My FTMO Challenge

- Thread starter hayseed

- Start date

- Watchers 6

-

- Tags

- ftmo prop firm prop trading

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I think this was the image that started. You made a good point about trailing the right PSAR based on distance.

my question about why a stop vs a limit here, you mentioned PSAR being stop and reverse. Most of the pictures I am seeing stop orders on the PSAR, however, here you choose a limit - on a pretty high tf at that.

Is that because you have a bearish PSAR already on the higher tf?

my question about why a stop vs a limit here, you mentioned PSAR being stop and reverse. Most of the pictures I am seeing stop orders on the PSAR, however, here you choose a limit - on a pretty high tf at that.

Is that because you have a bearish PSAR already on the higher tf?

Attachments

//----I think this was the image that started. You made a good point about trailing the right PSAR based on distance.

my question about why a stop vs a limit here, you mentioned PSAR being stop and reverse. Most of the pictures I am seeing stop orders on the PSAR, however, here you choose a limit - on a pretty high tf at that.

Is that because you have a bearish PSAR already on the higher tf?

that was riding the psar down in case of a weak move up and bounce off...... similar to a riding a downtrend line with a sell limit......

you get a better entry price..... similar to selling the upper band of raghee horners wave in a downtrend.....

you might have a slight draw down as the price peaks above but over all it's a better entry.....h

//----

I can agree with that, I recall you showing that logic with your fib-box trade script.//----

that was riding the psar down in case of a weak move up and bounce off...... similar to a riding a downtrend line with a sell limit......

you get a better entry price..... similar to selling the upper band of raghee horners wave in a downtrend.....

you might have a slight draw down as the price peaks above but over all it's a better entry.....h

//----

Can you elaborate on what reinforces your decision to use that as a “better entry” rather than a “stop and reverse”?

You mentioned bband stop, PSAR , as stop and reverse. I definitely get this logic. And Inalso understand that they represent new opportunities to fade the move for a better entry.

I’m just curious what helps you decide which way to view the PSAR

//----Can you elaborate on what reinforces your decision to use that as a “better entry” rather than a “stop and reverse”?

I’m just curious what helps you decide which way to view the PSAR

https://www.earnforex.com/forum/threads/in-search-of-minimum-wage.46877/post-206762

//------

https://www.earnforex.com/forum/threads/mq4-code-works.46716/post-205174

//------

read those posts again...... your trying to find something that is not there......

imagine you were planting beans this month....... does it really matter which week you plant..... or matter which day..... or which hour...... or minute...... second......

all that really matters is the temperatures trend is above some level and it's average is rising..... the seeds actual entry time is almost immaterial..... planting might appear whimsical..... and probably is......

i could just as easily placed 50 sell stops every pip down and 50 sell limits every pip up...... and out of pure laziness sometimes i do..... that can be a good plan.... i would not waste my time writing all those ea's and scripts if it was not....

a very easy way to prove that is for you to choose one of the following,

iWPR,

iRSI,

iRVI,

iAO,

iCCI,

iWPR

then give me a appropriate realistic trigger level......

such as iCCI and 0......

i'll write a ea using what you have chosen...... give me one week...... the results will surprise you.......

the actual entry signal is almost immaterial to me.....h

I feel like a schoolboy whose been sent to select his switch…

iAO - how you use it. Pardon my forgetfulness. I know you’ve discussed awesome oscillator but I couldn’t find the video. Cannot recall if you use as a zero line cross or simply a change in the histogram

iAO - how you use it. Pardon my forgetfulness. I know you’ve discussed awesome oscillator but I couldn’t find the video. Cannot recall if you use as a zero line cross or simply a change in the histogram

//----I feel like a schoolboy whose been sent to select his switch…

iAO - how you use it. Pardon my forgetfulness. I know you’ve discussed awesome oscillator but I couldn’t find the video. Cannot recall if you use as a zero line cross or simply a change in the histogram

good choice of indicator and terms..... let's use iAO for the indicator and 0 as the switch......

so we will buy in the conventional manner when iAO crosses above the 0 line..... and sell when it crosses below.....

the orders comment will say, "tc iao crossed above 0 buy" or "tc iao crossed below 0 sell".... a search by comment makes it easy to sort out our orders.....

hold on a second..... just dawned on me....... you might be from australia ...... above for us is below for them......

so, lets do the opposite also.....

so we will sell in the unconventional manner when iAO crosses above the 0 line..... and buy when it crosses below.....

the orders comment will say, "tc iao crossed above 0 aussie sell" or "tc iao crossed below 0 aussie buy".... a search by comment makes it easy to sort out our orders.....

sounds like a can't lose system to me..... next week we should know.....h

Crikey. I’m intrigued and curious all at the same time. I have this silly feeling I know what’s coming (your success), but I hope I learn by the end of it.

I hope to learn about what is material to you by watching you do this!

the actual entry signal is almost immaterial to me.....h

I hope to learn about what is material to you by watching you do this!

