14 December 2023

Thursday

On Thursday, December 14, 2023, the financial markets are set to experience a day of significant announcements globally. The series of key economic disclosures will commence with Australia revealing its latest employment change figures and the unemployment rate. Following this, the Swiss National Bank is scheduled to announce its policy rate decision. The focus will then shift to the United Kingdom, where the official bank rate will be declared. Subsequently, the European Union will announce its main refinancing rate. In the United States, critical economic data such as core retail sales m/m, total retail sales m/m, and unemployment claims are due for release. The day’s series of announcements will culminate with a press conference by the European Central Bank, marking a day full of potentially market-impacting news.

AUD – Employment Change

Job creation, a key driver of consumer spending, significantly impacts overall economic activity, as it influences the majority of consumer purchases and economic growth.

Australian Employment Soared Beyond Expectations in October: In a remarkable surge, Australia's employment figures for October 2023 outpaced market predictions, with a significant addition of 55,000 jobs, raising the total to 14.17 million. This performance, which was a marked acceleration from the 7,800 increase in September, saw part-time employment jump by 37,900, while full-time jobs experienced a growth of 17,000, indicating robust economic activity.

The forecast for the upcoming Employment Change suggests a decrease to 25K, down from the previous outcome of 55K.

The upcoming Employment Change data is scheduled for release on Thursday, December 14, 2023, at 12:30 AM GMT.

AUD – Unemployment Rate

Though typically considered a lagging indicator, the unemployment rate is a crucial indicator of overall economic health, as consumer spending closely aligns with labor market conditions.

In October 2023, Australia's unemployment rate marginally increased to 3.7% amid a complex job market, despite the addition of 55,000 jobs and a climb in the participation rate to 67.0%, reflecting a robust yet nuanced employment landscape.

The forecast for the Unemployment Rate indicates it is expected to remain steady at 3.7%, unchanged from the previous figure.

The next release of Unemployment Rate data is scheduled for Thursday, December 14, 2023, at 12:30 AM GMT.

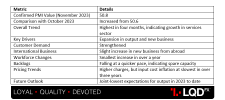

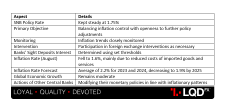

CHF - SNB Policy Rate

Short-term interest rates are the primary factor in determining currency value, with traders typically analyzing other indicators mainly to forecast future rate changes.

The Swiss National Bank (SNB) opted to keep the SNB policy rate steady at 1.75%, balancing inflation control with openness to further policy adjustments. They continued to monitor inflation trends and participated in foreign exchange interventions as necessary. Interest on banks' sight deposits was determined using set thresholds. In August, inflation had fallen to 1.6%, mainly due to reduced costs of imported goods and services. The forecast projected an average inflation rate of 2.2% for 2023 and 2024, dropping slightly to 1.9% by 2025. Meanwhile, global economic growth remained moderate, with central banks worldwide modifying their monetary policies in line with inflationary patterns.

TL;DR

The forecast for the SNB Policy Rate suggests it will remain unchanged at 1.75%, consistent with the previous rate.

The next SNB Policy Rate announcement is scheduled for Thursday, December 14, 2023, at 8:30 AM GMT.

CHF - SNB Press Conference

This tool is a key method for the SNB Governing Board to communicate with investors about monetary policy and economic forecasts. Conferences, scheduled alongside rate announcements in June and December, last about an hour and consist of two segments: initial prepared statements followed by a press Q&A session, where unscripted responses can often lead to market volatility.

The SNB Press Conference is scheduled for Thursday December 14, 2023, at 09:00 AM GMT.

GBP - Official Bank Rate

Traders primarily focus on short-term interest rates for currency valuation, considering other indicators mainly as tools to forecast future rate changes.

In its November meeting, the Bank of England decided to keep its benchmark interest rate at a 15-year peak of 5.25%, unchanged for the second time in a row, amid concerns over UK's slowing economy and high inflation. The 6-3 vote by the Monetary Policy Committee was against a proposed 25 basis points hike. The bank plans to continue its restrictive monetary policy to combat inflation, with a possibility of more tightening if necessary, while expecting modest economic growth in the near future.

The forecast suggests that the Official Bank Rate will remain unchanged at 5.25%, consistent with the previous rate.

The upcoming Official Bank Rate announcement is scheduled for Thursday, December 14th, at 12:00 PM GMT.

