milestones

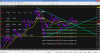

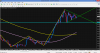

well month 8 has now passed along with several milestones...... usdjpy just passed 100, the account just passed 100,000 pips and balance rose above 7k......

once above 7k, the minimum lot size will be 0.04.... there are a few trades still on the board less..... the max lot size will now be 2..... things should really pick up speed now.....

speakin of lot size..... an technical error on my part allowed for a huge loss during the month..... it is usually losses of this type that bring about improvements..... such is the case here......

//----

fwiw, included are ibfx's statement and forex factory's explorer...... it's a lot of numbers that very little can be derived from..... the more someone trades, the more that becomes apparrent......

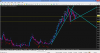

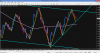

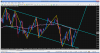

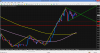

the usdjpy has been and will be my main focus..... but will reach out to other pairs when possible..... the primary trigger will be the td sequential count......

speakin of the usdjpy only, from this point on i will add heavy everytime it falls 100 pips from it's highest recent price.....

have high hopes for this month...... 9 has always been my favorite number.....h

well month 8 has now passed along with several milestones...... usdjpy just passed 100, the account just passed 100,000 pips and balance rose above 7k......

once above 7k, the minimum lot size will be 0.04.... there are a few trades still on the board less..... the max lot size will now be 2..... things should really pick up speed now.....

speakin of lot size..... an technical error on my part allowed for a huge loss during the month..... it is usually losses of this type that bring about improvements..... such is the case here......

//----

fwiw, included are ibfx's statement and forex factory's explorer...... it's a lot of numbers that very little can be derived from..... the more someone trades, the more that becomes apparrent......

the usdjpy has been and will be my main focus..... but will reach out to other pairs when possible..... the primary trigger will be the td sequential count......

speakin of the usdjpy only, from this point on i will add heavy everytime it falls 100 pips from it's highest recent price.....

have high hopes for this month...... 9 has always been my favorite number.....h

Attachments

Last edited: