21 March 2024

Thursday

On March 21st, the global financial arena braces for an intense flurry of economic data releases from major economies. Australia will reveal its employment figures, including the pivotal unemployment rate, while France, Germany, Great Britain, and the US will disclose their Flash Manufacturing and Services PMI data, offering crucial insights into economic health. Additionally, Switzerland and Great Britain will make crucial interest rate announcements, potentially impacting global currencies and investment strategies. Finally, the US will release its Unemployment Claims data, completing the mosaic of economic indicators that investors will scrutinize for clues about inflation, growth trajectories, and potential central bank interventions.

AUD – Employment Change

The monthly release of the change in the number of employed people, typically about 15 days after the month ends, is vital economic data with significant market impact due to its importance and timeliness. Traders closely monitor this data as job creation serves as a crucial leading indicator of consumer spending, which in turn drives a majority of overall economic activity.

Australia's job market experienced a minor increase in January 2023, with employment numbers inching up by 500 to reach 14,201,300. This subtle rise fell significantly short of the anticipated 30,000 gain, underscoring a cautious start to the year and a notable deviation from the previous month's revised decrease of 62,800 jobs.

The detailed employment figures revealed a nuanced shift in the job landscape. Full-time positions saw a modest uptick, adding 11,100 jobs to total 9,797,800. On the flip side, the part-time sector witnessed a contraction, shedding 10,600 jobs to settle at 4,403,500. This dynamic underscores the fluctuating nature of employment trends, with full-time roles gaining ground while part-time positions retract.

On an annual scale, the employment scene has shown resilience and growth, with a total increase of 356,700 jobs over the year leading up to January, marking a 2.6 % expansion. This growth highlights the broader, positive trajectory of Australia's job market, despite the short-term fluctuations and missed forecasts at the beginning of 2023.

TL;DR

- Total employment in January 2023: 14,201,300 (increase of 500 jobs)

- Full-time employment: 9,797,800 (increase of 11,100 jobs)

- Part-time employment: 4,403,500 (decrease of 10,600 jobs)

- Expected job gain was 30,000; actual gain fell short

- Annual job growth: 356,700 jobs (2.6% increase)

The forecast for

Employment Change is indicating an increase to

30,000 compared to the previous figure of

500.

AUD – Unemployment Rate

The Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month, released monthly approximately 15 days after the month ends. Traders pay attention to this data because while it's typically considered a lagging indicator, the number of unemployed people serves as a crucial signal of overall economic health, given the strong correlation between labor-market conditions and consumer spending.

In January, the unemployment rate surged to 4.1 %, marking a notable increase from December's 3.9 %. This rise, accompanied by a modest addition of only 500 jobs, as reported by the Australian Bureau of Statistics (ABS), reflects the first instance of unemployment surpassing 4 % in two years. According to the ABS's head of labour statistics, Bjorn Jarvis, this uptick in unemployment represents a shift from the trend observed since January 2022. Last month saw a notable increase of 22,000 in the officially unemployed population, while hours worked declined by 2.5 %, continuing a trend of decreasing hours observed since mid-2023. Additionally, there was a slight uptick in underemployment, rising by 0.1 percentage point to 6.6 %.

TL;DR

| Indicator | January Figures | Change from December |

| Unemployment Rate | 4.1% | +0.2 percentage points |

| Total Employment Change | +500 jobs | Not compared to December |

| Unemployed Population | Increase of 22,000 | Not applicable |

| Hours Worked | Declined by 2.5% | Continuing decrease since mid-2023 |

| Underemployment Rate | 6.6% | +0.1 percentage points |

The forecast for the

Unemployment Rate indicates a decrease to

4.0%, down from the previous rate of

4.1%.

The next release for

Employment Change and

Unemployment Rate is scheduled for

Thursday at

12:30 AM GMT.

EUR - French Flash Manufacturing PMI

The Purchasing Managers' Index (PMI) is a monthly economic indicator derived from surveys of manufacturing sector purchasing managers, reflecting industry conditions. Values above 50 indicate expansion, below 50 contraction. It includes early "Flash" and later "Final" releases, with the "Flash" version typically having more impact since it's first. As a leading economic indicator, PMI provides insights into business sentiment and market conditions based on around 750 respondents' views on various business aspects like employment and production.

