The5ers - Funding Forex Traders & Growth Program

- Thread starter The5ers

- Start date

- Watchers 1

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

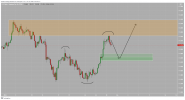

Weekly trade idea on GBP/USD.

Week: 27-31.12.2021

No Key Event.

There is no news expected this week as we are between the week of Christmas and new year's. This is when we usually will find a large drop in volatility as everyone takes a step away from the charts to spend time with their families. However, looking at the current state of the UK and how it is currently going about handling its covid outbreak, more restrictions may come into play which will further push the GBP to the downside.At this current time, we expect a continuation of the actual trend.

Key Levels:

- Resistance 1.3500, 1.3600

- Support 1.3370, 1.3200

Trend GBP/USD

BearishPrice has completed a slow turnover at the highs around 1.42 and is now pushing towards the 1.20's. A test of the next resistance is very likely. If that level holds, we should see a drop all the way to 1.32.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend. If we find that the price can't break the current resistance of 1.34, await confirmation, then trade to the downside.Weekly trade idea on EUR/USD.

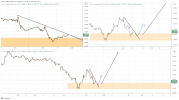

Week: 02-07.01.2022

Unemployment Rate.

USD has its biggest news release on Friday this week, with the Unemployment rate being announced. Over the past year, we have seen a steady trend of a decreasing rate as everyone gets back to normal life post lockdowns. I expect this trend to continue. We are currently sitting at an unemployment rate of 4.1%, which matches the rate back in 2017. I believe it will manage to get back into mid 3% this year.At this current time, the weekly trend is bearish, and I expect it to continue.

Key Levels:

- Resistance 1.1400, 1.1500

- Support 1.1250, 1.1200

Trend GBP/USD

BearishPrice is currently in a consolidation awaiting volatility to form a breakout. The unemployment rate volume will be that breakout.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend. If we see a strong move to the downside from the unemployment rate, our target will be around 1.1200.

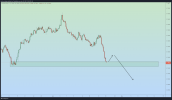

Weekly trade idea on XAG/USD.

Week: 10-14.01.2022

CPI/PPI/Retail Sales.

There are a few volatility events being released this week for the USD, which we will need to keep an eye on. My overall bias is a bullish one for the USD, as I believe in current times it is going to show its strength coming out of the pandemic. While all the releases are lagging macro indicators, they will still bring strong movement into the market and need to be accounted for.

Consumer Price Index, while the past 3 months has proven good results for the USDs CPI, the recent forecast predictions are a sign that they are predicting it to slow. The forecast produced is half of Decembers release figures. I do believe the actual will be greater than the forecast; however, having such a drop in confidence is a worrying factor to macro traders.

Producer Price Index, Unlike the CPI, I sit in a more confident position in assuming that the PPI can increase the bullish strength in the USD.

Retail SalesJanuary isn’t usually a great time for retail sales as everyone calms down after the holiday period. However, a low ball forecast of 0.0% could make for catching people into thinking the sales are bullish.

At this current time, I expect a continuation of the actual trend, which is bearish on Silver.

Key Levels:

Bearish

Price has sat in a channel since July 2020 and is not testing the demand for the product. After testing this level many times over the past 8 months, I can see the demand drying up as the USD gets stronger. We have a free $2 worth of movement where no supply or demand zones have sat for years if we manage to break this 21.50 zone.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend. If we find that the price can’t break the current support of 21.50, await confirmation, then trade to the 19.50.

Week: 10-14.01.2022

CPI/PPI/Retail Sales.

There are a few volatility events being released this week for the USD, which we will need to keep an eye on. My overall bias is a bullish one for the USD, as I believe in current times it is going to show its strength coming out of the pandemic. While all the releases are lagging macro indicators, they will still bring strong movement into the market and need to be accounted for.

Consumer Price Index, while the past 3 months has proven good results for the USDs CPI, the recent forecast predictions are a sign that they are predicting it to slow. The forecast produced is half of Decembers release figures. I do believe the actual will be greater than the forecast; however, having such a drop in confidence is a worrying factor to macro traders.

