Global Economic Concerns Mount as Markets Reflect a $12 Trillion Loss

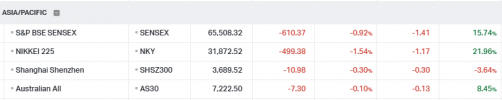

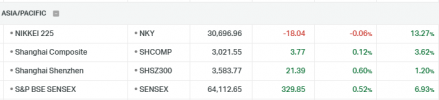

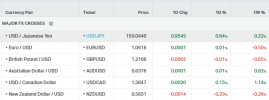

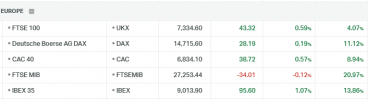

Investors eagerly awaited significant economic data from the Asian-Pacific markets as the week began with a mixed start. Meanwhile, investors closely watched the latest inflation figures from Spain and Germany, anticipating a mixed opening for European markets on Monday.

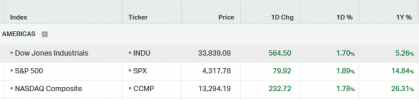

The global stock market has suffered a significant loss in value of $12 trillion since the end of July. This decline has raised concerns about the sustained "higher-for-longer" interest-rate policies of central banks, which could potentially lead the global economy toward a recession.

The Bank of Japan initiated its two-day monetary policy meeting, leading to an 11-year high in 10-year government bond yields. Nearly two-thirds of economists anticipate that the Bank of Japan will end negative rates in 2024, which could lead to higher Japanese yields and present additional challenges to the Treasury market.

Australia reported a 0.9% month-on-month increase in seasonally adjusted retail sales for September, indicating growth in the retail sector.

China Evergrande Group, the world's most indebted developer, experienced a decline in its shares. However, the company gained some breathing space as a Hong Kong court postponed a winding-up hearing to December 4.

The director-general of the World Trade Organization has warned that the ongoing Israel-Hamas war could significantly impact global growth if it spills into the broader Middle East region.

The core personal consumption expenditures (PCE) price index, a closely watched inflation measure by the Federal Reserve, increased by 0.3% in September, aligning with Dow Jones forecasts. The core PCE rose by 3.7% year-over-year, consistent with expectations. Inflation expectations also experienced a significant swing in the final revision of the University of Michigan consumer sentiment survey for October, which was released on Friday.

Bitcoin is expected to record its strongest week since June, following a substantial rally earlier in the week that broke it out of the tight trading range it had been stuck in for most of this year.

ECB Pause and Economic Concerns Pressure Euro, US Data Offers Contrast

ECB Pause and Economic Concerns Pressure Euro, US Data Offers Contrast

Last week, the European Central Bank (ECB) announced that it would take a break from rate hikes and expressed concerns over economic growth. This week, the US calendar will include the Federal Reserve's monetary policy decision and the release of the Nonfarm Payrolls report.

There were various notable factors that affected financial markets last week. The euro took a hit on Tuesday after reports from S&P Global indicated a worsening economic contraction in the Eurozone. The German economy remained in contraction mode, and there were signs of weakness in activity and the labor market. The Eurozone's economic downturn also picked up pace, with the Composite PMI reaching its lowest level in nearly three years.

In contrast, data from the United States was more positive. Business activity expanded in October, with preliminary estimates of the Manufacturing PMI and services index exceeding expectations. The Composite PMI also reached its highest level in three months.

The US Dollar benefited from a risk-off environment, driven by mixed earnings reports and a retreat in government bond yields. However, the USD resumed its rally towards the end of the week.

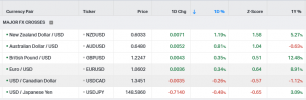

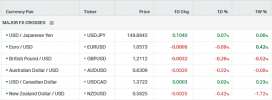

Following the ECB's monetary policy decision, the EUR/USD pair came under selling pressure. The ECB kept rates unchanged and expressed concerns over economic growth, claiming that inflation remains high. They also indicated that additional rate hikes are still possible while rate cuts are not being considered.

Additionally, the US released the preliminary estimate of Q3 GDP, which showed a growth rate of 4.9% between July and September, surpassing previous expectations.

EUR/USD is in a muted movement today where the next support level is the 10500-where continuing the price range started this month. 1.0450 is the last level in the area of support EURUSD will need to break for more selloff.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.0930 | 1.0800 | 1.0700 | 1.0630 | 1.0500 | 1.0400 |

Pound Sterling Awaits BoE Interest Rate Decision

Investors are waiting for the Bank of England's (BoE) interest rate decision, causing the Pound Sterling to struggle to find direction on Monday. The GBP/USD pair is trading sideways as the market mood turns quiet. Investors are also keeping an eye out for new developments in the Israel-Palestine conflict before taking further action.

It is widely expected that the BoE will keep the status quo on November 2 due to subdued consumer spending and labor demand, which would not allow price pressures to accelerate further. However, guidance on where the bank sees the interest rate peak and inflation will be closely monitored. Market participants would like to know if the central bank shares UK Prime Minister Rishi Sunak’s view of halving headline inflation to 5.4% by the end of the year.

