Forex Trading vs. Crypto Trading

Contents

- What is Forex trading?

- What is crypto trading?

- Similarities and differences in the markets

- Similarities and differences in how to trade

- Regulatory considerations

- Anonymity

- Taxes

- Getting started

- Pros of trading Forex

- Cons of trading Forex

- Pros of trading cryptos

- Cons of trading cryptos

- Which is right for you?

If you have an interest in trading currencies on the Forex market, there is a chance you are also thinking about trading cryptocurrencies. You may be wondering how Forex trading and crypto trading compare to one another.

In this guide, you can learn about the similarities and differences between the two in detail to help you figure out what you want to trade. To get started, let us briefly define Forex trading and crypto trading.

What is Forex trading?

Forex trading is trading on the foreign exchange market. This asset class includes fiat currency pairs such as:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- AUD/USD

- USD/CAD

- NZD/USD

Those are the major currency pairs, but there are also a lot of minor currency pairs.

What is crypto trading?

Crypto trading is the buying and selling of cryptocurrencies (cryptos). It is considered a different asset class from Forex pairs. Here are some examples of crypto pairs:

- BTC/USD

- BTC/EUR

- BTC/LTC

- BTC/ADA

- BTC/XLM

- ETH/BCH

- ETH/LINK

- BTC/USDT

- DAI/USDC

As you might guess, there is a huge spectrum of crypto pairs, being as there are so many cryptos to begin with. And of course the thing is they are also get mixed with fiat currencies to form pairs. What you see above is just a small sample.

So, fiat currencies and cryptos are different, but there is an overlap between the Forex and crypto markets. It is important to be aware of that.

Similarities and differences in the markets

Now that you understand the basics of these asset classes, let us compare the two markets.

1. Market size and diversity

If you are in search of a huge, diverse market for trading, you will be happy with Forex or crypto. Both have a tremendous range of assets. Technically, the crypto market is more diverse, as there are more than 23,000 cryptos. But you will find no shortage of fiat pairs.

In fact, the reality is that you probably will not be all that interested in trading the vast majority of cryptos or fiat currencies. The more exotic the asset, the more volatile and unpredictable it tends to be. Most of the best trading opportunities are concentrated around the major Forex pairs and cryptos.

2. Market volatility

Between the crypto and Forex markets, there is a clear answer as to which is more volatile. Without a doubt, it is the crypto market.

To give you some examples, above is a chart of EUR/USD since the start of 2023. As you can see, there are some fluctuations in value, but they are not too dramatic. There is enough movement that a well-placed trade could earn you money, but not so much that the euro gains or loses an insane amount of value against the US dollar.

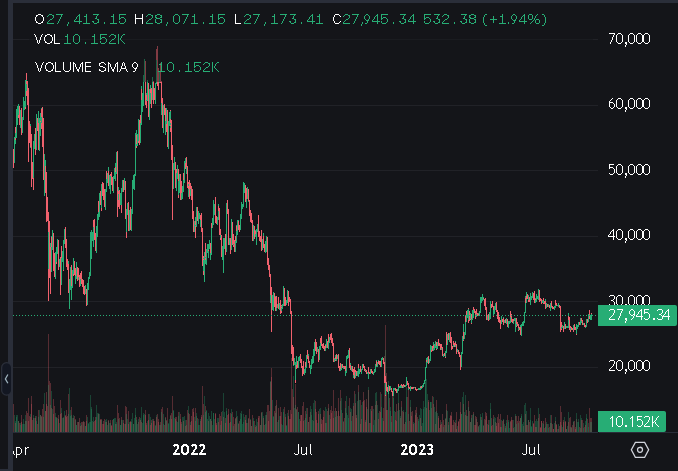

In the chart below, you can see price movement over time for BTC/USD:

What you are seeing in this chart is massive fluctuations in value. At the time of the screenshot, 1 BTC = $27,945.34 USD. But you can clearly see that in late 2021, the value of 1 BTC was well over $60,000 USD. Look how swiftly it crashed from that high.

Even though you will find volatility in Forex, there are ways to avoid a lot of the crazy whipsaws. You can steer clear of exotic pairs, and avoid trading during news releases, for example.

But with cryptos, even the most commonplace pairs can soar or tank in an instant with little to no warning. The sheer amount of value that cryptos gain or lose in hours or even minutes scrambles the mind.

That means that the riskier market to participate in is the crypto market. The Forex market can be very risky, but mitigating your risk is much easier.

3. Liquidity

The major currency pairs in the Forex market are very liquid. But almost no cryptos are particularly liquid, except maybe BTC. In fact, as you research various cryptos, you will discover that the creators of coins and tokens often need to put quite a lot of work and ingenuity into maintaining their liquidity.

When liquidity is low and volatility is high—as frequently happens with cryptocurrencies—you sometimes will see gaps in your charts.