Producer Price Index, Unlike the CPI, I sit in a more confident position in assuming that the PPI can increase the bullish strength in the USD.

Retail SalesJanuary isn’t usually a great time for retail sales as everyone calms down after the holiday period. However, a low ball forecast of 0.0% could make for catching people into thinking the sales are bullish.

At this current time, I expect a continuation of the actual trend, which is bearish on Silver.

Key Levels:

- Resistance 23.50

- Support 21.50, 19.50

Bearish

Price has sat in a channel since July 2020 and is not testing the demand for the product. After testing this level many times over the past 8 months, I can see the demand drying up as the USD gets stronger. We have a free $2 worth of movement where no supply or demand zones have sat for years if we manage to break this 21.50 zone.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend. If we find that the price can’t break the current support of 21.50, await confirmation, then trade to the 19.50.

Weekly trade idea on USD/JPY.

Week: 17-21.01.2022

Bank of Japan Outlook.

The BOJ outlook report is one of the strongest movers of the JPY we have seen in recent years. While the report is tentative, we do know that it will be released on Tuesday. Keep your eye on this report as it has the power to change trend direction.At this current time, the daily trend is bullish and I expect it to continue.

Key Levels:

- Resistance 115.600

- Support 113.500

Trend USD/JPY:

BullishPrice has just completed a strong pullback before either a continuation or a change in trend direction.

Call to Action/Trade Idea

We will look for any opportunity to join the bearish trend with a good RR moving up into the drawn supply zone. Keep your eye on the BOJ report as it can change this analysis drastically.

www.the5ers.com

Weekly trade idea on EUR/AUD.

Week: 24-28.01.2022

AUD CPI.

The major news which will move this pair this week is the Consumer Price Index for the AUD. This result gives a major indication of inflation within the economy. With fuel and housing prices showing no sign of slowing down, I can see this release triggering an RBA cash rate meeting. Keep your eye on this release, I think their expectations are set too high and the market will be disappointed.Key Levels:

- Resistance 1.58500, 1.59000

- Support 1.56000

Trend EUR/AUD

SidewaysPrice has been consolidating for the past few weeks and I am expecting this to continue. We are approaching a strong supply area and given the current climate of the currencies, I can see this supply zone being too strong for the price to break.

Call to Action/Trade Idea

We have entered the supply zone on the 4H chart, look into the 1H and start to build a trading plan, look for Lower Lows, trend line breaks, and chart patterns which point towards the downside, then short to 1.56000.

Weekly trade idea on USD/JPY.

Week: 31-04.01.2022

USD NFP.

The major news which will move this pair this week comes at the end of the week. NFP. I ideally would prefer this trade to be completed by then, however if it is not, I will likely ignore the idea.Key Levels:

- Resistance 115.600, 116.400

- Support 114.800, 113.600

Trend USD/JPY

Direction Change 4hPrice has just completed a higher low and a higher high, confirming that we may be seeing a strong trend change on the 4h chart. With the power of the bulls creating the new high, I can see a minor pullback then a trend continuation.

Call to Action/Trade Idea

Wait for the USDJPY price to come into the most recent demand area, then dive into the lower time frames to find a bullish entry point.For more trade ideas check out our forex trading ideas page

Weekly trade idea on GBP/USD.

Week: 07-11.02.2022

Core CPI (USD).

The major news which will move this pair this week is the Consumer Price Index for the USD. It is coming at the end of the week and usually doesn’t impact the price movement too much. I can’t see this affecting our analysis at this stage.Key Levels:

- Resistance 1.36200, 1.35800

- Support 1.35110

Trend GBP/USD

BearishPrice since mid January has been moving towards the downside, halting and forming a large pull back on the 1h chart. While this pullback did retreat into a supply zone, it formed a strong push below the most recent low and has begun forming another pullback.

Call to Action/Trade Idea

Keep an eye on the pair to retrace its steps back up into the most recent supply, there was a strong push from that area. If we find our way into that zone, head into the 15m chart and look for entries to go short.For more trade ideas check out our forex trading ideas page

Weekly trade idea on USD/CAD.