Due to soft labor demand, poor factory activity, weak consumer spending, and deepening geopolitical tensions, BoE policymakers are expected to maintain the current interest rate of 5.25%.

GBPUSD is touching the last support at 1.2070 waiting for more developments to find direction. The pair is bearish, and more selloffs can come with the actual strength of the dollar and the weakness of the pound.

Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

1.2450 | 1.2300 | 1.2200 | 1.2000 | 1.1900 | 1.1800 |

Divergence in Monetary Policy Between US and Japan Pressures JPY/USD Pair

That said, the divergence in monetary policy between the United States and Japan is putting downward pressure on the Japanese Yen (JPY) relative to the US dollar (USD). There is some speculation that the Bank of Japan (BOJ) might make adjustments to its yield curve control (YCC) policy. According to a Reuters poll, analysts anticipate the BoJ ending its negative interest rate policy next year, with more now believing the central bank is getting closer to ending its highly accommodative monetary policy.

On the other hand, the Federal Reserve (Fed) is expected to keep interest rates unchanged at the conclusion of its two-day meeting on Wednesday, even though the Fed's preferred inflation gauge, the Core US Personal Consumption Expenditure Index (PCE), remains well above the 2% target. In September, the Core US PCE moderated to 3.7% YoY, down from the previous 3.8%, while the monthly Core PCE increased by 0.3%, up from the previous 0.1%. Additionally, the PCE Price Index for September arrived at 3.4% YoY, in line with expectations.

Nevertheless, Fed officials have noted that recent economic data indicate robust economic activity and a strong job market. These positive reports are raising expectations of further interest rate hikes at the December meeting, which could temporarily boost the value of the US dollar.

Looking ahead, the focus for this week will be on the monetary policy meetings of the BoJ and the Fed. Additionally, the US ISM Manufacturing PMI for October and Initial Jobless Claims data will be released on Wednesday and Thursday, respectively. Attention will shift to the US Nonfarm Payrolls report on Friday, which is expected to show the addition of 172,000 jobs in October.

The USDJPY is coming back today after a test of the 15.00 resistance level but the movement is still tight and the price hasn’t yet decided any clear direction. The possibility of a reversal down is the most probable.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 152.70 | 151.50 | 150.00 | 148.00 | 146.50 | 146.00 |

Gold Price Approaches Key Levels Following Central Bank Meetings

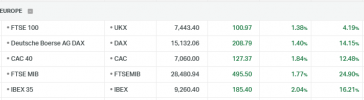

The price of gold (XAU/USD) rose above $2,000 on Friday, marking a third consecutive weekly gain and recording its highest level since May 16th. However, the strong performance of US Treasury bond yields - supported by the expectation of further monetary policy tightening by the Federal Reserve (Fed) - has boosted the US Dollar (USD) and kept XAU/USD bulls cautious below the $2,000 mark as we enter the European session on Monday.

On the other hand, the ongoing conflict between Israel and Hamas has provided some support for safe haven buying, which may limit any significant downward correction in the price of gold.

Traders may choose to be cautious and refrain from making aggressive bets on the direction of the gold price, opting to wait for key central bank events scheduled for this week. The Bank of Japan (BoJ) is set to announce its policy decision on Tuesday, followed by the Federal Reserve's (Fed) monetary policy update on Wednesday and the Bank of England (BoE) meeting on Thursday. Investors will also be closely watching the official Purchasing Managers' Index (PMI) data from China to gain insights into business activity in the world's second-largest economy.

Additionally, preliminary Eurozone GDP and Consumer Price Index (CPI) figures, along with the US nonfarm payrolls (NFP) report, are expected to provide further momentum for the price of gold.

Gold has reached the 2006 resistance level and is now trending towards the 2000 resistance level. The bullish momentum remains strong, and gold may continue to rise to the next resistance level in 2020.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

2040 | 2020 | 2006 | 2000 | 1947 | 1920 |

Oil Prices Unsettled Ahead of U.S. Federal Reserve Meeting and China's Economic Data Release

On Monday, oil prices fell by more than 1% as investors remained cautious ahead of the U.S. Federal Reserve's policy meeting and China's upcoming manufacturing data release. This decline countered the support from Middle East tensions. Last Friday, both Brent and WTI had risen by 3%, driven by increased Israeli ground incursions into Gaza, raising concerns about a potential conflict escalation in a region responsible for one-third of global oil production.

Investors are closely watching the U.S. Federal Reserve meeting, U.S. job data, and Apple earnings for signs of an economic slowdown that could affect global fuel demand. While the Federal Reserve is expected to keep interest rates stable, Britain and Japan's central banks are also set to review their policies.

China will report its October manufacturing and services PMIs this week, with investors hoping for signs of stabilization in the world's top crude-importing economy and improved fuel demand due to supportive measures from Beijing. Despite Middle East developments causing price fluctuations, both Brent and WTI experienced their first weekly decline in three weeks.

WTI is trading around $85 with no clear direction for the month, as volatility continues. A possible descending triangle pattern is forming but requires confirmation.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

98 | 94 | 90 | 84 | 82 | 78 |

Gold Rises as Fed Rate Hike Expectations Diminish

Gold Rises as Fed Rate Hike Expectations Diminish