Daily Analysis By zForex Research Team - 10.07.2024

Markets Lifted by Strong U.S. Jobs Data and Geopolitical Tensions

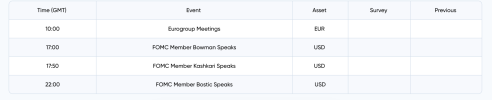

The dollar gained on solid U.S. labor data, with the nonfarm payrolls report showing 254,000 new jobs in September, reducing expectations of a major rate cut by the Federal Reserve in November.As a result, the EUR/USD pair continued its decline, while the Japanese yen weakened amid cautious remarks from Japanese officials. Gold prices retreated as robust labor figures limited expectations of aggressive Fed rate cuts, though Middle East tensions may offer near-term support. The pound fell after Bank of England Governor Bailey’s comments fueled speculation of a rate cut, and silver rose, benefiting from safe-haven demand and China’s hard efforts.

Post automatically merged:

Gold Analysis By zForex Research Team - 10.07.2024

Gold Retreats Amid Strong US Labor Data, Eyes on Fed Meeting and CPI

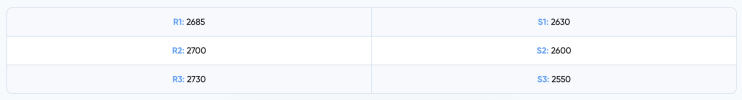

Gold prices dipped below $2,650 per ounce on Monday, continuing a retreat from recent record levels. This decline follows reports of a robust U.S. labor market, which diminishes the likelihood of the Federal Reserve pursuing aggressive interest rate cuts. In September, nonfarm payrolls rose by 254,000—far surpassing the anticipated 14,000—while the unemployment rate unexpectedly dropped to 4.1%. This data eases fears of a weakening job market, thereby limiting expectations for significant rate reductions in this cycle. Typically, lower interest rates lessen the opportunity cost associated with holding non-yielding assets like gold. Investors are now looking ahead to the Fed's meeting minutes due Wednesday and the consumer price index report set for Thursday for further insights. Additionally, gold's appeal as a safe-haven asset is bolstered by escalating violence in the Middle East, which may support prices in the near term.In gold, the first support is at 2630, with subsequent levels at 2600 and 2550 below that. The initial resistance is at 2685, followed by 2700 and 2730 if this level is surpassed.

Post automatically merged:

GBP/USD Analysis By zForex Research Team - 10.07.2024

GBP/USD Weakens After Bailey’s Comments Fuel Rate Cut Speculation

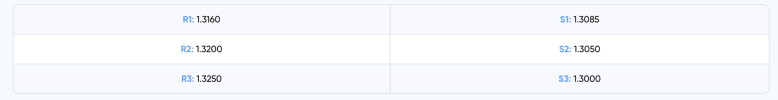

The British pound weakened to $1.31, retreating from the March 2022 highs reached in late September, following comments from Bank of England Governor Andrew Bailey that heightened expectations for another rate cut in November. In an interview with the Guardian, Bailey suggested that the central bank might act more swiftly to lower interest rates if further positive inflation news emerges. As a result, markets are now anticipating a 25 basis point rate cut next month, with a 40% chance of a similar reduction in December. The Bank of England held interest rates steady at 5% in September after a quarter-point cut in August. The pound has also benefited from a general weakness in the dollar, as traders foresee a more aggressive monetary easing from the Federal Reserve compared to other major central banks, including the BoE. In September, the sterling appreciated by 1.9%.In GBP/USD, the first support is at 1.3085, with subsequent levels at 1.3050 and 1.3000 below that. On the upside, the initial resistance is at 1.3160, followed by 1.3200 and 1.3250 if this level is surpassed.