In February 2024, France's manufacturing sector, as measured by the S&P Global PMI, was adjusted upwards slightly to 47.1 from a preliminary figure of 46.8, reaching its highest level since March 2023. Despite this, the sector remained in a contraction phase for the 13th month in a row. The decrease in both production and new orders was notably less severe this month. Moreover, there was a less pronounced reduction in both employment and purchasing activities. Even though there were fewer delays in delivery times than in January, supply chain challenges persisted, especially due to disruptions in the Red Sea. Cost pressures eased, with input prices dropping due to decreased costs for metals, industrial products, and materials imported from Asia. Facing competitive pressures, manufacturers in France opted to lower their sales prices by providing discounts. Optimism regarding the production outlook for the coming 12 months emerged for the first time since May 2023.

TL;DR

| Indicator | February 2024 Figures | Notable Changes |

| S&P Global PMI | 47.1 | Adjusted from preliminary 46.8 |

| Manufacturing Sector Trend | Contraction | 13th consecutive month |

| Production | Decrease | Less severe than previous months |

| New Orders | Decrease | Less severe than previous months |

| Employment | Decrease | Less pronounced reduction |

| Purchasing Activities | Decrease | Less pronounced reduction |

| Delivery Times | Fewer Delays | Improved from January, but challenges persist |

| Supply Chain Challenges | Yes | Continued, particularly due to Red Sea disruptions |

| Cost Pressures | Eased | Due to lower prices for metals, industrial products, Asian imports |

| Sales Prices | Lowered | Manufacturers offered discounts |

| Optimism for Future Production | Yes | First time since May 2023 |

The forecast for the

French Flash Manufacturing PMI suggests a reading of

47.5, up from the previous figure of

47.1.

The last time,

French Flash Manufacturing PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(EURUSD M5) below:

EUR – French Flash Services PMI

The Services Purchasing Managers' Index (PMI) is a monthly diffusion index derived from surveys of purchasing managers in the services sector, indicating industry health. Scores above 50 signify expansion, below 50 contraction. It features "Flash" and "Final" releases, with the "Flash" version, introduced in March 2008, generally having greater impact. As a leading economic indicator, it reflects business sentiment and market conditions from the perspective of around 750 surveyed managers, covering aspects such as employment, orders, and prices.

In February 2024, the HCOB France Services Purchasing Managers' Index (PMI) increased to 48.4 from 45.4, signaling a continued but moderating contraction in the service sector for the ninth consecutive month, a trend softer than previous declines. This improvement was underpinned by the slowest reduction in business activity and new orders in nine months, alongside a revival in international sales for the first time since May 2023. Employment growth also saw an uptick, hitting a four-month high, which contributed to a decrease in outstanding business. While input costs rose, largely due to higher labor costs, the increase in output prices was the most minimal since May 2021. Looking forward, optimism within the service sector reached a seven-month high, reflecting growing confidence in future growth prospects.

TL;DR

- Services PMI for February 2024: 48.4, up from 45.4

- Business activity and new orders: slowest reduction in 9 months

- International sales: increased for the first time since May 2023

- Employment growth: reached a four-month high

- Input costs rose, mainly due to higher labor costs

- Output price increase: most minimal since May 2021

- Sector optimism: reached a seven-month high

The expected

Flash Services PMI is anticipated to be

48.3, slightly lower than the previous figure of

48.4.

The upcoming release of the

French Flash Manufacturing &

Services PMI is scheduled for

Thursday at

8:15 AM GMT.

The last time, French Flash Service PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(EURUSD M5) below:

EUR - German Flash Manufacturing PMI

The Manufacturing Purchasing Managers' Index (PMI) is a key monthly indicator, derived from surveys of 800 purchasing managers, reflecting the health of the manufacturing sector. A PMI above 50 indicates expansion, below 50 contraction. The index is released in two versions, "Flash" and "Final," approximately a week apart, with the "Flash" release, introduced in March 2008, often having more influence. As a leading indicator, it offers insights into economic conditions by assessing factors like employment, production, and new orders from the perspective of those directly involved in industry procurement.

