Any trader opening a new account with a Forex broker should first learn about the rules and regulations imposed by the broker as some of them may interfere with the trader's strategies and expert advisors. One such rule is the FIFO rule.

What is the FIFO rule?

FIFO means First In — First Out. It is a rule that requires a broker to close positions in the same order they were opened, provided those positions were opened in the same currency pair and have the same size.

For example, a trader opens several positions on a FIFO account:

- Buys 1 lot of EUR/USD.

- Buys 0.5 lot of EUR/USD.

- Buys 1 lot of EUR/USD.

- Buys 1 lot of GBP/USD.

In this case, the trader will not be able to close the third position before closing the first one as they are in the same currency pair and have the same size. But they will be able to close the second position (because it has a different size) and the fourth position (because it is in a different currency pair).

Example of trading on FIFO Forex account vs. regular account

Let us demonstrate a difference between FIFO and non-FIFO accounts in a real-life example using demo accounts.

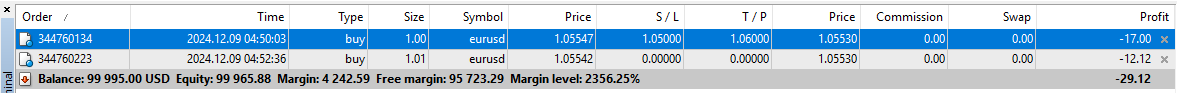

We opened a demo account with OANDA Corporation (the US division of OANDA) that has FIFO-compliant accounts.

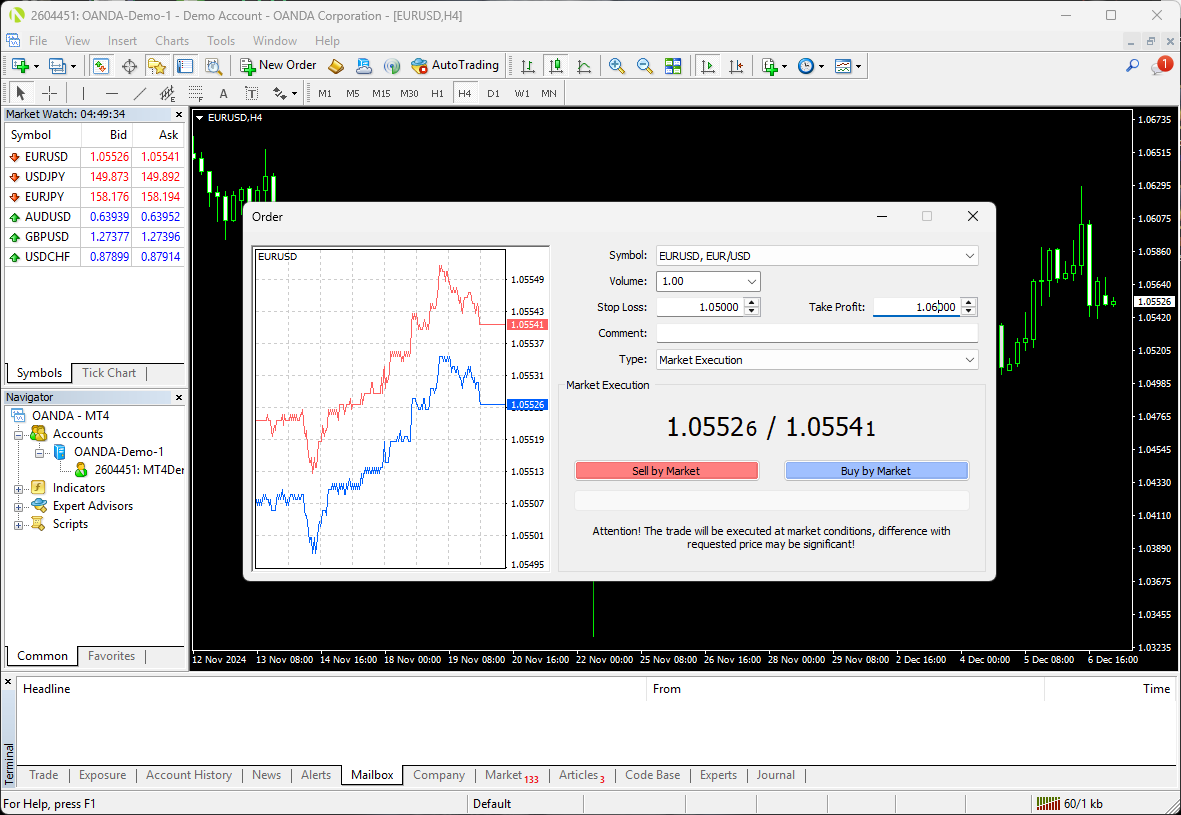

We placed an order to buy 1 lot of EUR/USD at the market price.

