Daily News Update

Daily News Update

24 January 2024

Wednesday

January 24th is set to be a momentous day in the financial world, marked by a series of major news releases anticipated to impact market movements significantly. France, Germany, and Great Britain are all scheduled to publish their Flash Manufacturing PMI and Flash Services PMI data. Concurrently, the Bank of Canada will announce its Overnight Rate, a key economic indicator. Alongside these developments, the United States will also release its Flash Manufacturing PMI and Flash Services PMI. Adding to the day's significance, the Bank of Canada will hold a press conference, likely to provide further insights into its rate decision and economic outlook.

EUR - French Flash Manufacturing PMI

This metric is crucial for evaluating the economic landscape. Businesses often respond quickly to changes in the market, and the perspectives of their purchasing managers provide timely and pertinent information about a company's view of economic conditions. In the survey, around 750 purchasing managers are queried to evaluate the state of different business components, such as employment, production, new orders, prices, supplier deliveries, and inventories.

In December of 2023, the HCOB France Manufacturing PMI had fallen to 42.1 from 42.9 in the previous month, marking the lowest reading on record, aside from the pandemic-induced crash in the second quarter of 2022. This figure was a slight upward revision from the preliminary reading of 42. The decline pointed to the 11th consecutive month of decreasing activity in French manufacturing. This trend was driven by slowing conditions in key markets and increased international competitive pressures, which continued to suppress new orders. As a result, manufacturing output contracted for the 19th consecutive month, and outstanding orders decreased. The low demand for capacity led to reduced purchasing levels and triggered a seventh consecutive month of job losses. In terms of pricing, a renewed decrease in input costs, coupled with intensified competition, compelled firms to lower their output charges. Looking back, French manufacturers had reported a consistent pessimism about the outlook for 2024, although this sentiment had reached its lowest level in five months.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 42.1 |

| Previous Month's PMI Value | 42.9 |

| Comparison to Record Low | Lowest since pandemic in Q2 2022 |

| Preliminary Reading | 42.0 |

| Consecutive Months of Decline | 11 |

| Cause of Decline | Slowing market conditions, increased international competition |

| Manufacturing Output Trend | Contracted for 19th consecutive month |

| Orders Status | Decreased |

| Demand for Capacity | Low, leading to reduced purchasing |

| Employment Trend | 7th consecutive month of job losses |

| Pricing Changes | Decrease in input costs; firms lowered output charges due to competition |

| Outlook for 2024 | Consistently pessimistic, though sentiment slightly improved in the past 5 months |

The projected French Flash Manufacturing PMI is expected to rise to 43, up from the previous figure of 42.1.

The upcoming French Flash Manufacturing PMI is scheduled for January 24th at 08:15 AM GMT.

The last time, the French Flash Manufacturing PMI was announced on the 15th of December, 2023. You may find the market reaction chart (EURUSD M5) below:

EUR – French Flash Services PMI

This metric is crucial for evaluating the state of the economy. Businesses often respond quickly to changes in the market, and the views of their purchasing managers provide highly current and pertinent information about the company's perspective on economic conditions. In the survey, around 750 purchasing managers are queried to evaluate various aspects of business, such as employment, production, new orders, prices, supplier deliveries, and inventory levels.

In December 2023, the HCOB France Services PMI rose to 45.7, marking its highest level in four months. This increase surpassed initial estimates and market forecasts, which had been set at 44.3, and was a notable improvement from November's figure of 45.4. Despite this rise, the reading indicated the seventh consecutive month of economic contraction, primarily driven by weak demand conditions. Businesses experienced a decline in new orders for the eighth consecutive month, although the rate of decline eased compared to November’s three-year low. The backlog of orders saw a significant reduction, one of the fastest in over three years, while employment growth remained steady.

Regarding prices, the rate of input price inflation was the lowest since August 2021. However, the prices charged by businesses increased at a moderate pace. In a positive turn, business confidence showed significant improvement, reaching a four-month high.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 45.7 |

| Comparison to Previous Months | Highest in four months |

| Initial Estimates | 44.3 |

| Previous Month's PMI Value | 45.4 |

| Consecutive Months of Contraction | 7 |

| Main Cause of Contraction | Weak demand conditions |

| New Orders Trend | Declined for the 8th consecutive month, but at a slower rate than November |

| Backlog of Orders | Significantly reduced, fastest in over three years |

| Employment Growth | Remained steady |

The forecast for French Flash Services PMI suggests a modest increase to 46.4, up from the previous reading of 45.7.

The upcoming French Flash Services PMI release is scheduled to be disclosed on January 24th at 08:15 AM GMT.

