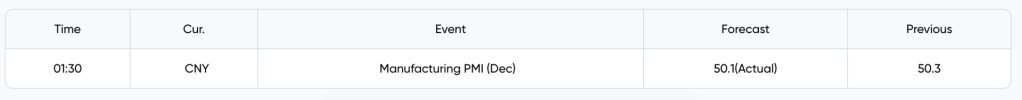

Daily Analysis By zForex Research Team - 12.31.2024

Dollar Holds Steady as Fed Rate Outlook Guides Year-End Trading

Global markets wrap up the year with the euro near $1.04 and the yen showing slight gains, as the Federal Reserve’s 2025 outlook limits rate cut expectations.Gold remains stable above $2,600 despite subdued holiday trading and a cautious Fed stance, while silver dips below $29 amid weaker industrial demand and central bank hawkishness. Investors look to upcoming U.S. data releases for clues on future policy and market direction.

Post automatically merged:

EUR/USD Analysis By zForex Research Team - 12.31.2024

EUR/USD Steady as Strong Dollar Dominates Year-End Trading

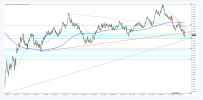

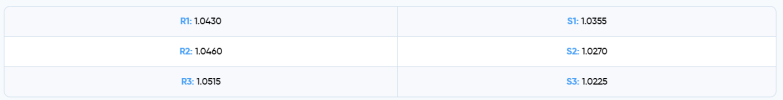

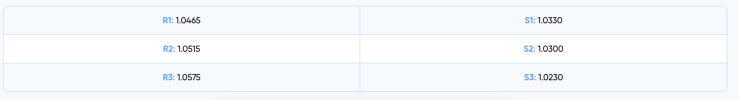

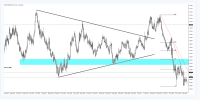

The EUR/USD trades near 1.0410, while the dollar index holds steady at 107.9 on Tuesday, close to two-year highs as the year ends. The US dollar is set to gain over 6% annually, driven by the Fed's hawkish stance and reduced expectations for 2025 rate cuts, now forecasted at 50 basis points. Support also comes from expectations that President-elect Donald Trump's pro-growth policies, including tax cuts, tariffs, and deregulation, will fuel inflation and sustain high US yields.From a technical perspective, the first resistance level is at 1.0465, with further resistance levels at 1.0515 and 1.0575 if the price breaks above. On the downside, the initial support is at 1.0330, followed by additional support levels at 1.0300 and 1.0230.

Post automatically merged:

