Monday 4th of April 2011 GIGFX Daily Technical Analysis Report

EUR/USD

The trades of the end of the last week saw the pair’s declining targeting to re-test the broken up bearish trendline where a bottom has been formed and coincided with the trendline and pushed the pair to rise again achieving a close around the resistance level 1.4248, at the beginning of this week trades it is expected that the pair will rise targeting the resistance level 1.4310 followed by the resistance level 1.4389 which represent 127% and 161.8% of Fibonacci's continuous levels for the bearish wave (From 1.4248 to 1.4020) and in order to reach these levels, the pair should break the resistance level 1.4248 with stability above.

The stability of these expectations requires the stability of the support level 1.4160.

Res: 1.4292 1.4360 1.4475

Pivot: 1.4177

Sup: 1.4109 1.3994 1.3926

GBP/ USD

As it was expected at the end of the last week trades, the pair succeeded to reach the support level 1.5985 which became a suitable bottom to achieve more gains for the intraday levels and for the short-term, the pair reflected up forming a harmonic pattern AB=CD which is almost done by reaching the resistance level 1.6185 which represents the point D for the formed pattern expecting the probability of corrective declining to the pair for the intraday levels targeting the support level 1.6080 before continuing to rise again trying to form a new top for this bullish wave for the short-term and the intraday trades expecting that, this formed top may be at the resistance level 1.6225 which represents 61.8% of Fibonacci’s correction level for the last bearish wave for the medium-term.

It is important to notice that, the support level represents 61.8% of Fibonacci’s correction level for the last bearish wave BC and at the same time represents a middle line for a bullish channel in which the pair is moving expecting remaining the pair inside this channel during today's intraday trades.

The stability of these expectations requires the stability of the support level 1.6080.

Res: 1.6171 1.6231 1.6331

Pivot: 1.6071

Sup: 1.6011 1.5911 1.5851

USD/CHF

It is noticed that the pair is forming a bullish direction for the short and the medium-term, this direction has been formed through moving inside a bullish channel for the short and the medium-term, the pair formed a bearish top coincided with the top border of the bullish channel that will push the pair to re-test the nearest support levels, expecting more decline for the pair targeting the bottom border of the bullish channel at which the price coincides with the level 0.9177 that represents 38.2% of Fibonacci's correction level for the bullish wave (From 0.8915 to 0.9339).

The stability of these expectations requires the stability of the resistance level 0.9290.

Res: 0.9330 0.9414 0.9489

Pivot: 0.9255

Sup: 0.9171 0.9096 0.9012

USD/CAD

As expected at the end of last week trades the pair declined trying to complete the (butterfly) harmonic pattern by reaching the price to the support level 0.9590 which represents the D point for the end of the pattern the pair was able to break the important support level 0.9670 which represents the X point for the pattern at the end of last week trades expecting for it a further drop during the intraday trades targeting the previous mentioned support level 0.9590.

Notable, that the formed pattern is a positive harmonic pattern which refers to the probability of reflecting the price up with a corrective reflection by a strong probability therefore with reaching the price to the end of the pattern it is recommended to observe the pair the price on appearance any reflecting sign for the price which means that there's a probability on reflecting the price up retesting the resistance level 0.9670 as it's first targeted price for this correction.

Success of this scenario up depends on the stability of the resistance level 0.9670.

Res: 0.9689 0.9737 0.9770

Pivot: 0.9656

Sup: 0.9608 0.9575 0.9527

AUD/USD

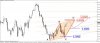

The Australian dollar is continuing the strong rising against the American dollar whereas during the end of last week trades, the pair registered a new record by reaching the level 1.0394, with opening this week trades the pair is continuing achieving a new records reaching the level 1.0416 nearest to 200% Fibonacci retracement continuous level for the direction ( from 1.0312 to 1.0202 ), this strong bullish move for the pair is still embodied through the movement inside the bullish channel therefore a further rise is expected with breaking the resistance level 1.0422 , the pair will target reaching the level 1.0506 which represents 161.8% Fibonacci retracement continuous level for the bearish direction ( from 1.0200 to 0.9705 ) which is expected to coincide at it the price with the top border for the bullish channel.

This expectation depends on the stability of the support level 1.0334.

