Price Action Swing Trading - The PAST Strategy

- Thread starter Nigel Price

- Start date

- Watchers 91

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

400% Welcome Forex Deposit Bonus Promotion to each new client of Forex Demo Contests and Forex Live Contests.The 400% Welcome Deposit Bonus offer a monthly profit taking model or the option to trade the required lot volume.know more from http://www.iforexbonus.com.

Sofic, thank you for this insightful and thought-provoking contribution to the price action discussion

Hi Guys, I did a pretty comprehensive review video over the weekend - thought I would share it with you here too. In the video I look at a fantastic losing trade in EURGBP, undertake a review of current open positions in USDJPY, EURJPY, AUDJPY, EURAUD and take a look to see if there are any good upcoming opportunities. As you might imagine, I have benefited very nicely from the recent Yen strength.

If you have any questions, post them and I will do my best to answer. All the best!

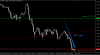

In the above example I get interested when price is approaching the underside of the trendline (drawn in orange in the above example).

I like to enter my sell trade when price is as close as possible to the trendline.

I have very clear expectations - price should not manage to establish itself above the trendline, because this would signal that the buyers have regained control of the market. If price manages to to this, I quickly acknowledge that I am wrong on this occasion. I close my trade and take my loss.

I want to see price fail at the underside of the trendline and then quickly fall away. The buyers tried to regain control of the market after the trendline break but have run out of steam; the sellers are back in control. When this happens my sell trade will move into profit, and as it does so, I will tighten my risk by bringing my stop to break-even.

I now have a risk-free trade.

Nigel, I feel like either I am looking over your shoulder, or you are looking over mine, as our strategies are very similar right down to money management. Anyone following your strategy will do just fine! Cheers!

Nigel, I feel like either I am looking over your shoulder, or you are looking over mine, as our strategies are very similar right down to money management. Anyone following your strategy will do just fine! Cheers!

Thanks Gary - yes you are absolutely correct - I have tried my best to look over the shoulder of many traders over the years, and there are definitely commonalities between profitable strategies and approaches. Sensible money-management and asymmetric risk v reward are the two things that I come across most often in profitable strategies.

(nice performance on the myfxbook account there Gary, keep it up!

Hi guys, latest video has been posted - got a very nice entry on EUR/GBP!

Let's see what happens!

Nigel

Let's see what happens!

Nigel

Hi Nigel, thanks for the post! I would not have considered the weekly chart as part of my analysis, but this makes absolute sense if serious about maximising potential from a trade. Thanks again, Gary!

Just an after-thought re trendlines and spikes, etc. Personally, I switch to a line chart and use the close prices to draw my lines. Allows me to see things without the clutter and noise, and seems to work for me. Cheers!

Just an after-thought re trendlines and spikes, etc. Personally, I switch to a line chart and use the close prices to draw my lines. Allows me to see things without the clutter and noise, and seems to work for me. Cheers!

Hi there Gary,

Yes, I know exactly what you mean - sometimes candle charts can be a little messy. As you say, they can have spikes and false breaks and that can make them a little hard to read. Yes, if you want to take a step back and see the big picture, there is nothing better than a line chart set to the close price, and then just draw the trendlines off that! Thanks for pointing that out - I'm sure some people reading this will find that little trick useful!

All the best!

Nigel

Latest Video here Guys - looking at the benefits of embracing "Uncomfortable Trading" -

Enjoy

Enjoy

Couple of new videos for you here guys - enjoy!

Here's Why Your Trading Is Driving You Mad Right Now

How Persistence Pays In Forex Trading: A Real Life Example

Here's Why Your Trading Is Driving You Mad Right Now

How Persistence Pays In Forex Trading: A Real Life Example

Lol, i like your style NigelSofic, thank you for this insightful and thought-provoking contribution to the price action discussion

Hi guys, latest video has been posted - got a very nice entry on EUR/GBP!

Let's see what happens!

Nigel

Hi Nigel to you have any recent video?

Very nice vids by the way, i love Price Action

Hi Nigel to you have any recent video?

Very nice vids by the way, i love Price Action

Funny you should ask Price Action Pro, I just did one yesterday!

Here it is:

I think we might be coming into a nice sell zone on NZDUSD. Obviously we can't know for certain whether price will turn around here or not, but if it does, there could be some very nice risk v reward to be had here. And that's what it's all about, risk v reward.

Hope you enjoy, if you want me to deal with any specific topic, or have any other questions, don't be afraid to let me know.

All the best!

Nigel

Hello Traders,

After a lot of false starts, it looks like we might have got a good potential low risk/high reward position in play on NZDUSD.

This hasn't been a straightforward trading setup but the complexity makes for a good learning example. If you can trade around NZDUSD lately, you can probably trade anything

The open position is +117 pips in profit, and I'm starting to make back what I have spent getting the trade in play. The price action looks solid, with a nice strong move to the downside. The daily, weekly, and even the monthly charts (bearing in mind that we still have more than half the month to go) are looking nice and toppy.

I intend to get aggressive and add further if price continues to decline.

Take a look at the attached video and I'll take you through exactly what I'm seeing on the pair right now.

All the best!

After a lot of false starts, it looks like we might have got a good potential low risk/high reward position in play on NZDUSD.

This hasn't been a straightforward trading setup but the complexity makes for a good learning example. If you can trade around NZDUSD lately, you can probably trade anything

The open position is +117 pips in profit, and I'm starting to make back what I have spent getting the trade in play. The price action looks solid, with a nice strong move to the downside. The daily, weekly, and even the monthly charts (bearing in mind that we still have more than half the month to go) are looking nice and toppy.

I intend to get aggressive and add further if price continues to decline.

Take a look at the attached video and I'll take you through exactly what I'm seeing on the pair right now.

All the best!

Latest Report here guys:

Good luck for the coming week guys - with FOMC, BOJ and RBNZ, it's likely to be a lively one!

Nigel

Good luck for the coming week guys - with FOMC, BOJ and RBNZ, it's likely to be a lively one!

Nigel

Hello there Traders!

Check out the latest video below.

We are starting to see some weakness in the NZDUSD pair now (finally!)

Hopefully you can see how we can stack the overall odds in our favour by limiting our exposure if price moves against us, but making sure we squeeze every last pip out of the move if if goes for us.

Trading is nothing more than doing exactly that - over and over again.

Enjoy!

Check out the latest video below.

We are starting to see some weakness in the NZDUSD pair now (finally!)

Hopefully you can see how we can stack the overall odds in our favour by limiting our exposure if price moves against us, but making sure we squeeze every last pip out of the move if if goes for us.

Trading is nothing more than doing exactly that - over and over again.

Enjoy!

Similar threads

- Replies

- 13

- Views

- 10K

- Replies

- 0

- Views

- 3K

- Replies

- 1

- Views

- 2K

- Replies

- 23

- Views

- 11K