Gold Analysis By zForex Research Team - 12.31.2024

Gold Holds Firm Despite Fed Outlook and Q4 Pressures

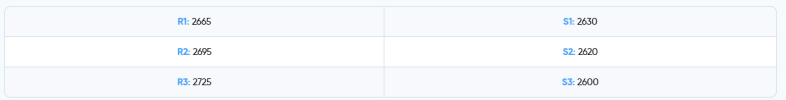

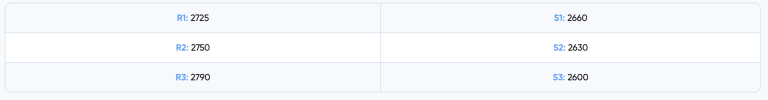

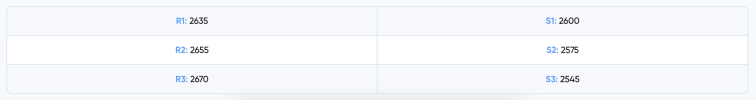

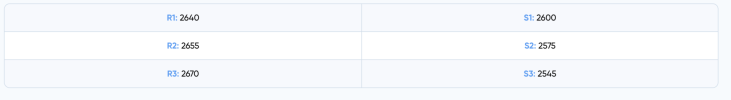

Gold held above $2,600 per ounce on Tuesday after two days of declines, with minimal movement as investors awaited market drivers. Traders focused on the US economy, Trump’s tariff policies, and the Fed’s monetary stance, which could influence gold’s direction. Persistent inflation and strong labor data led the Fed to project fewer rate cuts, weighing on gold in Q4. Still, gold is set for a 27% annual gain, its best since 2010, driven by safe-haven demand amid global conflicts and significant central bank purchases, including from the PBoC, which helped push prices to a record $2,790 in September.Technically, the first resistance level will be 2635 level. In case of this level’s breach, next levels to watch would be 2655 and 2670 consequently. On the downside 2600 will be the first support level. 2575 and 2545 are next levels to monitor if first support level is breached.

Post automatically merged:

Daily Analysis By zForex Research Team - 01.02.2025

Dollar Starts 2025 Softer Amid Stable Yen and Gold Extending Gains

The euro trades near $1.0370 as the dollar index eases from last year's strength, supported by rising U.S. yields and anticipated pro-growth Trump policies.The yen holds at 157 amid potential BOJ rate changes and intervention risks, while gold climbs above $2,630 on continued safe-haven appeal. The pound hovers around 1.2535, awaiting U.S. data for further cues, and silver gains despite subdued China PMI figures, with investors looking to upcoming U.S. reports for market direction.

Post automatically merged:

Gold Analysis By zForex Research Team - 01.02.2025

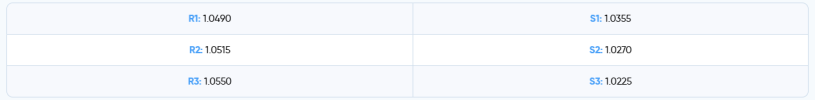

Gold Rises Above $2,630, Extending Best Rally Since 2010

Gold rose above $2,630 per ounce on Thursday, extending last year’s 27% rally, its best since 2010, driven by US monetary easing, geopolitical risks, and record central bank purchases. Investors focus on Federal Reserve Chair Powell’s cautious stance on rate cuts amid rising inflation, which has slightly reduced gold’s appeal as a non-yielding asset. Meanwhile, attention turns to potential challenges under the Trump administration and China’s economic revitalization efforts. A World Gold Council survey suggests continued central bank gold buying, supporting demand.Technically, the first resistance level will be 2640 level. In case of this level’s breach, next levels to watch would be 2655 and 2670 consequently. On the downside 2600 will be the first support level. 2575 and 2545 are next levels to monitor if first support level is breached.

Post automatically merged:

GBP/USD Analysis By zForex Research Team - 01.02.2025

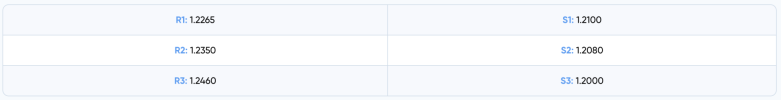

GBP/USD Starts New Year at 1.2535 Ahead of US Data

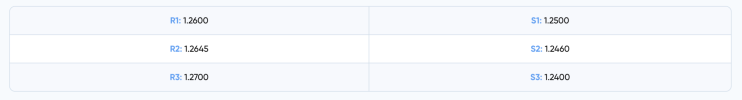

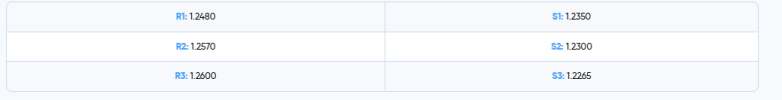

The GBP/USD pair started trading in the new year at around 1.2535. In the later hours of the day, the upcoming PMI and unemployment data from the US, along with a relatively quiet economic calendar in the UK, are expected to create volatility in the GBP/USD pair.The first resistance level for the pair will be 1.2600. In case of this level's breach, the next levels to watch would be 1.2645 and 1.2700. On the downside 1.2500 will be the first support level. 1.2460 and 1.2400 are the next levels to monitor if the first support level is breached.