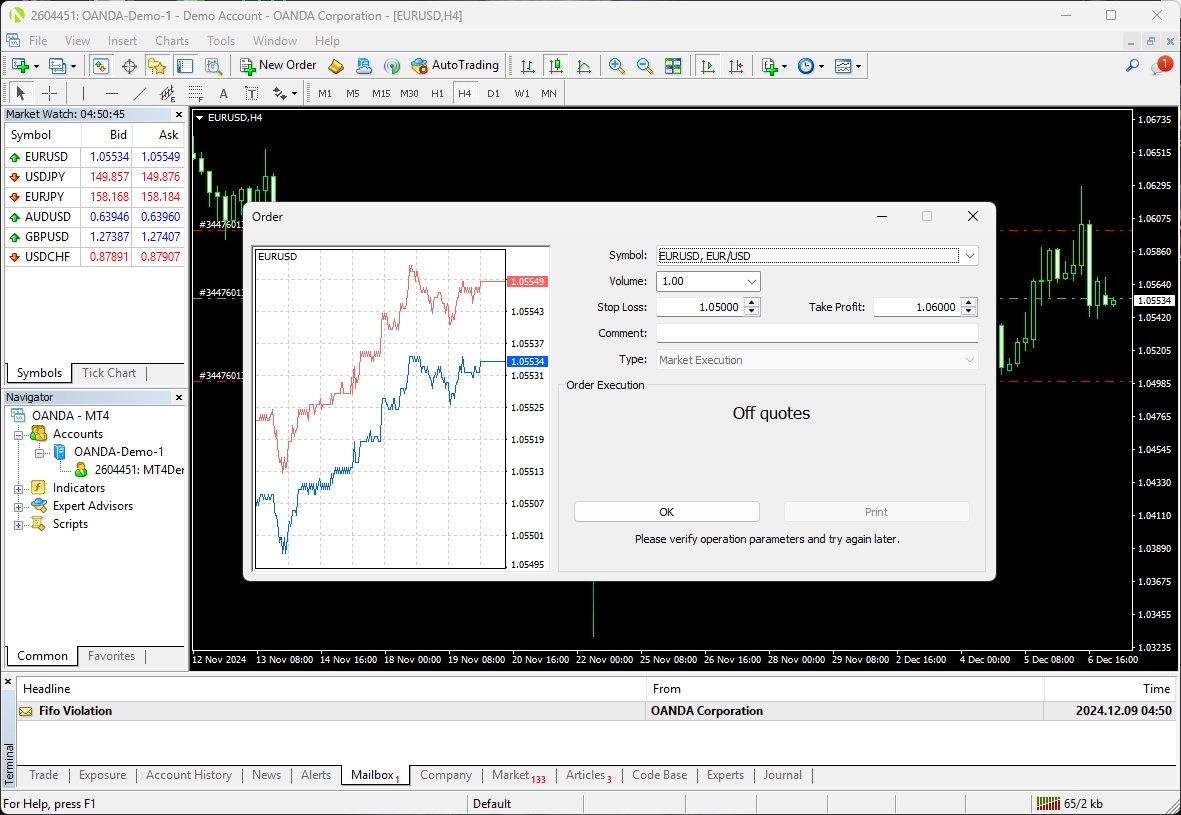

Let us attempt to place the exact same order the second time. The platform simply will not allow it, displaying an error message.