Res: 1.0416 1.0446 1.0498

Pivot: 1.0364

Sup: 1.0334 1.0282 1.0252

EUR/USD

The trades of the end of the last week saw the pair’s declining targeting to re-test the broken up bearish trendline where a bottom has been formed and coincided with the trendline and pushed the pair to rise again achieving a close around the resistance level 1.4248, at the beginning of this week trades it is expected that the pair will rise targeting the resistance level 1.4310 followed by the resistance level 1.4389 which represent 127% and 161.8% of Fibonacci's continuous levels for the bearish wave (From 1.4248 to 1.4020) and in order to reach these levels, the pair should break the resistance level 1.4248 with stability above.

The stability of these expectations requires the stability of the support level 1.4160.

Res: 1.4292 1.4360 1.4475

Pivot: 1.4177

Sup: 1.4109 1.3994 1.3926

GBP/ USD

As it was expected at the end of the last week trades, the pair succeeded to reach the support level 1.5985 which became a suitable bottom to achieve more gains for the intraday levels and for the short-term, the pair reflected up forming a harmonic pattern AB=CD which is almost done by reaching the resistance level 1.6185 which represents the point D for the formed pattern expecting the probability of corrective declining to the pair for the intraday levels targeting the support level 1.6080 before continuing to rise again trying to form a new top for this bullish wave for the short-term and the intraday trades expecting that, this formed top may be at the resistance level 1.6225 which represents 61.8% of Fibonacci’s correction level for the last bearish wave for the medium-term.

It is important to notice that, the support level represents 61.8% of Fibonacci’s correction level for the last bearish wave BC and at the same time represents a middle line for a bullish channel in which the pair is moving expecting remaining the pair inside this channel during today's intraday trades.

The stability of these expectations requires the stability of the support level 1.6080.

Res: 1.6171 1.6231 1.6331

Pivot: 1.6071

Sup: 1.6011 1.5911 1.5851

USD/CHF

It is noticed that the pair is forming a bullish direction for the short and the medium-term, this direction has been formed through moving inside a bullish channel for the short and the medium-term, the pair formed a bearish top coincided with the top border of the bullish channel that will push the pair to re-test the nearest support levels, expecting more decline for the pair targeting the bottom border of the bullish channel at which the price coincides with the level 0.9177 that represents 38.2% of Fibonacci's correction level for the bullish wave (From 0.8915 to 0.9339).

The stability of these expectations requires the stability of the resistance level 0.9290.

Res: 0.9330 0.9414 0.9489

Pivot: 0.9255

Sup: 0.9171 0.9096 0.9012

USD/CAD

As expected at the end of last week trades the pair declined trying to complete the (butterfly) harmonic pattern by reaching the price to the support level 0.9590 which represents the D point for the end of the pattern the pair was able to break the important support level 0.9670 which represents the X point for the pattern at the end of last week trades expecting for it a further drop during the intraday trades targeting the previous mentioned support level 0.9590.

Notable, that the formed pattern is a positive harmonic pattern which refers to the probability of reflecting the price up with a corrective reflection by a strong probability therefore with reaching the price to the end of the pattern it is recommended to observe the pair the price on appearance any reflecting sign for the price which means that there's a probability on reflecting the price up retesting the resistance level 0.9670 as it's first targeted price for this correction.

Success of this scenario up depends on the stability of the resistance level 0.9670.

Res: 0.9689 0.9737 0.9770

Pivot: 0.9656

Sup: 0.9608 0.9575 0.9527

AUD/USD

The Australian dollar is continuing the strong rising against the American dollar whereas during the end of last week trades, the pair registered a new record by reaching the level 1.0394, with opening this week trades the pair is continuing achieving a new records reaching the level 1.0416 nearest to 200% Fibonacci retracement continuous level for the direction ( from 1.0312 to 1.0202 ), this strong bullish move for the pair is still embodied through the movement inside the bullish channel therefore a further rise is expected with breaking the resistance level 1.0422 , the pair will target reaching the level 1.0506 which represents 161.8% Fibonacci retracement continuous level for the bearish direction ( from 1.0200 to 0.9705 ) which is expected to coincide at it the price with the top border for the bullish channel.

This expectation depends on the stability of the support level 1.0334.

Res: 1.0416 1.0446 1.0498

Pivot: 1.0364

Sup: 1.0334 1.0282 1.0252