//-----Can you help me build the list?

Higher:

• Fresh Signals in higher timeframes

• existence of a very over drawn downtrend and stale counts

•near term strength starting to show itself on the daily TF.

Lower:

• dollar rates are likely to continue to increase, but I don’t like using fundamentals because I know so little

• larger timeframes clearly show weakness in The EUR. Yes it is a long down trend, but an object in motion tends to stay that way.

• current Daily surge, at least among the quicker indicators (JJMA, JFATL, ALMA) is past/hitting the stale count area and could signal the end of this surge.

I suppose a lot of things depend on what you mean too. Is this a daily look to send a grid for the next day? Or is it to send a grid for the next few months/weeks.

If the former and for a shorter term grid, I would certainly be wary of shorting, because something is giving the EUR strength. If the latter, I would create a net short grid despite knowing I may be in Drawdown for a while before the current upward impuls corrects

lol...... you sure put more thought in it than me.....

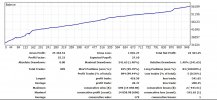

i was just thinking about trying to take a 100$ account , place one 0.01 trade every day making 1$ and see where it stood in 100 days.....

similar to the the angle if incidence ...... fun trading from years ago....

yep, we can build a list..... might help to think in pure definable terms...... things like fresh, stale, very over drawn, strength, and surge are subject to interpretation.....

100$.... 1 trade per day..... 1$ per day..... 100 days..... sounds silly i know...... but wonder how many said the same thing about minimum wage......

gotta start somewhere..... 1 is as good a place as any.....h