In February 2024, the HCOB Germany Manufacturing Purchasing Managers' Index (PMI) saw a slight adjustment upwards to 42.5 from an initial estimate of 42.3, indicating a continued significant downturn in the manufacturing sector. This period witnessed the steepest decline in production since October 2023, driven by a more pronounced drop in demand. The acceleration in the reduction of new orders was attributed to decreased sales both within the country and internationally. Furthermore, there was a reduction in backlog work and the most significant decrease in employment since August 2020. Persistent decreases were noted in both pre-production and post-production inventory levels, alongside a marked reduction in purchasing activity due to the ongoing decline in demand. This decline in demand for inputs contributed to a continuous downward trend in purchasing prices, remaining in a deflationary phase for the thirteenth consecutive month, even as transport costs rose due to disruptions in Red Sea shipping. Additionally, there was a more rapid decrease in average output prices. The outlook for future production became pessimistic, influenced by diminishing backlogs, economic uncertainties, and a lack of investment.

TL;DR

| Indicator | February 2024 Figures | Change/Trend |

| Manufacturing PMI | 42.5 | Slight adjustment from initial 42.3 |

| Production Decline | Steepest since October 2023 | Driven by more pronounced demand drop |

| New Orders Reduction | Accelerated reduction | Due to decreased domestic and international sales |

| Backlog Work | Reduced | - |

| Employment Decrease | Most significant since August 2020 | - |

| Inventory Levels | Decreased | Both pre-production and post-production |

| Purchasing Activity | Marked reduction | Due to decline in demand |

| Purchasing Prices | Continued deflation | 13th consecutive month of decrease |

| Output Prices | More rapid decrease | - |

| Future Production Outlook | Pessimistic | Influenced by diminishing backlogs and economic uncertainties |

The projected

Flash Manufacturing PMI stands at

43.5, showing an improvement from the prior

42.5.

The last time,

German Flash Manufacturing PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(EURGBP M5) below:

EUR - German Flash Services PMI

The Services Purchasing Managers' Index (PMI) is a vital monthly diffusion index from surveys of 800 purchasing managers, gauging the services sector's performance. A PMI above 50 signals expansion, while below 50 indicates contraction. The index is issued in "Flash" and "Final" versions, roughly a week apart, with the "Flash" release typically having greater significance since its inception in March 2008. Serving as a leading economic indicator, the PMI reflects the sector's response to market conditions through purchasing managers' assessments of various business aspects such as employment, orders, and pricing.

In February 2024, the HCOB Germany Services PMI saw a minor adjustment upward to 48.3 from an initial estimate of 48.2, up from January's 47.7, continuing a five-month trend of contraction. The ongoing solid decline in sector activity was influenced by stringent financial conditions, customer hesitancy, and the broader economic downturn, with export sales experiencing an additional decrease. The service sector faced intensifying inflationary pressures, particularly due to rising wage demands, pushing input costs inflation to a peak not seen in ten months and causing output charges to surge to the highest rate since August 2023. Despite these challenges, service firms reported an uptick in employment, the most significant in eight months, reflecting a positive movement. Future business outlooks brightened to a level not observed since April 2023, fueled by optimism regarding marketing initiatives and anticipated overall economic improvements.

TL;DR

- Services PMI for February 2024: 48.3, a slight increase from January's 47.7

- Continued contraction for the fifth month, driven by financial conditions, customer hesitancy, and economic downturn

- Export sales decreased further

- Inflationary pressures intensified, with input cost inflation hitting a 10-month high

- Output charges surged to the highest rate since August 2023

- Employment saw the most significant increase in eight months

- Future business outlook improved to the brightest since April 2023, fueled by marketing initiatives and economic optimism

The projected

Flash Services PMI is

49.0, slightly up from the last reported value of

48.3.

The upcoming

Flash Manufacturing &

Services PMI report is scheduled for release on

Thursday at

8:30 AM GMT.