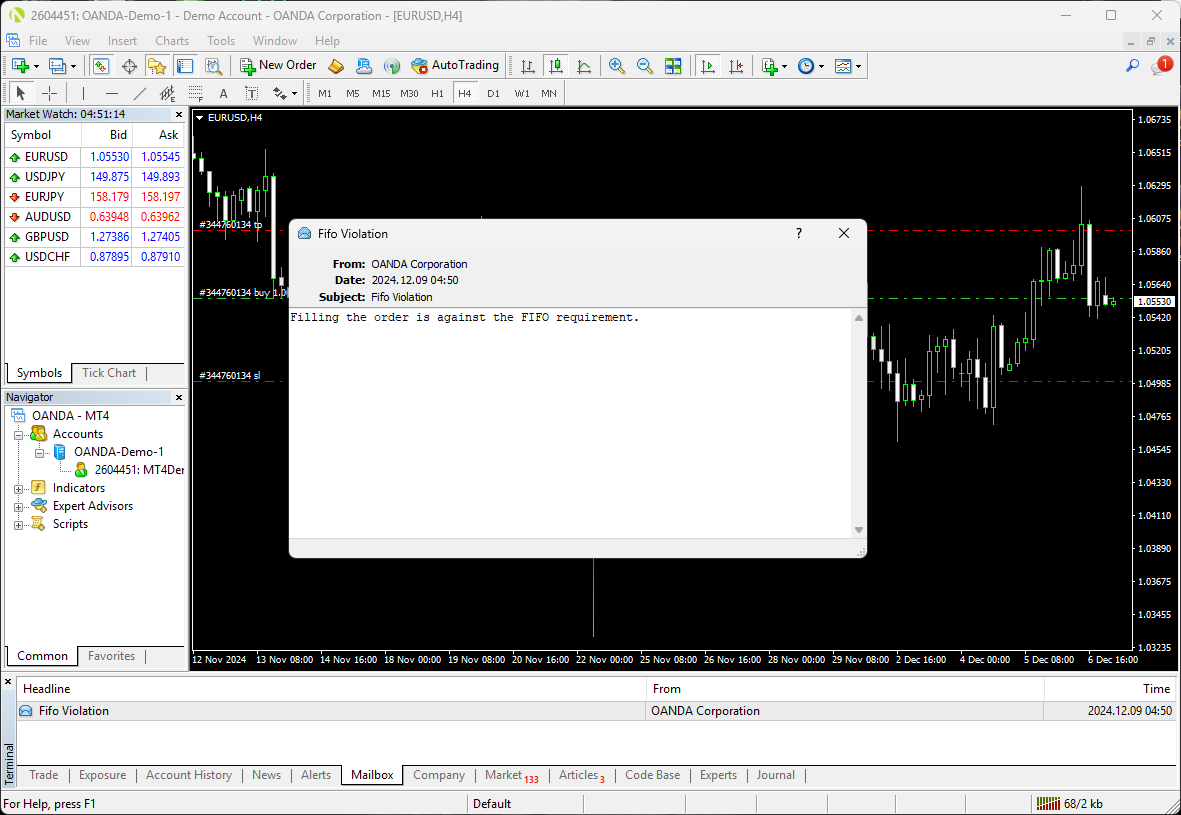

And we got a message in the mail that filling the order would violate the FIFO requirement.

