Daily Analysis By zForex Research Team - 09.06.2024

Anticipation Builds in Global Markets Before Key US Jobs Data Release

As global markets remain on edge, the forex landscape is marked by cautious trading ahead of crucial US employment data. The dollar, balancing near recent lows, reflects investor hesitancy while the EUR/USD steadies, reflecting subdued activity before the jobs report potentially triggers more aggressive Fed rate cuts. Similarly, the yen strengthens on domestic wage growth amidst BOJ rate hike expectations, contrasting with the Fed's easing trajectory. Gold positions for potential gains, anticipating shifts in Fed policy could enhance its appeal. Meanwhile, GBP/USD benefits from USD weakness, and silver trades cautiously, each sensitive to the imminent Nonfarm Payrolls outcomes which could dictate short-term market directions and central bank responses.

Post automatically merged:

EUR/USD Analysis By zForex Research Team - 09.06.2024

EUR/USD Trades Cautiously Ahead of Key US Employment Data

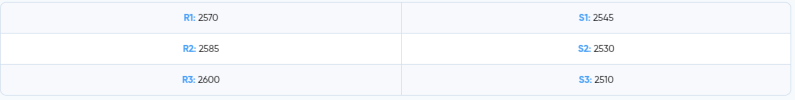

On Friday, the dollar index was around 101 and the EUR/USD pair was near 1.1115, both approaching their lowest levels in a week as investors anticipated the release of the August jobs report. This report could reinforce expectations for a substantial 50 basis point rate cut by the Federal Reserve this month. Meanwhile, the EUR/USD pair struggled to build on recent gains, trading within a narrow range during the Asian session. Prices remained above 1.1100, showing minimal change as traders held off on new positions ahead of the US Nonfarm Payrolls (NFP) report. The dollar index is poised to drop nearly 1% this week, influenced by weak US economic data that has heightened recession fears and led to expectations of more aggressive Fed rate cuts. Recent figures showed the smallest increase in US private sector jobs since January 2021, although weekly jobless claims fell more than expected. Additionally, July saw job openings drop to their lowest level in three years, while manufacturing activity in August contracted more than expected. Currently, markets are pricing in a 40% chance of a 50 basis point rate cut this month, with over 100 basis points of total easing expected for the year. Later today, European growth data will be crucial ahead of next week's anticipated ECB rate cut decision.In the pair, the first support level is at 1.1100. If this level is breached, the next supports to watch will be 1.1045 and 1.1000. On the upside, the first resistance is at 1.1150; if this level is surpassed, the next targets will be 1.1200 and 1.1250.

Post automatically merged:

GBP/USD Analysis By zForex Research Team - 09.06.2024

GBP/USD Benefits from USD Decline Ahead of Nonfarm Payrolls Report

The GBP/USD pair remained in positive territory around 1.3180 on Friday, benefiting from ongoing US Dollar (USD) weakness. The market is keenly awaiting the August Nonfarm Payrolls (NFP) data, which will be set for release later in the day. Thursday's ADP report showed the slowest private sector job growth in over three and a half years, with just 99,000 jobs added in August, falling short of forecasts. This data heightens expectations for a Federal Reserve rate cut at its September 17-18 meeting. However, the Pound Sterling (GBP) is supported by expectations for modest Bank of England (BoE) rate cuts. BoE Governor Andrew Bailey has signaled that while inflation pressures might be easing, any further rate cuts will be cautious. The market anticipates a rate cut in November, with a 25% chance priced in for the September meeting.For GBP/USD, the initial support lies at 1.3150, followed by 1.3100 and 1.3050 below. On the upside, the first resistance is at 1.3190, with subsequent levels at 1.3265 and 1.3300 if the pair breaks above this resistance.