Tuesday 8-2-2011 Technical Analysis Report

EUR/USD

As it was expected through yesterday report, Euro continued declining against the American dollar whereas; the pair achieved the lowest price during yesterday trades at the level 1.3508 near to the level 1.3484 which represents 38.2% Fibonacci correction level for the bullish direction (from 1.2874 to 1.3508). Through forming the bearish direction that performed this declining, a bullish move for the stochastic index was noticed, this means the existence of a positive divergence that shifts the direction from downtrend to uptrend, so that the pair formed a bottom at the level 1.3508 and used it to push rising in order to re-test the nearest resistance levels. During the current trades the pair is in its way to test the resistance level 1.3680 and if the pair succeeded to break it up, it will continue rising targeting to reach the resistance level 1.3765.

The stability of these expectations requires the stability of the support level 1.3508.

Res: 1.3636 1.3690 1.3754

Pivot: 1.3572

Sup: 1.3518 1.3454 1.3400

GBP/ USD

The bullish direction is still dominating the trades of the pair for medium and long periods whereas the pair declined at the beginning of this week trades in order to re-test the support level 1.6055 which declared its stability, once the pair hit that level it reflected up again with expectations of more rising in the light of a harmonic pattern (butterfly) which is still in the forming stage and now it is forming the last wave (CD) after breaking the level 1.6055, its re-testing and stability against the pair till now.

So that it is expected to continue rising during trading the pair above the level 1.6055 targeting the level 1.6260 as the first target of the intraday levels, if the pair succeeded to break this level up it means that the pair tends to continue rising in order to achieve the target of the pattern that is formed on the medium-term, this target is to reach the resistance area between the levels 1.6460 and 1.6545.

The stability of these expectations requires the stability of the support level 1.6055.

Yesterday analysis is still remaining till now

Res: 1.6165 1.6222 1.6260

Pivot: 1.6127

Sup: 1.6070 1.6032 1.5975

USD/CHF

The level 0.9555 could not be steady against the price action yesterday, now the pair is trading below this level; this shows the weakness of the bullish direction for the near-term and the intraday levels with expectations of more declining during today's trades as trading below the level 0.9555 targeting the support level 0.9500 as the first target of this declining wave then to the support level 0.9435.

The stability of these expectations requires the stability of the resistance level 0.9555.

Res: 0.9591 0.9628 0.9659

Pivot: 0.9560

Sup: 0.9523 0.9492 0.9455

USD/CAD

The bearish direction is still dominating the pair for the medium and the short-terms, so it is expected that the intraday trades the pair will continue the bearish direction because the pair is still in process of forming a harmonic pattern whereas the price is moving now within the last wave of the pattern which is CD which is expected for it to target the support level 0.9658 but to confirm this, the pair must break the support level 0.9826 which represents the B point.

This expectation depends on breaking and the stability of the lowest support level 0.9826 which represents the B point.

But if the pair is not able to break the support level 128.56 which represents the B point and hold below it, the pair will target the support level 1.0060 which represents the C point for the pattern.

The previous analyze still remains till now

Res: 0.9925 0.9944 0.9979

Pivot: 0.9890

Sup: 0.9871 0.9836 0.9817

AUD/USD

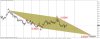

As noticed in the chart, the pair is in process of forming a harmonic pattern AB=CD whereas the ( BC ) rib came by 61.8% Fibonacci retracement correction level for the ( AB ) rib therefore it is expected that the ( CD ) will be completed at 161.8% Fibonacci retracement continuous level for the ( BC ) rip. if the resistance level 1.0194 that represents the ( B ) point is broken, the pair will continue rising to complete the remaining part of the ( CD ) rib which will be completed by reaching the level 1.0250 which represents the ( D ) point, it's noticed through forming the harmonic pattern that the pair is still keeping it's direction between the frame of the bullish channel for the medium and the short-terms.

This expectation depends on the stability of the support level 1.0102.