The last time,

German Flash Services PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(EURGBP M5) below:

CHF - SNB Policy Rate

The Swiss National Bank (SNB) targets a specific interest rate for the short-term money market, with adjustments made on a quarterly basis. This rate serves as the SNB's primary tool for monetary policy, although market anticipation often leads to its impact being overshadowed by the forward-looking Monetary Policy Assessment. Traders place significant importance on short-term interest rates as they are crucial for currency valuation, utilizing other economic indicators mainly to forecast future rate movements. The determination of this policy rate is achieved through a consensus among the members of the SNB Governing Board.

In a decisive move during its December 2023 meeting, the Swiss National Bank held its key policy rate steady at 1.75% for the second time in a row, echoing the predictions of experts and pointing to a slight easing in inflationary pressures. Despite maintaining the rate, the bank expressed concerns over the persistently high economic uncertainty and pledged to keep a vigilant eye on inflation trends, ready to tweak its monetary stance to safeguard medium-term price stability. Notably, November saw Switzerland's inflation dip to 1.4%, the lowest since October 2021, but the central bank warned of potential near-term increases due to factors such as escalating electricity costs, rising rents, and an upturn in VAT. The bank's forecasts suggest a gradual inflation decline, from an average of 2.1% in 2023 to 1.9% in 2024, and down to 1.6% by 2025. On the economic front, growth prospects appear modest, with 2023's growth projected at around 1% and 2024's estimates fluctuating between 0.5% and 1%.

TL;DR

| Indicator | December 2023 Meeting Details |

| Policy Rate | Held steady at 1.75% |

| Inflation Concerns | Bank is vigilant; inflation easing slightly but risks remain |

| Inflation Rate (November) | Dipped to 1.4%, the lowest since October 2021 |

| Inflation Forecast | 2023: 2.1% average; 2024: 1.9%; 2025: 1.6% |

| Economic Growth Prospects | 2023: Around 1%; 2024: Between 0.5% and 1% |

| Factors Influencing Inflation | Rising electricity costs, rents, and VAT upturn |

Predictions suggest that the

SNB Policy Rate will remain steady at the previous level of

1.75%.

The upcoming

SNB Policy Rate announcement is set for

Thursday at

8:30 AM GMT.

CHF – SNB Press Conference

The conference, featuring the SNB Chairman and Governing Board members, is a key event where more hawkish outcomes than anticipated are beneficial for the currency. Scheduled to coincide with the rate announcements in June and December, this approximately one-hour conference comprises two segments: an initial reading of prepared statements followed by a press Q&A session. The latter often yields unscripted responses, which can lead to significant market fluctuations. Traders closely monitor this conference as it serves as one of the primary channels through which the SNB Governing Board communicates its monetary policy stance and economic outlook to investors.

At the Swiss National Bank's press conference on December 14, 2023, Chairman Thomas Jordan announced the decision to maintain the SNB policy rate at 1.75%, citing a slight decrease in inflationary pressures. The bank revised its inflation forecasts downward, anticipating rates within the price stability range through 2025. While discussing a subdued global economic outlook and the mixed performance of Switzerland's economy, the SNB emphasized its readiness to adjust monetary policy as needed. The conference also addressed the importance of maintaining cash as a payment option amidst declining usage and introduced the new SIC5 payment system, enabling instant electronic transactions. This system is seen as a significant step towards modernizing Switzerland's payments infrastructure, offering immediate transaction capabilities and benefits for liquidity management.

TL;DR

- SNB policy rate remains at 1.75% as of December 14, 2023

- Inflation forecasts revised down, expected within price stability range through 2025

- SNB prepared to adjust monetary policy in response to economic changes

- Emphasis on maintaining cash as a viable payment option

- Introduction of SIC5 payment system for instant electronic transactions, enhancing Switzerland's payment infrastructure

The

SNB Press Conference is scheduled for

Thursday at

8:30 AM GMT.

GBP - Flash Manufacturing PMI

The Manufacturing Purchasing Managers' Index (PMI) is a critical diffusion index, collected from around 650 purchasing managers' surveys, that evaluates the manufacturing sector's state each month. Scores above 50 denote expansion, while those below 50 suggest contraction. The index is released in two editions, "Flash" and "Final," with the "Flash" version, first reported in November 2019, generally exerting more influence due to its earlier release. As a leading economic indicator, the PMI quickly reflects changes in market conditions through detailed insights from purchasing managers on various business aspects like employment, production, and new orders.

