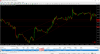

Trade with great care like on thin ice

- Thread starter Trench

- Start date

- Watchers 3

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 3

- Views

- 3K

- Replies

- 8

- Views

- 2K

- Replies

- 0

- Views

- 3K