EUR/USD prepares for Draghi and Yellen speeches

An hourly chart reveals that the Euro is moving against the American Dollar in a short-term symmetrical triangle, as traders await both Mario Draghi and Janet Yellen speeches that will be delivered later this day at the Jackson Hole Symposium.

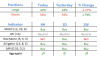

From a technical perspective, a breakout to the northern direction seems more possible, as the currency pair experiences pressure from the 55- and 100-hour SMAs from the bottom. In addition, the upper area lacks any notable resistance barriers in the next 45-pip range.

However, if the downfall happens, then in the worst case scenario it should be stopped by the 100% Fibonacci retracement level at 1.1714.

An hourly chart reveals that the Euro is moving against the American Dollar in a short-term symmetrical triangle, as traders await both Mario Draghi and Janet Yellen speeches that will be delivered later this day at the Jackson Hole Symposium.

From a technical perspective, a breakout to the northern direction seems more possible, as the currency pair experiences pressure from the 55- and 100-hour SMAs from the bottom. In addition, the upper area lacks any notable resistance barriers in the next 45-pip range.

However, if the downfall happens, then in the worst case scenario it should be stopped by the 100% Fibonacci retracement level at 1.1714.