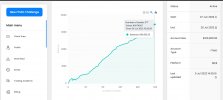

officially cleared step 1...... step 2 requires half the profit target in twice the time.....

the max loss and max daily loss need to be fully understood....... it's more like a max equity swing than a loss......

my max negative equity swing during the day was almost - 3000 even though i did not take a loss that day..... every trade closed profitable.....

had it gone over -5000 i would have failed even though never taking a loss.....

so be prepared......

went ahead and just closed everything open after going over 10k..... the remaining trades began to move hard against me..... i work full time and just could not deal with both...... so my job won out......

most of the losses i would never have taken in my oanda accounts for several reasons....... they kinda hurt my numbers but nothing to cry about.....h

//-----

//-----

//----

the max loss and max daily loss need to be fully understood....... it's more like a max equity swing than a loss......

my max negative equity swing during the day was almost - 3000 even though i did not take a loss that day..... every trade closed profitable.....

had it gone over -5000 i would have failed even though never taking a loss.....

so be prepared......

went ahead and just closed everything open after going over 10k..... the remaining trades began to move hard against me..... i work full time and just could not deal with both...... so my job won out......

most of the losses i would never have taken in my oanda accounts for several reasons....... they kinda hurt my numbers but nothing to cry about.....h

//-----

//-----

//----

inspiring stuff, mate. In a game that chews people up and spits them out every single day, you've figured it out. Making $10k in 10 days....

why the heck are you working a full-time job?

why the heck are you working a full-time job?

//----inspiring stuff, mate. In a game that chews people up and spits them out every single day, you've figured it out. Making $10k in 10 days....

why the heck are you working a full-time job?

don't be fooled by randomness...... linear results are seldom linear......h

//----

good choice of indicator and terms..... let's use iAO for the indicator and 0 as the switch......

so we will buy in the conventional manner when iAO crosses above the 0 line..... and sell when it crosses below.....

the orders comment will say, "tc iao crossed above 0 buy" or "tc iao crossed below 0 sell".... a search by comment makes it easy to sort out our orders.....

hold on a second..... just dawned on me....... you might be from australia ...... above for us is below for them......

so, lets do the opposite also.....

so we will sell in the unconventional manner when iAO crosses above the 0 line..... and buy when it crosses below.....

the orders comment will say, "tc iao crossed above 0 aussie sell" or "tc iao crossed below 0 aussie buy".... a search by comment makes it easy to sort out our orders.....

sounds like a can't lose system to me..... next week we should know.....h

To show I am not free loader, I gave you a headstart... assuming you are not already past the finished line.

Included is the simply AO criteria, the option to have it check a different Timeframe (or 0 for current timeframe), and the long/short market order.

Attachments

//----gave you a headstart...

lets move this over to the mq4 code works thread.....h

//---//----

don't be fooled by randomness...... linear results are seldom linear......h

speaking of which,..... here are last weeks ftmo challenge results...... we all have'em....

stand up..... dust yourself off..... get back in the game.....

we'll all be laughin about it later.....h

//

//-----//---

stand up..... dust yourself off..... get back in the game.....

dang..... glad they give ya twice as long to make half as much on part 2......

by the time i find my feet dusting off will out of the question.......

googled 'trading excuses' and it appears i've used them all..... several times.....

might have to deposit that last 1500 myself.......h

//-----

//---

it might have been a mistake but i shut this down today..... the trades went hard against me.....

you get about 60 days to make 5000, and i have only used 14 maybe...... so plenty of time left......

will resume next week..... with a clear mind......hopefully anyway......h

you get about 60 days to make 5000, and i have only used 14 maybe...... so plenty of time left......

will resume next week..... with a clear mind......hopefully anyway......h

//---How is your challenge doing, @hayseed? Did you manage pass?

hey enivid..... not good i'm sorry to say..... still in holding pattern..... have time left....

really need to get back to it.....h

//---

good chance the holiday had things running slow.... kinda picked up quick though didn't it.....

down to the last 700..... after todays movement it will probably the hardest of it all,,,,,

in any event, those chickens haven't hatched yet......h

//------

View attachment 22003

//-----

Post automatically merged:

I ASSUME YOU PASSED THE CHALLENGE...RIGHT?

before last week i could not even spell ftmo......

several guys over on another forum started out discussing it's pros and cons, which of course turned into kicking up some dust..... seems their time could be better spent.....

made me wonder what all the fuss was about...... the more i looked the more interesting it became..... to the point where i decided to roll the dice.....

lets don't kid ourselves, making the required 10% in 30 days is a high wire for most of us..... still, all in all it offers a unique opportunity.....

will add some of the specific points that interest me the most, if this does not blow up in my hands first...... and i fully expect some disagreements on my thoughts...... i see that as a good thing.....

after all, it's disagreements that move the markets......h

//-----

//-----

View attachment 21982

//------

View attachment 21983

//----

FTMO, like most prop firms make money from the challenge fees. They expect over 90% of aspiring traders to fail. Unfortunately, the less than 10% that pass the challenge are frustrated by shutting down their funded accounts suddenly or manipulating their accounts against them. I will send proof from my ftmo account.before last week i could not even spell ftmo......

several guys over on another forum started out discussing it's pros and cons, which of course turned into kicking up some dust..... seems their time could be better spent.....

made me wonder what all the fuss was about...... the more i looked the more interesting it became..... to the point where i decided to roll the dice.....

lets don't kid ourselves, making the required 10% in 30 days is a high wire for most of us..... still, all in all it offers a unique opportunity.....

will add some of the specific points that interest me the most, if this does not blow up in my hands first...... and i fully expect some disagreements on my thoughts...... i see that as a good thing.....

after all, it's disagreements that move the markets......h

//-----

//-----

View attachment 21982

//------

View attachment 21983

//----

Similar threads

- Replies

- 27

- Views

- 15K

- Replies

- 3

- Views

- 3K