading, similar to gamification, and are thus not a suitable promotion. Indeed, in the UK and EU, Forex rebates are banned for this reason.

Those who believe that rebates are inherently problematic suggest that brokers offer lower spreads or commissions instead.

Are brokers actively and deliberately trying to compel traders to place more trades than they should? Alas, we could debate the motivations of brokers all day and not reach a clear conclusion. This may be something that bad actors would be motivated by.

Trustworthy brokers probably are not deliberately trying to drive overtrading, but that does not mean that the structure of rebates will not still tempt some traders to engage in the behavior. Either way, if you live in a region where regulators have taken action to prevent brokers from offering rebates, you will need to look for a different type of promotion.

Best Practices

To get the most out of Forex rebate programs, here are some best practices to follow.

- Trade with a reputable broker: Do not let an exciting rebate program blind you to the other factors that are important when you are selecting a broker to trade with. Always do your research to make sure that the broker is trustworthy and has a solid reputation. Make sure that their spreads and commissions are affordable, and that they are offering you the trading tools and features you need.

- Calculate savings: When you are comparing various Forex rebate programs, you should try to calculate how much you could potentially save with each based on how you tend to trade. This is the only way to figure out which programs are actually the best ones, taking into account the cost of spreads and commissions at each broker as well.

- Continue to follow your trading rules: The money you get back from rebates can boost your bottom line, but it is not enough on its own to make the difference between whether you are a profitable trader or not. You still need to follow a tested trading method that delivers consistent, reliable results.

Whether you receive Forex rebates directly through your broker or via an affiliate, a rebate program can put a significant amount of money back in your pocket, helping you alleviate some of the costs incurred toward your trading goals.