In February 2024, the S&P Global UK Manufacturing PMI climbed to 47.5, marking a ten-month peak, slightly above the initial estimate of 47.1. However, this figure still reflects a downturn for the 19th straight month, primarily attributed to the ongoing crisis in the Red Sea that has led to interruptions in production and delays in deliveries. Manufacturers are struggling to secure alternative sources, often resorting to more expensive options from nearer regions. The drop in demand is clear, with the fastest decrease in new orders since October. Most components of the PMI, like new orders, production, employment, and inventory levels, indicated a contraction. The only area that contributed positively was the extended delivery times from suppliers, the most significant since July 2022, which, rather than signalling a rise in demand, points to the prevailing supply chain difficulties.

TL;DR

- UK Manufacturing PMI in February 2024: 47.5, a ten-month high but still indicating contraction

- Downturn ongoing for 19 months, exacerbated by Red Sea crisis affecting production and deliveries

- Manufacturers facing challenges in sourcing alternatives, often at higher costs

- New orders declined at the fastest rate since October

- Contraction observed in new orders, production, employment, and inventory levels

- Extended supplier delivery times, the most significant since July 2022, reflect supply chain issues rather than increased demand

The forecast for the

Flash Manufacturing PMI suggests a reading of

47.1, down from the previous figure of

47.5.

The last time,

British Flash Manufacturing PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(GBPUSD M5) below:

GBP - Flash Services PMI

The Services Purchasing Managers' Index (PMI) is a monthly diffusion index derived from the surveys of approximately 650 purchasing managers, indicating the services sector's health. A PMI above 50 suggests expansion, below 50 contraction. The index is published in "Flash" and "Final" versions, with the "Flash" release, introduced in November 2019, typically having more impact due to its timeliness. As a leading indicator, the PMI provides early insights into economic conditions by capturing purchasing managers' perspectives on key business variables such as employment, order volumes, and pricing.

In February 2024, the S&P Global UK Services PMI underwent a downward revision to 53.8, a slight decline from both the preliminary estimate of 54.3 and the figure reported in January. Despite this adjustment, the UK's service sector experienced a consistent growth in business activities, attributed to an increase in new orders and a slight uptick in employment levels. The output expansion, although marginally less robust than January's eight-month peak, remained significant. The period saw a notable rise in input costs, hitting a five-month high, predominantly driven by escalated wage demands and heightened shipping expenses. In response to diminishing profit margins, service providers implemented price hikes at a rate surpassed only by that of December in the past seven months. Moreover, the sector's optimism regarding future growth surged to levels not observed since February 2022, underscoring a positive outlook amidst evolving economic challenges.

TL;DR

- UK Services PMI for February 2024 revised to 53.8, slightly down from preliminary 54.3 and January's figure

- Continued growth in business activities due to increased new orders and employment levels

- Output expansion marginally less robust than January's eight-month high

- Input costs rose to a five-month high, driven by higher wage demands and shipping expenses

- Service providers increased prices, with the rate of hikes near the seven-month high seen in December

- Sector optimism about future growth reached the highest level since February 2022

The

Flash Services PMI is forecasted to reach

54.2, showing a slight increase from the previous reading of

53.8.

The

Flash Manufacturing &

Services PMI data is scheduled for release on

Thursday at

9:30 AM GMT.

The last time, British Flash Services PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(GBPUSD M5) below:

GBP - Official Bank Rate

The Bank of England's interest rate, set for overnight lending to financial institutions, is determined on a monthly schedule. Market anticipation often factors in the rate decision, leading to greater emphasis on the Monetary Policy Summary, which offers insights into future policy directions. Traders prioritize short-term interest rates as they are crucial in assessing currency value, using other indicators mainly to forecast potential rate adjustments. The Monetary Policy Committee (MPC) members cast their votes on the rate setting, with the detailed voting record made available in the MPC Meeting Minutes two weeks post-decision.