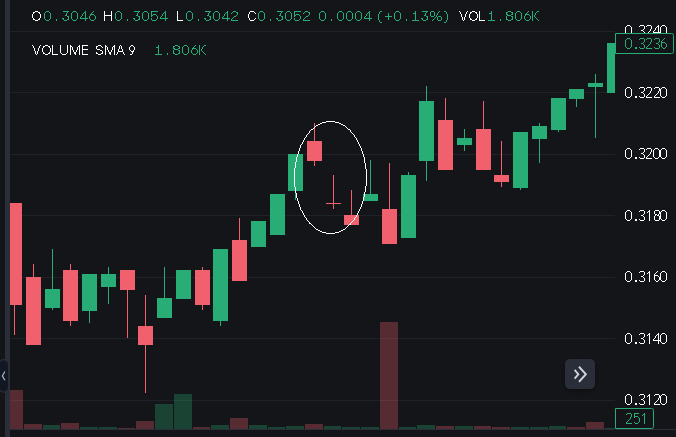

Here are a couple of examples of gaps in OCEAN/USD:

Gaps also occur in the Forex market under similar conditions. Below is an example:

While challenging to execute, there are multiple trading strategies that utilize gaps. You can make use of these strategies in either the Forex or crypto market.

4. Spreads

Let us talk about spreads in Forex vs. crypto, the difference between the bid and ask prices for assets. As a trader, you are looking for narrow spreads.

Above, you see the spreads displayed for a set of Forex currency pairs. As you can tell, they are pretty low for most major currencies. Not only that, but if you could have watched this image in real-time, you would have noted that those low spreads are rather stable much of the time (not the case with that 171 you see for USD/CNH).

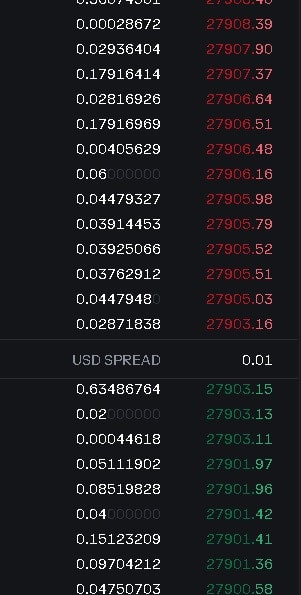

Now let us take a look at crypto spreads. We are going to look at BTC/USD since BTC accounts for the overwhelming majority of crypto trading volume.

As you can see, the spread is typically quite low. Nice! But sometimes, it jumps:

A jump like this can happen in under a second, so sometimes you might end up with unpredictable spreads as you are trading cryptos.

While spreads are one way that brokers and exchanges can make money on transactions, they can also do so by charging commissions and fees. These are not built into the price the way spreads are.

Along with trading commissions/fees, Forex brokers may charge rollover fees. Crypto exchanges can charge trading fees and rollover fees as well. Usually, trading fees at crypto exchanges take the form of maker and taker fees, rather than fixed fees.

It is difficult to directly compare fees since every broker and exchange has a different method to calculate them, but they are usually pretty affordable for either type of trading.

As a rule of thumb, commission on crypto exchanges is usually lower than commission charged by brokers on Forex pairs, while the spreads are usually wider on crypto exchanges than for currency pairs at brokers.

Similarities and differences in how to trade

Now that you understand the similarities and differences between the crypto and Forex markets, let us compare the process of participating in these two markets.

1. Where to trade

When you trade Forex, you sign up for an account with a Forex broker. This is a middleman that facilitates the buying and selling of currency pairs.

Forex brokers mainly offer trading for fiat pairs, though some offer other assets to trade as well.

If you want to trade cryptos, you will usually sign up with a crypto exchange. This is the equivalent of a Forex broker, but with a focus on trading cryptocurrencies.

Fiat currencies are included on crypto exchanges, but usually for conversion purposes (i.e., so you can convert your US dollars to crypto after depositing, or vice versa).

All of that said, there are now platforms that allow you to engage fully in both Forex and crypto trading.

For example, Exness was originally just a Forex platform, but now offers cryptocurrency trading as well. FXOpen is another example of a Forex broker that now lets you trade crypto.

What is cool about using a Forex broker like this to trade crypto is that you do not need to get a wallet or join a separate exchange.

There is another option for trading cryptos, which is to trade derivatives called contracts for difference (CFDs). Between opening and closing a CFD, the price of the contract will move based on what the underlying currency pair or crypto is doing. You then pay or receive the difference.

When you trade cryptos on an exchange or you engage in regular Forex trading, you are purchasing and selling the assets directly. But with crypto or Forex CFDs, you do not actually possess the currencies or cryptos you are trading. What are the benefits? Trading crypto CFDs can help you minimize your fees and take advantage of instant execution of your orders. Lot sizes are affordable and flexible, and there are no expiration dates.

