going to push the risk multiplier back above 2......

//-----

how could that be done..... how to intentionally force darwin to raise my multiplier back above 2.......

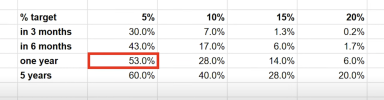

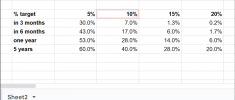

numbers are subject to manipulation.... both good and bad manipulation ...... examples below.....

//-----

starting with bad manipulation......

suppose someone had 143 losing trades totaling -46,616$ with an average loss of -325$.....

suppose he intentionally took 143 losing trades, -5$ each , for a total of -715$ ......

the result would be his average loss was almost cut in half..... now -165$...... a shallow point of view might be he looks much better......

we could expand on that but the point is bad manipulation......

//-----

admitting upfront , i'm fixin to intentionally manipulate the numbers...... for a good reason......

going to push the risk multiplier back above 2......

again, how could that be done..... it would help knowing exactly how the risk multiplier is calculated...... i don't......

the length, also called duration, of the trade may be a component...... not sure...... if so, cutting the average length in half might help.....

i am not going to fiddle with the average losing trade duration...... currently 17 hours and 34 minutes..... that would be bad manipulation.....

i will attempt to lower the average winning trade duration..... currently 7 hours and 17 minutes..... need to explain reasoning later.....

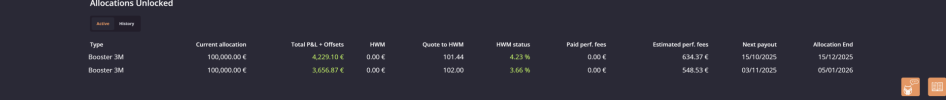

also perhaps by lowering my average var and d leverage would help raise the risk multiplier..... again, not sure.....

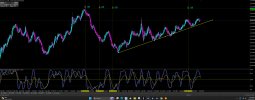

to do all the above, i must cut my charts timeframe to a point where the signals double or more......

not so low as to be considered scalping......h

//------

//-----

how could that be done..... how to intentionally force darwin to raise my multiplier back above 2.......

numbers are subject to manipulation.... both good and bad manipulation ...... examples below.....

//-----

starting with bad manipulation......

suppose someone had 143 losing trades totaling -46,616$ with an average loss of -325$.....

suppose he intentionally took 143 losing trades, -5$ each , for a total of -715$ ......

the result would be his average loss was almost cut in half..... now -165$...... a shallow point of view might be he looks much better......

we could expand on that but the point is bad manipulation......

//-----

admitting upfront , i'm fixin to intentionally manipulate the numbers...... for a good reason......

going to push the risk multiplier back above 2......

again, how could that be done..... it would help knowing exactly how the risk multiplier is calculated...... i don't......

the length, also called duration, of the trade may be a component...... not sure...... if so, cutting the average length in half might help.....

i am not going to fiddle with the average losing trade duration...... currently 17 hours and 34 minutes..... that would be bad manipulation.....

i will attempt to lower the average winning trade duration..... currently 7 hours and 17 minutes..... need to explain reasoning later.....

also perhaps by lowering my average var and d leverage would help raise the risk multiplier..... again, not sure.....

to do all the above, i must cut my charts timeframe to a point where the signals double or more......

not so low as to be considered scalping......h

//------