In February 2024, the Bank of England's Monetary Policy Committee (MPC) decided to keep the Bank Rate steady at 5.25%, following a vote with a majority of 6-3. This decision was based on the goal of achieving the 2% inflation target and supporting sustainable growth and employment. The MPC's projections, outlined in the February Monetary Policy Report, anticipated a gradual decrease in the Bank Rate to around 3.25% by the end of the forecast period, a significant reduction from previous expectations. Despite global GDP growth remaining subdued with slight improvements in the US, inflationary pressures started to ease, particularly in the euro area and the US, influenced by dropping wholesale energy prices and ongoing risks from geopolitical tensions and disruptions in the Red Sea. The UK's GDP growth is expected to recover gradually, influenced by diminished impacts from past Bank Rate increases, with business surveys hinting at a near-term positive outlook. Although the labor market began to relax, it remained historically tight, with unemployment projected to rise slightly. December 2023 saw a drop in twelve-month CPI inflation to 4.0%, with expectations of a temporary return to the 2% target in Q2 of 2024, followed by a slight increase. The MPC anticipated inflation to stay above the target for most of the forecast period, driven by persistent domestic inflationary pressures despite increasing economic slack. The Committee noted balanced risks to inflation, with no significant difference between its modal and mean projections for the coming years. Maintaining the Bank Rate at 5.25% was seen as necessary to ensure a sustainable return to the 2% inflation target, with the MPC ready to adjust policy in response to economic data and persistent inflationary pressures.

TL;DR

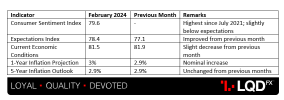

| Indicator | Details |

| Bank Rate Decision | Held steady at 5.25% |

| Vote Split | 6-3 in favor of holding the rate |

| Inflation Target | 2% |

| Bank Rate Forecast | Anticipated to decrease to around 3.25% by the end of the forecast period |

| Global GDP Growth | Subdued, with slight improvements in the US |

| Inflationary Pressures | Easing, especially in the euro area and the US, due to lower wholesale energy prices and geopolitical risks |

| UK GDP Growth | Expected to recover gradually, influenced by reduced impacts from past Bank Rate increases |

| Labor Market | Beginning to relax but remains tight, with a slight projected increase in unemployment |

| CPI Inflation | Dropped to 4.0% in December 2023, expected to temporarily hit 2% target in Q2 2024, then slightly rise |

| Inflation Outlook | Projected to stay above the 2% target for most of the forecast period, due to domestic pressures and economic slack |

| Committee's Stance | Ready to adjust the Bank Rate based on economic data and inflationary pressures |

The anticipated decision on the

Interest Rate suggests a steady rate of

5.25%, mirroring the previous result.

The upcoming decision on the

Interest Rate is set for

Thursday at

12:00 PM GMT.

USD - Unemployment Claims

The Initial Jobless Claims, released weekly on the first Thursday after the week ends, signify the earliest economic data for the nation. Market impact varies but garners more attention during significant developments or extreme readings. Despite being considered a lagging indicator, the number of new unemployment insurance filings is vital for assessing overall economic well-being, as it strongly relates to consumer spending and influences monetary policy decisions. It is also known as Jobless Claims.

For the week ending March 9, the advance figure for seasonally adjusted initial unemployment claims in the United States fell slightly to 209,000, marking a decrease of 1,000 from the previous week's revised figure. The revision also adjusted the count for the week prior from an initially reported 217,000 down to 210,000. Additionally, the four-week moving average, a more stable measure of unemployment claims, dipped to 208,000, reflecting a modest decline of 500 from the last week's revised average. These adjustments provide a clearer picture of the labor market's current state, emphasizing a slight but positive shift in unemployment trends.

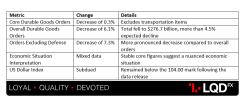

TL;DR

| Indicator | Figure for Week Ending March 9 | Change from Previous Week |

| Initial Unemployment Claims | 209,000 | Decrease of 1,000 |

| Previous Week's Revised Figure | 210,000 | Initially reported as 217,000 |

| Four-Week Moving Average | 208,000 | Decrease of 500 |

The projected number of

Unemployment Claims is forecasted to be

216,000, marking an increase from the previous figure of

209,000.

The upcoming

Unemployment Claims report is set for

Thursday at

12:30 PM GMT.