EUR - Main Refinancing Rate

Short-term interest rates are the key determinant in currency valuation, with traders typically examining other indicators primarily to anticipate future rate changes.

In its October meeting, the European Central Bank (ECB) had opted to maintain interest rates at multi-year highs, marking a notable departure from its 15-month streak of continuous rate hikes. This decision reflected a more cautious approach among policymakers, influenced by the gradual easing of inflationary pressures and concerns regarding a looming economic downturn. Prior to this decision, the ECB had implemented ten consecutive rate increases since July 2022, resulting in the main refinancing operations rate reaching a 22-year peak at 4.5%, and the deposit facility rate hitting an all-time high of 4%. The central bank reaffirmed its commitment to achieving its 2% inflation target over the medium term, emphasizing its readiness to keep interest rates at these elevated levels for an extended period until this goal was realized.

TL;DR

According to the latest forecast, the Main Refinancing Rate is expected to remain steady at 4.5%, unchanged from the previous announcement, as announced in recent financial news.

The next Main Refinancing Rate announcement is scheduled for Thursday, December 14th, 2023, at 1:15 PM GMT.

USD - Core Retail Sales m/m

Core Retail Sales month-over-month figures are closely monitored by traders as they offer insights into consumer spending, a major driver of economic expansion. By excluding the frequently fluctuating food and energy sectors, Core Retail Sales present a more reliable measure of underlying trends in consumer expenditure.

In October 2023, U.S. Retail Sales excluding motor vehicles and parts rose by 0.1% month-over-month, exceeding market expectations of a flat reading and following a 0.8% increase in the previous month.

The forecast for the upcoming Core Retail Sales m/m indicates a slight decrease to -0.1%, down from the previous figure of 0.1%.

The upcoming Core Retail Sales m/m announcement is scheduled for Thursday, December 14th, 2023, at 1:30 PM GMT.

USD - Retail Sales m/m

This measure is the main indicator of consumer spending, which constitutes a significant portion of overall economic activity.

In October 2023, U.S. retail sales saw a 0.1% month-over-month decrease, ending a six-month streak of growth and performing better than the anticipated 0.3% decline. Key sectors experiencing downturns included miscellaneous store retailers (-1.7%), furniture stores (-2.0%), and motor vehicle dealers (-1.0%). However, gains in health and personal care stores (1.1%), food & beverage stores (0.6%), and electronics and appliances stores (0.6%) partially offset these declines. Year-over-year, retail trade growth slowed to 2.5% in October, down from September's revised 4.1%.

TL;DR

The forecast for the US Retail Sales m/m is reading -0.1%, showing a reduction in the sales of major retailer categories.

The upcoming Retail Sales m/m announcement is scheduled for Thursday, December 14th, 2023, at 1:30 PM GMT.

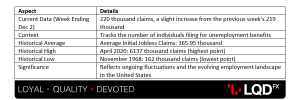

USD - Unemployment Claims

Despite being considered a lagging indicator, the unemployment rate is a crucial measure of the economy's health as consumer spending is closely linked to labor market conditions. Additionally, unemployment figures play a significant role in guiding the country's monetary policy decisions.

In the week ending December 2, 2023, the United States witnessed a slight uptick in Initial Jobless Claims, with the number rising to 220 thousand from the previous week's 219 thousand. This data, which tracks the number of individuals filing for unemployment benefits, demonstrates the ongoing fluctuations in the labor market. Over the decades, the average Initial Jobless Claims in the United States have stood at 365.95 thousand, with notable historical highs and lows. The highest point reached was a staggering 6137 thousand in April 2020, while the lowest recorded figure was a mere 162 thousand in November 1968, reflecting the nation's ever-evolving employment landscape.

TL;DR

The forecast for Unemployment Claims suggests a rise to 227K, up from the previous figure of 220K.

The release of the upcoming Unemployment Claims data is scheduled for Thursday, December 14, 2023, at 1:30 PM GMT.

EUR - ECB Press Conference

The primary way the ECB communicates with investors about monetary policy is through this method. It thoroughly discusses factors influencing recent interest rate and policy decisions, including the economic outlook and inflation, and importantly, offers insights into future monetary policy directions.

The ECB Press Conference is scheduled for Thursday, December 14th, 2023, at 1:45 PM GMT.

Disclaimer: The market news provided herein is for informational purposes only and should not be considered trading advice.