Daily Analysis By zForex Research Team - 11.29.2024

Economic Uncertainty Drives Volatility in Precious Metals and Forex

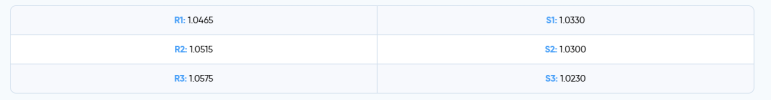

Recent market dynamics saw significant shifts in precious metals and major currencies. Gold climbed to nearly $2,660 per ounce amid geopolitical tensions, including Putin's nuclear warnings, though it faced weekly losses due to resilient US economic data and Fed speculation. However, silver dropped below $30 per ounce, pressured by easing geopolitical risks and weak industrial demand, particularly from China.In the forex market, the euro hovered near two-year lows at $1.05 as inflation eased in key economies, while the yen surged 1% to a six-week high on Tokyo's inflation data. The pound approached $1.26 despite UK economic weakness, reflecting mixed investor sentiment.

Post automatically merged:

Gold Analysis By zForex Research Team - 11.29.2024

Gold Gains on Geopolitical Tensions and Softer Dollar

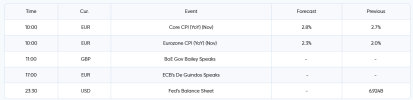

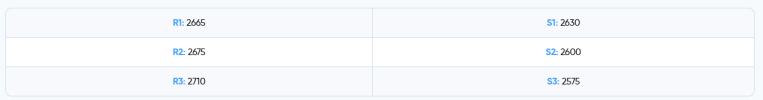

Gold rose to nearly $2,660 per ounce on Friday, gaining for the fourth straight session, supported by a softer US dollar and rising geopolitical tensions. Reports indicated that President Vladimir Putin warned of a potential new strike on Ukraine using a nuclear-capable ballistic missile, following Moscow's recent large-scale attack on critical energy infrastructure. However, the metal is set to decline by more than 2% for the week, as markets awaited further US data for additional insights into the Federal Reserve's monetary policy outlook. Earlier this week, core PCE prices in October met expectations, keeping investors anticipating another Fed rate cut in December. Yet, other data pointed to a resilient economy, reinforcing expectations that the Fed will adopt a cautious approach next year. Over the month, gold is set to decline for the first time since June.Technically, the first resistance level will be 2665, and if broken, the next levels to watch will be 2675 and 2710. On the downside, 2630 is the first support level, and if it breaks, the levels to watch will be 2600 and 2575.

Post automatically merged:

GBP/USD Analysis By zForex Research Team - 11.29.2024

Pound Recovers Slightly Amid BoE Rate Cut Speculations

The GBP/USD pair climbed to a two-week high of 1.2715 during Friday’s Asian session, gaining over 200 pips from its weekly low near 1.2500, driven by weak US Dollar demand. The USD Index (DXY) remains near a two-week low, with a 70% chance of a 25 bps Fed rate cut in December and falling US Treasury yields weighing on the dollar.The British Pound has strengthened as BoE rate cut expectations ease following October’s higher UK inflation data, supporting the GBP/USD recovery.

However, upside may be limited by stalled US inflation progress in October, hawkish FOMC minutes hinting at a pause in Fed rate cuts, and geopolitical risks boosting the USD’s safe-haven appeal.

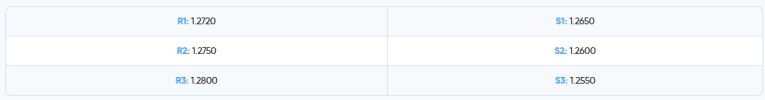

Technically, the first resistance level will be 1.2720, and if broken, the next levels to watch will be 1.2750 and 1.2800. On the downside, 1.2650 is the first support level, and if it breaks, the levels to watch will be 1.2600 and 1.2550.