The last time, the French Flash Services PMI was announced on the 15th of December, 2023. You may find the market reaction chart (EURUSD M5) below:

EUR – German Flash Manufacturing PMI

This key economic indicator offers a leading insight into the health of the economy, as businesses are known to swiftly respond to fluctuating market conditions. The views of purchasing managers, who are deeply entrenched in the day-to-day operations of their companies, provide some of the most immediate and pertinent perspectives on economic trends. The survey, encompassing responses from approximately 800 purchasing managers, asks these professionals to evaluate various business elements. These elements include employment levels, production rates, new order volumes, pricing trends, the efficiency of supplier deliveries, and the status of inventory stocks. This comprehensive assessment helps paint a clear picture of the current economic landscape.

The HCOB Germany Manufacturing PMI had been revised slightly higher to 43.3 in December 2023, up from a preliminary figure of 43.1, and marking an improvement from November’s 42.6. Despite remaining in contraction territory, there were indications that the manufacturing sector might have passed the worst of its downturn. The period witnessed solid and somewhat accelerated declines in both output and employment. However, more forward-looking indicators had been showing signs of improvement, with new orders falling at their slowest rate in eight months and business expectations turning positive for the first time since the previous April. On the pricing front, manufacturers had continued to reduce factory gate charges amidst competitive pressures and lower input costs. Notably, the rate of decline in output prices had been the slowest in seven months, although still modest. Concurrently, manufacturers had cut workforce numbers at the fastest rate since October 2020, adapting to reduced capacity utilization.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 43.3 |

| Preliminary PMI Value | 43.1 |

| Previous Month's PMI Value | 42.6 |

| General Trend | Improvement, but still in contraction |

| Output and Employment | Solid declines, somewhat accelerated |

| New Orders | Slowest rate of decline in eight months |

| Business Expectations | Turned positive, first time since previous April |

| Pricing Trends | Reduction in factory gate charges due to competitive pressures and lower input costs |

| Output Prices | Slowest decline in seven months, still modest |

| Employment Trend | Fastest workforce reduction since October 2020 |

| Capacity Utilization | Adapted to reduced capacity, hence workforce cuts |

The projected German Flash Manufacturing PMI suggests a rise to 44.6, up from the previous reading of 43.3.

The forthcoming release of the German Flash Manufacturing PMI is set to be revealed on January 24th at 08:30 AM GMT.

The last time, the German Flash Manufacturing PMI was announced on the 15th of December, 2023. You may find the market reaction chart (EURJPY M5) below:

EUR – German Flash Services PMI

The Purchasing Managers’ Index (PMI) is widely recognized as a critical barometer of economic health. This index is pivotal because businesses often respond swiftly to fluctuations in market conditions, and purchasing managers are at the forefront of gauging these changes. They possess up-to-the-minute insights that reflect the company’s perspective on the economy. The PMI is compiled from a survey of approximately 800 purchasing managers. These professionals are asked to evaluate various aspects of business conditions, such as employment, production, new orders, prices, supplier deliveries, and inventory levels. Their responses offer a comprehensive overview of the economic landscape, making the PMI a valuable tool for understanding the current state of the economy.

The HCOB Germany Services PMI was revised upwards to 49.3 in December 2023, from an initial estimate of 48.4, marking a slight increase from November’s figure of 49.6. This revision indicated that the services sector experienced a modest acceleration in its rate of contraction. Factors contributing to this trend included tightened financial conditions, general weakness in the broader economy, and client hesitancy driven by political uncertainty and geopolitical tensions.

The services sector saw a continued decline in new business inflows for the sixth consecutive month, particularly in terms of new work received from international sources. Concurrently, the level of outstanding business further decreased. In response to these challenges, service providers reduced their staff numbers at the fastest rate since June 2020, primarily as a measure to cut costs, which were rising notably due to increased wages. Additionally, a hike in road tolls at the beginning of the month contributed to a sharp and accelerated rise in overall input costs.

Despite these challenges, expectations for business activity over the next 12 months remained relatively stable, with little change from previous forecasts.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 49.3 |

| Initial Estimate | 48.4 |

| Previous Month's PMI Value (Nov) | 49.6 |

| Trend | Slight acceleration in rate of contraction |

| Contributing Factors | Tightened financial conditions, economic weakness, political uncertainty, geopolitical tensions |

| New Business Inflows | Declined for 6th consecutive month, especially from international sources |

| Outstanding Business | Decreased |

| Employment Changes | Fastest reduction in staff numbers since June 2020 |

| Reason for Employment Changes | Cost cutting, notably due to increased wages |

| Additional Cost Factors | Increase in road tolls, leading to sharp rise in overall input costs |

| Business Activity Expectations | Relatively stable for the next 12 months |

The forecast suggests a rise in the German Flash Services PMI to 49.7, up from the previous figure of 49.3.