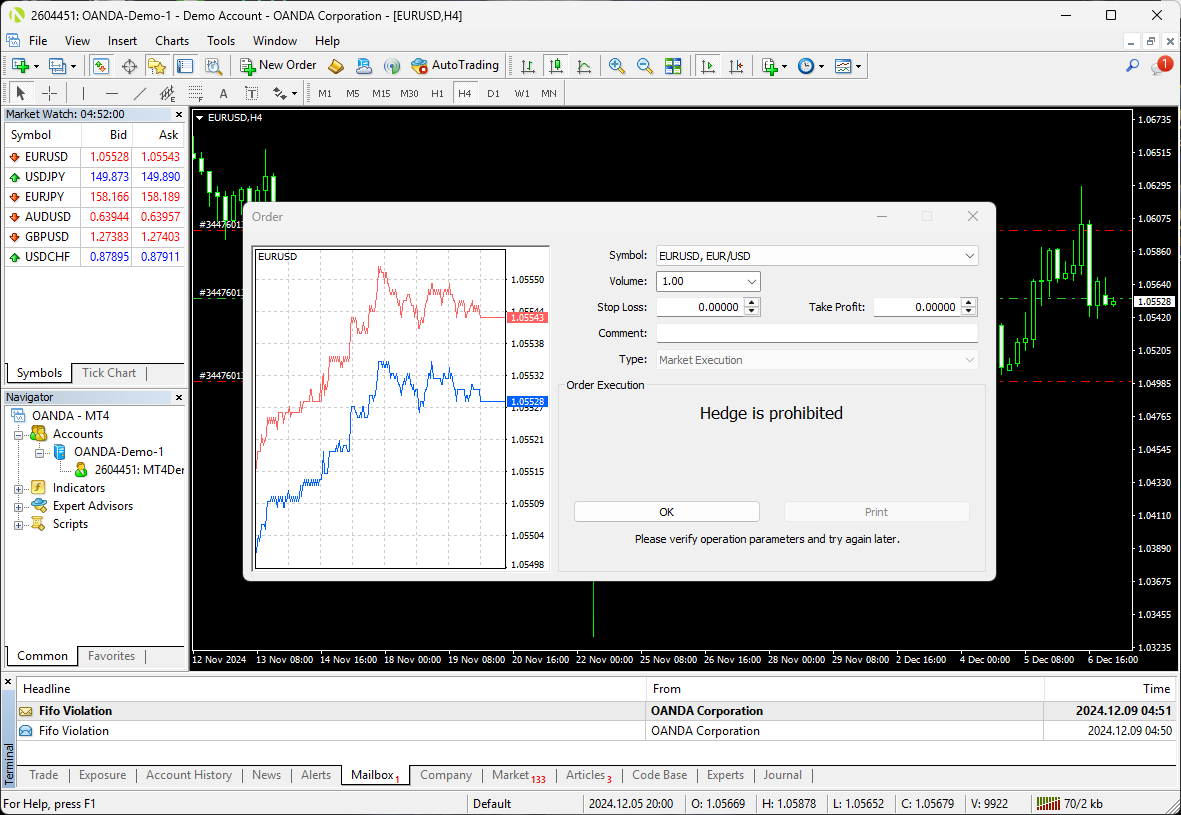

And if we try to sell 1 lot of EUR/USD, the error message specifically states that hedging is prohibited.

Of course, we can get around this problem by simply adjusting the order size even by a marginal amount. For example, if we want to place a second buy order for EUR/USD, we can do so by buying 1.01 lot instead of just 1 lot. And the order will be accepted with no problem.