Just be careful of how you are using leverage when trading CFDs, and read the fine print for the contracts.

2. Trading goals and strategies

With Forex and crypto trading, the overall goal is simple: profit. In both markets, we see traders looking for short-term and long-term gains.

That said, the crypto market has become especially popular for long-term strategies. In fact, the term "HODL" in the crypto world refers to this approach, and is short for "Hold On for Dear Life."

We have all heard stories about people who bought bitcoin in its infancy and ended up becoming extremely wealthy due to its enormous gains. A lot of people who purchase cryptos are hoping to get rich by holding for the long-term.

As far as how you plan your trades is concerned, fundamental analysis, technical analysis, and price action all can be used in both the Forex and crypto markets. Money management and trading psychology principles are similar for both as well.

Regulatory considerations

The Forex market is regulated by various authorities around the globe. For example, in the USA, the regulators that oversee the Forex market are the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Cryptos, by contrast, are in a regulatory gray area in many jurisdictions, including in the US. While for trading purposes, cryptocurrencies are considered commodities and fall under CFTC supervision, there is a certain lack of regulatory guidance for these instruments.

Anonymity

When you open an account to trade Forex, you are required to verify your identity through a process called Know Your Customer (KYC). This process protects both you and the broker.

You might think that trading cryptos is a way for you to avoid this, but these days, that is not the case. Crypto exchanges also will require you to verify your identity, so you are not truly anonymous when you trade.

Taxes

Governments around the world require their citizens to pay taxes on the gains they earn through investments. This applies both to Forex and crypto investments. And remember, you are verifying your identity when you open your account. Your crypto exchange or Forex broker is going to submit tax forms that report your earnings. Your government's tax authority is going to cross-reference those forms against the ones you submit.

So, if you fail to report your earnings in full, they will know. Make sure you report all your gains and pay taxes on them as required so you do not run afoul of your government.

Getting started

Whether you want to trade Forex or cryptos, getting started is easy. You can open your account with no initial deposit at either a crypto exchange or a Forex broker. When it comes time to make your first deposit, the minimum will depend on the specific company you are dealing with. In many cases, it is as low as $1.

It is recommended that you start trading with a larger amount than that. In either case, you will have an easier time growing your account if you have $100 or more in it (even better if you can manage closer to $1,000).

Demo accounts exist for practicing trading without risking real money whether you want to trade cryptos or fiat currencies.

When it comes time to trade, it is common in Forex to need to trade a minimum lot size. Depending on what that is for a given broker, it may or may not fit your money management plan, especially if you have a small account. But this concept does not seem to exist at crypto exchanges, so it appears this is one area where crypto may be more flexible. There are, however, some Forex brokers with customizable lot sizes.

Pros of trading Forex:

- The Forex market is open day and night, and features a huge selection of currency pairs to trade.

- There is enough volatility to profit from market movements, but by trading major currency pairs, you can avoid a lot of unpredictable, dramatic movements. Major Forex pairs are much more stable than cryptos.

- The Forex market is liquid.

- Spreads are typically low for major currency pairs and do not usually fluctuate a whole lot.

- The market is well-regulated, which helps to keep you safe as you trade.

- Entry barriers to Forex are low.

Cons of trading Forex:

- While we can see high gains in Forex, you are not going to see fiat currencies “moon” the way cryptos sometimes do.

- There is significant risk involved in trading Forex (though you can mitigate it with proper money management rules and a sound trading strategy).

- No trading during weekends.

Pros of trading cryptos:

- Like the Forex market, the crypto market is huge and diverse.

- The crypto market has low entry barriers.

- High volatility provides for numerous trade opportunities.

- It has become easier to start trading cryptos compared to in the past.

- Occasionally, cryptos rise astronomically in value in a brief amount of time, leading to stratospheric gains.

- There may be more flexibility in terms of how much you trade with crypto (many Forex brokers require a minimum lot size).

- Trade 24/7.

Cons of trading cryptos:

- There are problems with liquidity in the crypto market.

- While commission can be low, the spreads tend be rather wide and shoot up astronomically during some periods.

- The extreme volatility of the crypto market is a double-edged blade. It can bust your account if it goes against you.

Which is right for you?

Forex and crypto trading have a lot in common, but there are some key differences between them.

Forex trading might be right for you if...

We recommend Forex trading if the extreme volatility of crypto trading is a turn-off for you, but you are looking to catch significant market moves in a high-volume market featuring a diverse range of assets.

Crypto trading might be right for you if...

Think about trading crypto if you are looking for a diverse, high-volume market with flexible trade sizes. But you will need to be okay with the low liquidity and extreme volatility of this market in order to participate.

While many people only trade Forex or exclusively trade crypto, these two markets have a large enough overlap that they appeal to much of the same audience. So, you may very well decide to trade both Forex and crypto. If you think you are leaning in that direction, you might want to sign up for an account with a Forex broker that offers both.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.