Week: 14-18.02.2022

USD PPI and Russia invade?

We have a few pieces of news coming out for the USD at the moment, but there is one thing everyone is watching and anticipating. We have seen a volume drop and a lot of people selling out of the stock market predicting that an invasion may occur in the coming weeks. Keep this in mind, the markets could act crazy on new information.Key Levels:

- Resistance 1.28000, 1.28800

- Support 1.26500, 1.25700

Trend USD/CAD

SizewaysPrice since mid January has been moving sideways, we have had some big pulses in either direction but nothing too convincing. It looks like the market thinks it may be evenly priced at this point in time.

Call to Action/Trade Idea

Keep an eye on the pair to see if we can break and retest the upper trendline of this channel. Once broken, trade to the supply zone.For more trade ideas check out our forex trading ideas page

How to Manage Intraday Positions in Forex Trading - The5ers Class

In this class, Ruben managed in live multiples day-trading open positions.

The positions were on the GBPUSD, AUDUSD, and AUDNZD.

He explained what signals he waited to open those positions and how to manage them.

At the end of the session, he also gets a signal on the EURUSD.

For more 5ers classes

In this class, Ruben managed in live multiples day-trading open positions.

The positions were on the GBPUSD, AUDUSD, and AUDNZD.

He explained what signals he waited to open those positions and how to manage them.

At the end of the session, he also gets a signal on the EURUSD.

For more 5ers classes

Weekly trade idea on EUR/CAD.

Week: 14-18.03.2022

Will NATO join the war?

We have a few pieces of news coming out for both pairs at the moment, but I think there is one major play everyone is keeping their eye on. With money flooding out of the EUR, it is shaping up to be a potential bargain for low-cost stocks if war breaks out. Keep an eye on the news this week while trading the Euro.Key Levels:

- Resistance 1.40800, 1.42000

- Support 1.39000, 1.38000

Trend EUR/CAD

BearishPrices have been moving in a strong and stable downtrend for the past month with the current state of world economics. We have recently broken structure, however, to the upside on EURCAD, which is indicating a potential trend change.

Call to Action/Trade Idea

Keep an eye on the pair to see if we can break and retest the trend line. Once broken, trade to the recent highs or hold long term.

Weekly trade idea on GBP/USD.

Week: 21-25.03.2022

Annual Budget release for GBP.

This document outlines the government's budget for the year, including expected spending and income levels, borrowing levels, financial objectives, and planned investments. Given the war in Europe, I believe we will see an increase in spending and borrowing in order to strengthen the defence force in the UK.Key Levels:

- Resistance 1.32000, 1.32800

- Support 1.31000

Trend GBP/USD

BearishPrices have been moving in a strong and stable downtrend for the past month with the current state of world economics. We have recently broken the structure however to the upside on GBPUSD which is indicating a potential trend change.

Call to Action/Trade Idea

Keep an eye on the pair to see if we can break and retest the body of the head and shoulders. Once broken, trade to the recent highs or hold long term.

Weekly trade idea on EUR/USD.

Week: 28-01.04.2022

Final GDP for USD.

This release is the broadest measure of economic activity and the primary gauge of the economy's health. They are forecasting a large increase in the final GDP, with retail sales being down as a whole over the christmas period I am unsure on the confidence for it to hit the overall forecast. We did have a spike during February, but still not confident.Looking for a definite increase in the GDP, but falling below the levels forecasted.

Key Levels:

- Resistance 1.10300, 1.11000

- Support 1.09400

Trend EUR/USD

SidewaysPrices have been moving in a stable channel for the past month with the current state of world economics. We have recently broken the structure to the downside on EURUSD which is indicating a potential trend change.

Call to Action/Trade Idea

Keep an eye on the pair to see if we can break the weak demand area, then look for potential long plays from the strong demand zone.Forex Trading Ideas

Weekly trade idea on EUR/AUD.

Week: 4-08.04.2022

RBA Cash Rate for AUD.