The upcoming release of the German Flash Services PMI is scheduled for January 24th at 08:30 AM GMT.

The last time, the German Flash Services PMI was announced on the 15th of December, 2023. You may find the market reaction graph (EURJPY M5) below:

GBP - Flash Manufacturing PMI

The Purchasing Managers' Index (PMI) stands as a foremost indicator of economic vitality, reflecting how businesses rapidly adjust to market fluctuations. This survey, encompassing around 650 purchasing managers, serves as a lens into a company's economic outlook, with these managers offering some of the most timely and pertinent insights available. Participants in the survey are asked to evaluate various facets of business conditions, including employment, production, new orders, prices, supplier deliveries, and inventory levels, providing a comprehensive snapshot of the economic environment.

In December 2023, the S&P Global UK Manufacturing PMI had recorded a slight decrease to 46.2, falling just below the initial estimate of 46.4 and marking a decline from November's seven-month high of 47.2. The manufacturing sector experienced its tenth consecutive month of production decline, primarily due to downturns in the consumer and intermediate goods sub-sectors. This reduction in output was attributed to a combination of lower new business intakes, reduced overseas demand, and efforts by manufacturers and their clients to reduce inventory levels.

The sector also saw a continuous decrease in new business inflows for the ninth month in a row. Additionally, there was a significant reduction in backlogs of work, and the industry faced job cuts for the fifteenth consecutive month. In terms of pricing, there was a continued decrease in input costs, while average selling prices experienced a slight increase for the second consecutive month.

Business confidence in the manufacturing sector reached a 12-month low, reflecting concerns over a weakening economy, the closure of client businesses, and the impact of high interest rates.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 46.2 |

| Initial Estimate | 46.4 |

| Previous Month's PMI Value (Nov) | 47.2 |

| Production Trend | 10th consecutive month of decline |

| Affected Sub-Sectors | Consumer and intermediate goods |

| Causes of Output Reduction | Lower new business intakes, reduced overseas demand, inventory reduction efforts |

| New Business Inflows | Decreased for 9th consecutive month |

| Backlogs of Work | Significant reduction |

| Employment | Job cuts for 15th consecutive month |

| Pricing Trends | Decrease in input costs, slight increase in average selling prices |

| Business Confidence | Reached a 12-month low |

| Concerns | Weakening economy, closure of client businesses, high interest rates |

The British Flash Manufacturing PMI is expected to rise to 47 from its previous reading of 46.2, according to the forecast.

The British Flash Manufacturing PMI is set to be released on January 24th at 09:30 AM GMT.

The last time, the British Flash Manufacturing PMI was announced on the 15th of December, 2023. You may find the market reaction chart (GBPAUD M5) below:

GBP – Flash Services PMI

In the fast-paced world of economics, businesses are often the first to sense shifts in market conditions. Their responses are crucial indicators of economic health. At the forefront of this insight are purchasing managers, whose perspectives offer a direct glimpse into a company's outlook on the economy. To tap into this valuable source of information, a survey of approximately 650 purchasing managers is conducted. This survey probes these professionals to assess various aspects of business conditions. Key areas of focus include employment trends, production rates, new orders, pricing dynamics, supplier delivery performance, and inventory levels. Their responses provide a real-time barometer of the economic landscape, making it a vital tool for understanding market trends.

In a noteworthy deviation from Eurozone trends, the UK services sector experienced a significant boost in December 2023, with the S&P Global/CIPS UK Services PMI rising to 53.4, the highest since June and above expectations. This growth, marking a second consecutive month of expansion, is mainly attributed to increased new orders, particularly in financial and technology sectors, suggesting a revival in consumer demand. This positive development occurs despite ongoing economic challenges such as high living costs, tight budgets, and restrictive monetary policies by the Bank of England. While the sector faces rising operating costs and wage pressures, leading to the highest input cost inflation since August and cautious hiring, there is a growing optimism about future business conditions, reaching a seven-month high, indicating a resilient and potentially robust outlook for the UK services sector.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 53.4 |

| Comparison to Previous Months | Highest since June, above expectations |

| Trend | Second consecutive month of expansion |

| Main Growth Drivers | Increased new orders, especially in financial and technology sectors |

| Contextual Challenges | High living costs, tight budgets, restrictive monetary policies |

| Operating Costs and Wages | Rising, leading to highest input cost inflation since August |

| Hiring Practices | Cautious |

| Business Optimism | Growing, reaching a seven-month high |

| Sector Outlook | Resilient and potentially robust |

The latest forecast for the British Flash Services PMI suggests an expansion at 53.0, which is marginally lower than the previous figure of 53.4.