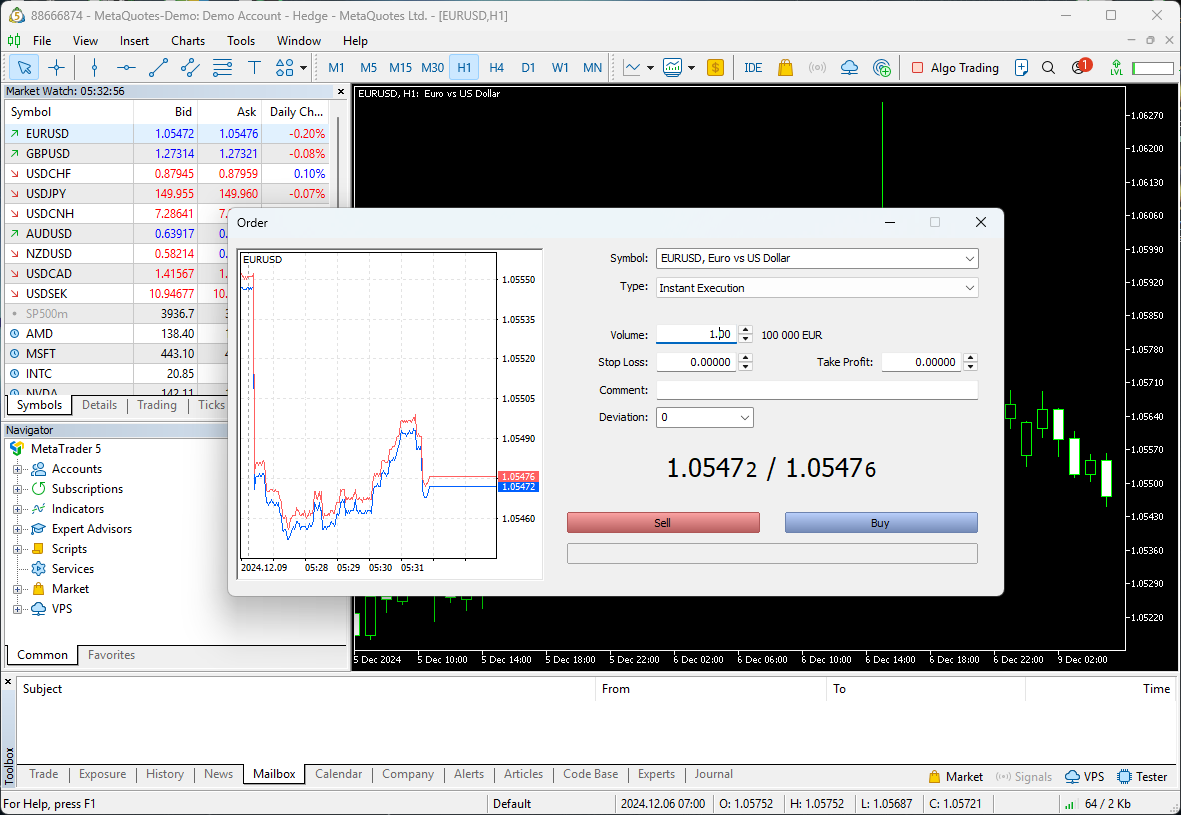

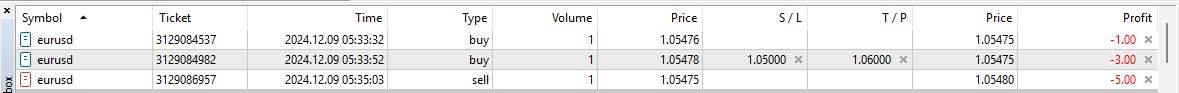

But what about non-FIFO accounts? Let us try to execute the same trades on a regular account. We bought 1 lot of EUR/USD.

Let us try to buy the same amount of the same currency pair. As you can see, the broker had no problem processing both orders at the same time.

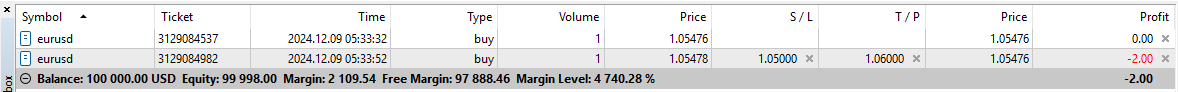

Furthermore, if we want to sell 1 lot of EUR/USD, we can do so with no problem.

The platform shows that all three orders were accepted with no problem.

Take note that a non-FIFO account works this way only if you choose to create a hedging account when you are creating an account on the MetaTrader platform. If you have a netting account, all positions in the same currency pair will be combined into one.

