Dollar Stabilizes, Inflation Data in Focus, and Shifts in Retail, Oil, and Gold Markets

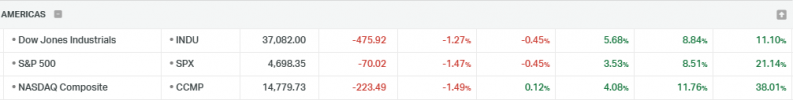

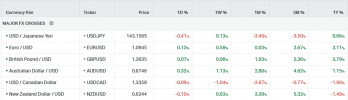

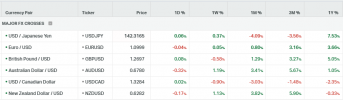

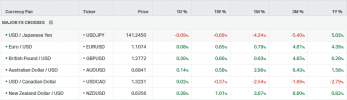

The dollar remained stable above a four-month low on Friday, ahead of a critical US inflation report that might influence the Federal Reserve's interest rate decisions next year. The upcoming US Core Personal Consumption Expenditures (PCE) data, a key inflation metric for the Fed, is projected to show a 3.3% annual increase, slightly lower than October's 3.5% rise. This data could impact bond markets, with a lower figure possibly justifying recent rallies, while a higher figure might challenge current market trends.

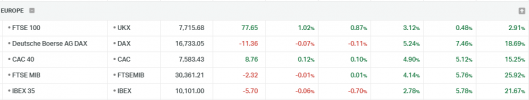

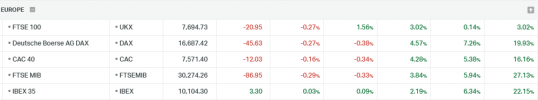

On Thursday, European Central Bank (ECB) Vice President Luis de Guindos stated it's too soon to relax monetary policy. He noted the ECB doesn't expect a technical recession in the Eurozone and would welcome EU fiscal reform to reduce market uncertainty. In recent data, Germany's Producer Price Index (PPI) for November showed a 7.9% year-over-year decrease, steeper than the anticipated 7.5% drop. Additionally, German consumer confidence improved more than expected in January.

In the UK, retail sales surged by 1.3% in November 2023, the highest increase since January, exceeding forecasts and following a stagnant October. This contrasted with the economy's unexpected 0.1% contraction in Q3 of 2023.

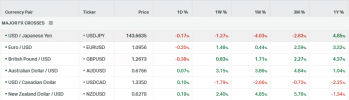

In Japan, the core Consumer Price Index (CPI) slowed in November, fueling uncertainty about the Bank of Japan's (BoJ) policy tightening timeline. BoJ meeting minutes from October emphasized the need to maintain their current easing policy, impacting the Japanese Yen.

Gold prices reached a peak on December 4, driven by anticipations of a shift in the Federal Reserve's policy. Despite Fed officials' efforts to downplay expectations of rapid rate cuts in the next year, investor sentiment remains unchanged.

Oil prices increased on Friday amid Middle East tensions following Houthi attacks in the Red Sea. However, Angola's decision to exit OPEC raised doubts about the organization's ability to stabilize prices. The ongoing geopolitical risks in the Red Sea are contributing to the current rise in oil prices. Additionally, consumer confidence data from France, Spain, and Italy are due later on Friday, though their impact on markets might be limited due to the holiday season.

EUR/USD Tests 1.1000 Resistance Ahead of PCE Data

EUR/USD has returned to test the 1.1000 resistance level as we await today's PCE data, which may either facilitate a breakout towards the next target at 1.0850 or lead to a reversion back to 1.0900.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1170 | 1.0850 | 1.1000 | 1.0900 | 1.0850 | 1.0750 |

Dollar's Performance to Shape Next Move as GBP/USD Consolidates Near 1.2800

The GBP/USD is currently trading within a narrow range, with the 1.2800 level remaining a key challenge for the pair's upward movement. Today's performance of the dollar will be crucial in determining the direction of this currency pair.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.3050 | 1.2930 | 1.2800 | 1.2630 | 1.2500 | 1.2400 |

USD/JPY Hovers Around 142.00 Support with Dollar Weakness

The USD/JPY pair is facing difficulties in maintaining support around the 142.00 area, mainly due to unfavorable yen fundamentals. A weakening dollar could potentially drive the pair towards the 138.00 area.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 148.00 | 146.50 | 144.00 | 142.00 | 140.00 | 138.00 |

Gold Eyes New Highs as It Tests Resistance at 2052

The bullish outlook for gold continues, with the metal currently at the resistance level of 2052 and the 2070 mark appearing achievable for potential new historical highs. Gold's strong fundamentals are supporting its price increase, while today's PCE data from the US will be a key test for this trend.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2100 | 2070 | 2052 | 2036 | 2006 | 1980 |

WTI Oil Gears Up for $76 Resistance Amid Reversal

WTI oil continues its reversal movement, eyeing $76 as the next resistance level. Despite the recent upswing, the long-term trend remains bearish, with oil prices requiring stronger fundamentals for sustained support.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 78 | 76 | 72.90 | 68 | 65 | 63 |