Res: 1.0160 1.0187 1.0216

Pivot: 1.0131

Sup: 1.0104 1.0075 1.0048

EUR/USD

As it was expected through yesterday report, Euro continued declining against the American dollar whereas; the pair achieved the lowest price during yesterday trades at the level 1.3508 near to the level 1.3484 which represents 38.2% Fibonacci correction level for the bullish direction (from 1.2874 to 1.3508). Through forming the bearish direction that performed this declining, a bullish move for the stochastic index was noticed, this means the existence of a positive divergence that shifts the direction from downtrend to uptrend, so that the pair formed a bottom at the level 1.3508 and used it to push rising in order to re-test the nearest resistance levels. During the current trades the pair is in its way to test the resistance level 1.3680 and if the pair succeeded to break it up, it will continue rising targeting to reach the resistance level 1.3765.

The stability of these expectations requires the stability of the support level 1.3508.

Res: 1.3636 1.3690 1.3754

Pivot: 1.3572

Sup: 1.3518 1.3454 1.3400

GBP/ USD

The bullish direction is still dominating the trades of the pair for medium and long periods whereas the pair declined at the beginning of this week trades in order to re-test the support level 1.6055 which declared its stability, once the pair hit that level it reflected up again with expectations of more rising in the light of a harmonic pattern (butterfly) which is still in the forming stage and now it is forming the last wave (CD) after breaking the level 1.6055, its re-testing and stability against the pair till now.

So that it is expected to continue rising during trading the pair above the level 1.6055 targeting the level 1.6260 as the first target of the intraday levels, if the pair succeeded to break this level up it means that the pair tends to continue rising in order to achieve the target of the pattern that is formed on the medium-term, this target is to reach the resistance area between the levels 1.6460 and 1.6545.

The stability of these expectations requires the stability of the support level 1.6055.

Yesterday analysis is still remaining till now

Res: 1.6165 1.6222 1.6260

Pivot: 1.6127

Sup: 1.6070 1.6032 1.5975

USD/CHF

The level 0.9555 could not be steady against the price action yesterday, now the pair is trading below this level; this shows the weakness of the bullish direction for the near-term and the intraday levels with expectations of more declining during today's trades as trading below the level 0.9555 targeting the support level 0.9500 as the first target of this declining wave then to the support level 0.9435.

The stability of these expectations requires the stability of the resistance level 0.9555.

Res: 0.9591 0.9628 0.9659

Pivot: 0.9560

Sup: 0.9523 0.9492 0.9455

USD/CAD

The bearish direction is still dominating the pair for the medium and the short-terms, so it is expected that the intraday trades the pair will continue the bearish direction because the pair is still in process of forming a harmonic pattern whereas the price is moving now within the last wave of the pattern which is CD which is expected for it to target the support level 0.9658 but to confirm this, the pair must break the support level 0.9826 which represents the B point.

This expectation depends on breaking and the stability of the lowest support level 0.9826 which represents the B point.

But if the pair is not able to break the support level 128.56 which represents the B point and hold below it, the pair will target the support level 1.0060 which represents the C point for the pattern.

The previous analyze still remains till now

Res: 0.9925 0.9944 0.9979

Pivot: 0.9890

Sup: 0.9871 0.9836 0.9817

AUD/USD

As noticed in the chart, the pair is in process of forming a harmonic pattern AB=CD whereas the ( BC ) rib came by 61.8% Fibonacci retracement correction level for the ( AB ) rib therefore it is expected that the ( CD ) will be completed at 161.8% Fibonacci retracement continuous level for the ( BC ) rip. if the resistance level 1.0194 that represents the ( B ) point is broken, the pair will continue rising to complete the remaining part of the ( CD ) rib which will be completed by reaching the level 1.0250 which represents the ( D ) point, it's noticed through forming the harmonic pattern that the pair is still keeping it's direction between the frame of the bullish channel for the medium and the short-terms.

This expectation depends on the stability of the support level 1.0102.

Res: 1.0160 1.0187 1.0216

Pivot: 1.0131

Sup: 1.0104 1.0075 1.0048