Daily Analysis By zForex Research Team - 11.04.2024

Markets Await the U.S. Elections Amid China’s Stimulus Actions

The dollar index retreated on Monday as investors braced for the U.S. presidential election and the Federal Reserve's interest rate decision.The yen strengthened due to dollar weakness and the BOJ's hint at a future rate hike. Gold remained stable amid U.S. political uncertainty and safe-haven demand. The British pound stabilized after a recent decline, while silver prices rose on China's potential stimulus measures and a weaker dollar.

Post automatically merged:

EUR/USD Analysis By zForex Research Team - 11.04.2024

Dollar Retreats Ahead of Fed and Election

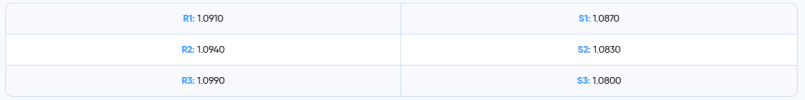

The dollar index fell below 104 on Monday, reversing gains from the prior session as investors braced for the upcoming U.S. presidential election and a key Federal Reserve policy announcement. Recent market dynamics have pushed the dollar and Treasury yields higher amid speculation that Trump might regain the presidency this month. His proposed policies on immigration, tax cuts, and tariffs raised concerns about potential inflation. However, uncertainty surrounding the election results led traders to temper those expectations this morning. On the monetary policy side, the Fed is largely anticipated to lower interest rates by a modest 25 basis points this week, following a larger half-percentage point cut in September. Markets are also factoring in an additional quarter-point reduction in December.In the EUR/USD pair, the initial resistance level is at 1.0910, followed by 1.0940 and 1.0960 as subsequent resistance points. On the downside, the first support level is 1.0870, which aligns with the 200-day moving average. If this level is breached, the next support levels to watch will be 1.0830 and 1.0800.

Post automatically merged:

Gold Analysis By zForex Research Team - 11.04.2024

Gold Maintains Stability Amid U.S. Election Uncertainty

Gold continues stable movement at $2,740 per ounce on Monday after closing the previous week nearly stable as well. Political uncertainty in the U.S., potential inflation from a possible Trump presidency, and conflicts in the Middle East and Ukraine continue to drive investors to gold as a safe-haven asset. Betting site polls showed a switch from Trump to Harris over the weekend nearly declining from 66% to 54% further supporting the yellow metal with providing more uncertainty.On the downside, the first support level for gold is at $2,735, followed by $2,714 and $2,685. On the upside, $2,758 serves as a key resistance level, with $2,770 and $2,790 as the next levels to monitor if this resistance is surpassed.