Big news coming out for the AUD this week, while usually the Cash Rate itself is already priced into the market, the RBA statement can give a lot of insight into where the economy is heading in the future. Short term interest rates are the paramount factor in currency valuation, so expect a volatile AUD.Looking for a positive outlook on AUD.

Key Levels:

- Resistance 1.47820, 1.49200

- Support 1.47000

Trend EUR/AUD.

Short-term BearishThe price of the EUR has been one of the most volatile currencies available with the war raging between Russia and Ukraine. We have recently seen some positive talks between the 2 countries resulting in a pullback of the EUR against the AUD. But given the outlook on AUD, I believe this pair can still head down to retest the recent lows.

Call to Action/Trade Idea

If the price returns to the recent supply area, look to short on confirmation of bearish power to 1.465Forex Trading Ideas

Weekly trade idea on GBP/CAD.

Week: 11-15.04.2022

CPI and Unemployment for GBP.

Big news coming out for the GBP this week, firstly we have the unemployment rate which is forecasted to be positive for the GBP. Recently the UK has seen a decrease in unemployment showing the fast recovery post covid lock downs. It is also forecasted to see high growth when it comes down to the CPI pushing the GBP up in value.Looking for a positive outlook on GBP.

Key Levels:

- Resistance 1.64600, 1.65000

- Support 1.63400

Trend GBP/CAD.

BearishPrice of the pound has been in a steady downtrend but I believe we may have hit the bottom and look for a potential bounce higher.

Call to Action/Trade Idea

If price breaks the second “BOS?” and returns to the recent demand area, look to go long on confirmation of bullish power to 1.67Forex Trading Ideas

A Revolutionary Funding Model - The5ers Freestyle Funding Program.

The5ers introduces a revolutionary funding model, where you show your trading skills over a series of trades instead of over a time or balance target.

What Do You Get Once Funded?

The5ers introduces a revolutionary funding model, where you show your trading skills over a series of trades instead of over a time or balance target.

What Do You Get Once Funded?

- Get funded with a live account of $50,000

- No profit split; 100% is yours.

- Growth up to 4M.

- Leverage of 1:30

- No daily drawdown

- 10% absolute DD

- Refund

Weekly trade idea on AUD/USD.

Week: 25-29.04.2022

USD signals 6 more rate hikes.

USD raised its rates in March and signalled 6 more hikes in the near future. These are very bullish signs for the USD whereas the RBA has dropped “Patient” from their policy statement signalling a possible 2022 hike.Key Levels:

- Resistance 0.745

- Support 0.718

Trend AUD/USD.

BearishThe overall

trend recently has been to the downside on the pair, I think this trend will continue into the near future and breaking lower lows as it moves.

trend recently has been to the downside on the pair, I think this trend will continue into the near future and breaking lower lows as it moves.Call to Action/Trade Idea

Wait for price to retrace and test the demand for the product, if demand is weak, join the force pushing to the downside.Forex Trading Ideas

Weekly trade idea on AUD/CHF.

Week: 02-06.05.2022

RBA hiking interest rates.

AUD is showing weakness as the RBA are ready to start hiking rates, this data is usually already priced into the market but it is the meeting minutes which indicate where we are heading into the future. Also expecting lower retail sales data later in the week.CHF is looking rather bullish, on the other hand with not much room for the Monetary Policy to ease the outlook is rather Dovish. The data releases do remain weak but with stocks heading lower I can see money flooding into the CHF.

Key Levels:

- Resistance 0.698

- Support 0.685

Trend AUD/CHF.

BearishOverall trend recently has been to the downside on the pair, I think this trend will continue into the near future and breaking lower lows as it moves.

Call to Action/Trade Idea

Short AUD ahead of interest rate decisions and retail sales data, keeping a close eye on the reaction of the market.Forex Trading Ideas

Similar threads

- Replies

- 107

- Views

- 25K

- Replies

- 5

- Views

- 2K

- Replies

- 23

- Views

- 5K

- Replies

- 84

- Views

- 8K