XAU/USD tries to break from channel down

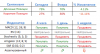

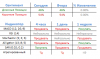

The gold prices continued to rise on Monday, following reports about the 1.3% PCE Price Index release as well as rumours that President Trump will chose Governor Powell take the Fed Chair seat. From technical point of view, this three-day growth has practically resulted in a breakout through the upper edge of recently formed descending channel. At the moment, the only barriers that constrain the bullion from climbing further are the 200-hour SMA near 1,277.16, the 61.8% Fibonacci retracement level at 1,279.00 and an alleged resistance near 1,281.57. One of these barriers as well as the weekly PP and the 100-hour SMA from the bottom are likely to constrain the pair from making major advances in the first half of the day. To be precise, until release of information on the US Consumer Confidence.

The gold prices continued to rise on Monday, following reports about the 1.3% PCE Price Index release as well as rumours that President Trump will chose Governor Powell take the Fed Chair seat. From technical point of view, this three-day growth has practically resulted in a breakout through the upper edge of recently formed descending channel. At the moment, the only barriers that constrain the bullion from climbing further are the 200-hour SMA near 1,277.16, the 61.8% Fibonacci retracement level at 1,279.00 and an alleged resistance near 1,281.57. One of these barriers as well as the weekly PP and the 100-hour SMA from the bottom are likely to constrain the pair from making major advances in the first half of the day. To be precise, until release of information on the US Consumer Confidence.