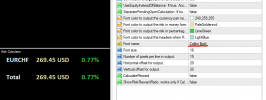

That looks interesting, but could be rather misleading when there are trades in more than one symbol. Also, how would the Free Margin level be displayed like that? I don't think it's possible. Stop-Out and Margin Call - yes, but not Free Margin.What I mean is, The indicator can display Stop Out, Free Margin and Margin Call lines on the chart. You can also set your own line at the custom level.

Displaying these lines on the chart is especially useful for people who trade with high leverage or go all-in, where the risk is very high.

You can adjust the line color, style, thickness and visibility (for each one separately). The last parameter that can be changed is the refresh interval.

If you have open orders on several stocks, the line levels will change dynamically.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sorry, maybe what I said was not very clear.That looks interesting, but could be rather misleading when there are trades in more than one symbol. Also, how would the Free Margin level be displayed like that? I don't think it's possible. Stop-Out and Margin Call - yes, but not Free Margin.

What I mean is, only consider the situation of a single variety and multiple orders.

Because people often need to know what the average price is for multiple orders in order to plan their account's funding arrangements

There is no need to edit source for that. You just set the font to its bold version. For example, here is 'Calibri Bold':

View attachment 26848

Thanks guy . Have a good day for help

Are you using it in MT4 or MT5? Windows or macOS?I think your indicator is very good but has one drawback: it flashes too much on the screen. Looking at it is very easy on the eyes and a bit uncomfortable. Is it possible to minimize the refresh of this indicator?

i use mt5 and windowAre you using it in MT4 or MT5? Windows or macOS?

This is some great work. Really appreciated!

Quick request that I am not sure how to solve. In case you use hedging as a strategy, the risk is not correctly defined. Let´s say you have 1 lot long and 1 lot short with a difference in price of 50 pips in the same pair. The risk should be 50 pips...

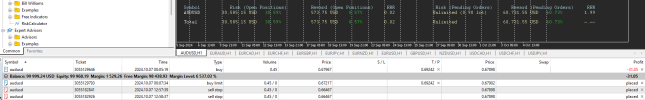

Attached you see an example of a 100k demo account...the real risk should be around USD900 but it reads unlimited and the potential reward around USD1.3-1.5k, but you can see almost 100K cumulative...don´t know if this is something worth looking into it. I beleive in the US hedging is not permited but elsewhere...

Many thanks in advance,

Quick request that I am not sure how to solve. In case you use hedging as a strategy, the risk is not correctly defined. Let´s say you have 1 lot long and 1 lot short with a difference in price of 50 pips in the same pair. The risk should be 50 pips...

Attached you see an example of a 100k demo account...the real risk should be around USD900 but it reads unlimited and the potential reward around USD1.3-1.5k, but you can see almost 100K cumulative...don´t know if this is something worth looking into it. I beleive in the US hedging is not permited but elsewhere...

Many thanks in advance,

Attachments

Last edited:

First, you have separate calculation for open trades and pending orders. The 'unlimited' result is showing for the pending orders where you have 2 x 0.45 sells and 1 x 0.45 buy, so 0.45 lot remains unhedged.This is some great work. Really appreciated!

Quick request that I am not sure how to solve. In case you use hedging as a strategy, the risk is not correctly defined. Let´s say you have 1 lot long and 1 lot short with a difference in price of 50 pips in the same pair. The risk should be 50 pips...

Attached you see an example of a 100k demo account...the real risk should be around USD900 but it reads unlimited and the potential reward around USD1.3-1.5k, but you can see almost 100K cumulative...don´t know if this is something worth looking into it. I beleive in the US hedging is not permited but elsewhere...

Many thanks in advance,

Second, even if you were using the combined calculation, it would still be an infinite risk because your buys have take-profits while your sells don't have stop-losses. After the buys' TPs are hit, your sells will be unhedged.

You are right! it´s a matter of misinterpretation on my part. Many thanks for your quick response. BR.First, you have separate calculation for open trades and pending orders. The 'unlimited' result is showing for the pending orders where you have 2 x 0.45 sells and 1 x 0.45 buy, so 0.45 lot remains unhedged.

Second, even if you were using the combined calculation, it would still be an infinite risk because your buys have take-profits while your sells don't have stop-losses. After the buys' TPs are hit, your sells will be unhedged.

Similar threads

- Replies

- 2K

- Views

- 512K

- Replies

- 1

- Views

- 256

- Replies

- 54

- Views

- 17K

- Replies

- 27

- Views

- 19K

- Replies

- 6

- Views

- 6K