The last time, the

US Unemployment Claims report was announced on the 14th of March, 2024. You may find the market reaction chart

(US100 M5) below:

USD - Flash Manufacturing PMI

This index, derived from a monthly survey of about 800 purchasing managers in the manufacturing sector, gauges industry health and economic outlook. Conducted around the third week of each month, it yields two versions: the Flash and the Final report, with the Flash, initiated in May 2012, often having more impact due to its promptness. A score above 50 indicates industry growth, while below 50 suggests contraction. This index is a crucial leading economic indicator as purchasing managers' responses provide timely insights into business conditions, including employment, production, orders, prices, deliveries, and inventories, reflecting their rapid adaptation to market changes.

The health of the US manufacturing sector improved in February 2024, exceeding expectations. The S&P Global PMI index rose to a revised 52.2, marking the strongest expansion since July 2022. Production surged at its fastest pace in nearly two years, fueled by a significant rise in new orders and exports. Hiring in the sector also picked up, and raw material purchases rebounded for the first time in seven months. While businesses continued raising prices at a notable clip, their input costs witnessed some welcome relief. However, a slight dip in business confidence suggests a cautious outlook for the near future.

TL;DR

| Indicator | February 2024 Figures | Notable Trends/Comments |

| S&P Global PMI Index | 52.2 (revised) | Strongest expansion since July 2022 |

| Production | Not specified | Fastest pace in nearly 2 years, driven by new orders and exports |

| Hiring | Picked up | - |

| Raw Material Purchases | Rebounded | First time in 7 months |

| Price Increases | Continued | Notable rate, despite input cost relief |

| Business Confidence | Slight dip | Suggests cautious outlook |

The forecast for

Flash Manufacturing PMI stands at

52.0, a slight decrease from the previous

52.2.

USD – Flash Services PMI

This index measures the economic health of the service sector through a diffusion index derived from a survey of approximately 400 purchasing managers, conducted monthly around the third week. A score above 50 signals expansion, while below 50 indicates contraction. The report is issued in two versions, Flash and Final, with the Flash version, first introduced in November 2013, generally having more impact due to its early release. Serving as a leading economic indicator, the index reflects the quick response of businesses to market conditions, with purchasing managers providing vital, up-to-date insights into various business conditions such as employment, production, new orders, prices, deliveries, and inventories.

The February 2024 S&P Global US Services PMI indicated sustained growth in the sector, albeit with signs of moderation. The revised reading of 52.3 confirmed continued expansion, though at a slightly slower pace compared to January. While business activity remained in positive territory for the thirteenth month straight, the influx of new business slowed, with a decline in export orders. Backlogs of work eased as companies increased hiring, alleviating capacity pressures. The inflationary environment witnessed some improvement, with input cost growth reaching its lowest level since October 2020. Businesses responded by raising selling prices moderately, yet the increase remained subdued compared to the pre-2020 period. However, business confidence dipped to its lowest point since November 2023, reflecting concerns about weakening customer purchasing power and ongoing cost-cutting measures.

TL;DR

| Indicator | February 2024 Figures | Notable Trends/Comments |

| S&P Global Services PMI | 52.3 (revised) | Expansion continues, though at a slightly slower pace |

| Business Activity | Positive for 13 months | Ongoing expansion but moderated |

| New Business | Slowed down | Including a decline in export orders |

| Backlogs of Work | Eased | Due to increased hiring, reducing capacity pressures |

| Input Cost Growth | Lowest since October 2020 | Inflationary environment improving |

| Selling Prices | Moderate increase | More subdued than in pre-2020 periods |

| Business Confidence | Lowest since November 2023 | Concerns about customer purchasing power and cost-cutting |

The anticipated

Flash Services PMI is expected to be

52.2, down from the previous outcome of

52.3.

The upcoming

Flash Manufacturing &

Services PMI is scheduled for release this

Thursday at

1:45 PM GMT.

The last time,

US Flash Manufacturing &

Services PMI was announced on the 22nd of February, 2024. You may find the market reaction chart

(AUDUSD M5) below:

Disclaimer: The market news provided herein is for informational purposes only and should not be considered trading advice.