The British Flash Services PMI is set to be released on January 24th at 09:30 AM GMT.

The last time, the British Flash Services PMI was announced on the 15th of December, 2023. You may find the market reaction chart (GBPAUD M5) below:

CAD - Overnight Rate

In the dynamic world of currency trading, short-term interest rates have emerged as the key factor influencing currency valuation. According to industry experts, traders prioritize these rates above all other economic indicators. The central focus is not just on the current rates but significantly on their future trajectory. Traders meticulously analyze various economic indicators, but their primary goal is to forecast how these rates will shift in the future. This approach underscores the critical role that short-term interest rates play in shaping the valuation of currencies in the global financial market.

In December 2023, the Bank of Canada made the decision to maintain its target for the overnight rate at 5% for the third consecutive meeting, aligning with market expectations and leaving borrowing costs at their highest in 22 years. Policymakers had observed signs suggesting that their monetary policy was effectively moderating spending and easing price pressures. Despite this, there remained a cautious stance regarding the inflation outlook, with the Bank expressing readiness to increase the policy rate further if necessary. The central focus for the Bank was to achieve a sustained reduction in core inflation. It continued to closely monitor the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior. Additionally, the Bank confirmed its ongoing commitment to quantitative tightening, reflecting its strategic approach to managing the economic challenges at the time.

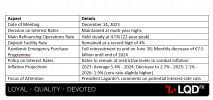

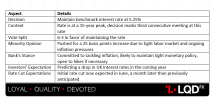

TL;DR

| Aspect | Detail |

| Overnight Rate Decision | Maintained at 5% |

| Consecutive Meetings at This Rate | 3 |

| Market Expectation | Aligned with decision |

| Borrowing Costs | Highest in 22 years |

| Monetary Policy Impact | Moderating spending, easing price pressures |

| Stance on Inflation | Cautious, readiness to increase rate if necessary |

| Primary Focus | Sustained reduction in core inflation |

| Monitoring Focus | Balance between demand and supply, inflation expectations, wage growth, corporate pricing behavior |

| Quantitative Tightening | Ongoing commitment |

The forecast for the upcoming Bank of Canada Overnight Rate suggests it will remain unchanged at 5.00%, consistent with the previous announcement.

The upcoming Bank of Canada Overnight Rate announcement is scheduled for January 24th at 2:45 PM GMT.

The last time, the Canadian Overnight Rate was announced on the 6th of December, 2023. You may find the market reaction chart (CADCHF M5) below:

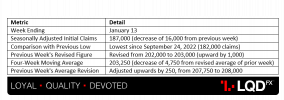

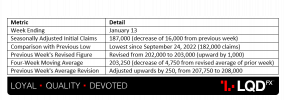

USD – Flash Manufacturing PMI

As a primary indicator of economic well-being, businesses swiftly respond to market fluctuations, and their purchasing managers often possess the most up-to-date and pertinent understanding of the company's economic perspective. A survey encompassing approximately 800 purchasing managers is conducted, where these professionals are queried to evaluate various aspects of business conditions such as employment, production, new orders, prices, supplier deliveries, and inventory levels.

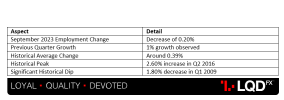

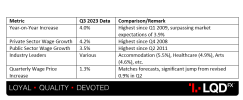

In December 2023, the U.S. manufacturing sector experienced a marked downturn, with the S&P Global U.S. Manufacturing PMI being revised to a lower rate of 47.9 from the initial 48.2 estimate, indicating a more severe decline compared to November. This was due to a decrease in output and an accelerated drop in new orders, reflecting weak demand both domestically and abroad. Manufacturers responded by cutting down on input purchases and hiring. The industry faced increased inflationary pressures, with costs rising sharply due to higher prices for metals, plastics, and transportation. Although selling prices increased at the fastest rate since April, overall client demand remained low, leading to a reduction in employment for the third month in a row. Despite these challenges, there was a slight improvement in business confidence, reaching a three-month high.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 47.9 |

| Initial Estimate | 48.2 |

| Comparison to November | More severe decline |

| Output Trend | Decrease |

| New Orders | Accelerated drop |

| Demand Conditions | Weak, both domestically and abroad |

| Manufacturer Responses | Reduced input purchases and hiring |

| Inflationary Pressures | Increased, with higher costs for metals, plastics, and transportation |

| Selling Prices | Increased at fastest rate since April |

| Client Demand | Remained low |

| Employment Trend | Reduction for the third consecutive month |

| Business Confidence | Slight improvement, three-month high |

The latest projection for the US Flash Manufacturing PMI suggests a contraction, with an anticipated figure of 47.2. This represents a slight decrease from the previous figure of 47.9.