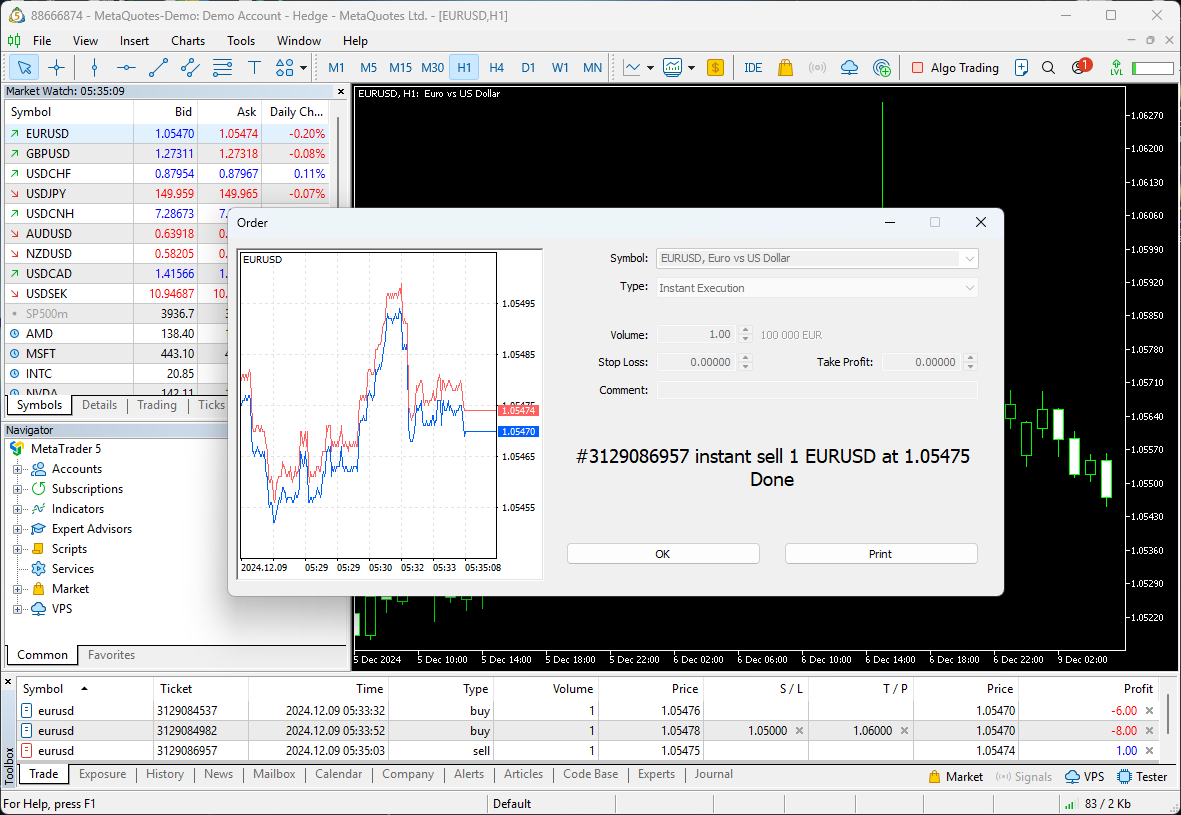

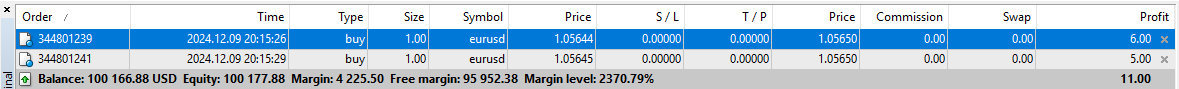

Another important thing to remember when trading on a FIFO account (at least when it is opened with OANDA Corporation) is that orders will fall under the FIFO requirement only if one of them has a stop-loss or a take-profit target. For example, here are two long EUR/USD positions 1 lot each that are opened with no problem as neither of them has a stop-loss or a take-profit.

But if you try to place an order of the same size in the same currency pair with a stop-loss or a take-profit, the platform will reject it even though the previous orders did not have SL/TP. You also will not be able to place an order without SL/TP if the previous order of the same size had SL/TP. Hedging orders are an exception as you will not be able to place an order in the same currency pair but in the opposite direction to the existing order even if neither order has SL/TP.

Does the FIFO rule apply to everyone?

The FIFO rule is most strictly adhered to in the United States. That is because the National Futures Association requires all regulated US Forex brokers to adhere to this rule as per Compliance Rule 2-43b. Consequently, most US Forex traders also have to follow this rule in their trading.

While the FIFO rule mostly affects US brokers and traders, you should check before opening an account with a non-US broker just in case it also follows the FIFO rule for some reason.

Why the FIFO rule exists

One of the most obvious reasons for the FIFO rule is to prevent hedging, which is banned in the United States. Those who argue in favor of the FIFO rule claim that the rule makes it safe to trade as the FIFO requirement prevents brokers from price adjustments that can hurt the trader. In fact, the NFA made an amendment to the FIFO rule which stipulates that the broker can adjust the price only to resolve a complaint in the client's favor. The FIFO rule is also supposed to make it easier to manage trades, making it easier to predict when each position will be closed.

But of course, there are plenty of downsides to this rule. Again, the most obvious one is the inability to use hedging to safeguard yourself from losses. It also prevents traders from using strategies that involve opening and closing several positions at different price levels, such as martingale and grid strategies. The rule also makes it difficult to test different expert advisors on the same currency pair.

How to get around FIFO requirements

For those traders, who want to avoid dealing with headaches associated with FIFO accounts, there are several options:

- Use non-US brokers. The most obvious option is to use non-US brokers, which are not beholden to NFA regulations and, therefore, unlikely to impose the FIFO requirement on their accounts. The problem with this approach is that most non-US regulated brokers will likely refuse to deal with US residents.

- Use several accounts. You can also open several FIFO accounts and trade them separately. But then you will have to deal with the headache of managing several separate accounts and potential additional costs.

- Use positions of different sizes. Perhaps, the easiest solution is to slightly change the position size for each new order. Even the smallest change in position size will help your positions to avoid the FIFO rule. Alas, this approach can make your trading and position management much more complicated, make it harder to compare the performance of different strategies during testing, and cause difficulties with using EAs.

- Try to use orders without stop-loss and take-profit. As was demonstrated in the example of trading with OANDA Corporation, you can sometimes avoid the FIFO rule by placing an order without stop-loss and take-profit. While it is usually dangerous to trade without stop-loss, it is another way to avoid the hassle of the FIFO requirement.

- Use different currency pairs. Using different currency pairs for each new position helps you avoid the FIFO rule altogether.

- Use exotic currency pairs. Brokers often apply the FIFO rule only to specific currency pairs. While all major ones are usually on the list, more exotic ones are often outside of the FIFO requirement. Of course, you will have to be willing to trade less popular pairs and deal with all the associated risks, including low liquidity.