The forthcoming release of the US Flash Manufacturing PMI is scheduled for January 24th at 2:45 PM GMT.

The last time, the US Flash Manufacturing PMI was announced on the 15th of December, 2023. You may find the market reaction chart (GBPUSD M5) below:

USD – Flash Services PMI

The Purchasing Managers’ Index (PMI) stands out as a significant indicator of economic health, offering early insights into the state of the economy. Businesses react promptly to changing market conditions, and purchasing managers are uniquely positioned to provide current and invaluable perspectives. This survey involves around 400 purchasing managers who are surveyed to gauge their evaluations of different facets of business conditions, including employment, production, new orders, pricing, supplier deliveries, and inventory levels.

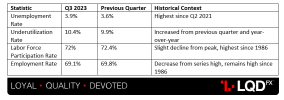

In December 2023, the S&P Global US Services PMI underwent a slight upward revision, reaching 51.4 from an initial estimate of 51.3. This revision highlighted the continued strength of the services sector, representing the most robust growth seen in five months. The improved output was driven by heightened demand conditions, with new orders surging at their fastest rate since June. Businesses were buoyed by the positive sales environment, leading to an increase in hiring activity. However, service providers also faced rising input costs due to higher wages and food prices, contributing to inflation. Nonetheless, efforts to stimulate new sales tempered the increase in output charges. Notably, business confidence saw a modest uptick, fueled by expectations of increased client demand, potential interest rate reductions, and investments in advertising and new product development.

TL;DR

| Aspect | Detail |

| PMI Value (Dec 2023) | 51.4 |

| Initial Estimate | 51.3 |

| Growth Indicator | Most robust in five months |

| Output Drivers | Heightened demand, fastest new orders rate since June |

| Hiring Activity | Increase due to positive sales environment |

| Input Costs | Rising, influenced by higher wages and food prices |

| Inflation Contribution | Significant, despite efforts to stimulate new sales |

| Output Charge Adjustments | Tempered increase |

| Business Confidence | Modest uptick |

| Confidence Factors | Expectations of increased client demand, potential interest rate reductions, advertising and new product investments |

The projected figure for the US Flash Services PMI indicates a continuing expansion, though at a slightly reduced rate, with a forecast of 51.0 compared to the previous outcome of 51.4.

The upcoming release of the US Flash Services PMI is set for January 24th at 2:45 PM GMT.

The last time, the US Flash Services PMI was announced on the 15th of December, 2023. You may find the market reaction chart (GBPUSD M5) below:

CAD – BOC Press Conference

This is one of the main ways the Bank of Canada interacts with investors about its monetary policy. It thoroughly discusses the elements influencing the latest decision on interest rates, including the general economic forecast and inflation. Crucially, it offers hints about potential future monetary policy directions.

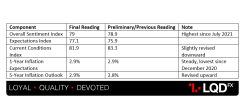

In the Monetary Policy Report Press Conference opening statement held on October 25, 2023, the Bank of Canada announced that they had maintained the policy interest rate at 5% and continued the policy of quantitative tightening. Although inflation had decreased since the summer of 2022, it was still considered high. The Bank had kept the policy rate steady to allow monetary policy to work on cooling the economy and alleviating price pressures. They expected further easing of inflation, although it might be slow, and had noted an increase in inflationary risks. The statement also highlighted the global economic context, geopolitical tensions, and the importance of monitoring various economic indicators and policy decisions in the future.

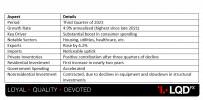

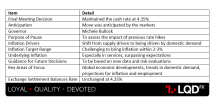

TL;DR

| Aspect | Detail |

| Policy Interest Rate Decision | Maintained at 5% |

| Quantitative Tightening | Continued |

| Inflation Status | Decreased since summer 2022 but still high |

| Reason for Steady Policy Rate | To cool the economy and alleviate price pressures |

| Inflation Outlook | Expected further easing, though slow |

| Inflationary Risks | Increased |

| Global Economic Context | Highlighted as important factor |

| Geopolitical Tensions | Noted as a consideration |

| Future Policy Monitoring | Emphasis on monitoring various economic indicators and making future policy decisions |

The Bank of Canada (BOC) Press Conference is scheduled to take place on January 24th at 4:00 PM GMT.

Disclaimer: The market news provided herein is for informational purposes only and should not be considered trading advice.