USDCAD, wins back losses

During the Asian session, the USDCAD pair is growing uncertainly, developing the “bullish” momentum formed yesterday, when the instrument was trading near local lows since January 26.

Investors are in no hurry to open long positions on the US currency, preferring to wait for today's publication of the final report on the labor market for February, hoping to receive additional confirmation of the possibility of raising interest rates during the March meeting of the US Federal Reserve. Given the aggravation of the situation around Ukraine, it is likely that the regulator may change its original plans. Some concern is caused by the US statistics on business activity published in recent days, which reflects the rapid decline in sentiment, especially in the service sector.

The Canadian currency is supported by the actions of the Bank of Canada. On Wednesday, the regulator expectedly raised interest rates by 25 basis points to 0.5%. Yesterday, the head of department, Tiff Macklem, stressed that the Board of Governors of the bank expects further tightening of monetary policy as the national economy grows, while the previous target levels remain unchanged.

Support and resistance

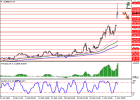

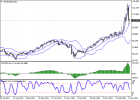

On the daily chart, Bollinger bands reverse a horizontal plane: the price range slightly expands from below, trying to keep with the surge in trading activity in the middle of the week. MACD indicator tries to reverse upwards, keeping its previous sell signal (the histogram is below the signal line). Stochastic shows similar dynamics, retreating slightly from its lows, signaling that the US dollar is oversold in the ultra-short term.

Resistance levels: 1.2700, 1.2750, 1.2786, 1.2812.

Support levels: 1.2650, 1.2600, 1.2558, 1.2500.

During the Asian session, the USDCAD pair is growing uncertainly, developing the “bullish” momentum formed yesterday, when the instrument was trading near local lows since January 26.

Investors are in no hurry to open long positions on the US currency, preferring to wait for today's publication of the final report on the labor market for February, hoping to receive additional confirmation of the possibility of raising interest rates during the March meeting of the US Federal Reserve. Given the aggravation of the situation around Ukraine, it is likely that the regulator may change its original plans. Some concern is caused by the US statistics on business activity published in recent days, which reflects the rapid decline in sentiment, especially in the service sector.

The Canadian currency is supported by the actions of the Bank of Canada. On Wednesday, the regulator expectedly raised interest rates by 25 basis points to 0.5%. Yesterday, the head of department, Tiff Macklem, stressed that the Board of Governors of the bank expects further tightening of monetary policy as the national economy grows, while the previous target levels remain unchanged.

Support and resistance

On the daily chart, Bollinger bands reverse a horizontal plane: the price range slightly expands from below, trying to keep with the surge in trading activity in the middle of the week. MACD indicator tries to reverse upwards, keeping its previous sell signal (the histogram is below the signal line). Stochastic shows similar dynamics, retreating slightly from its lows, signaling that the US dollar is oversold in the ultra-short term.

Resistance levels: 1.2700, 1.2750, 1.2786, 1.2812.

Support levels: 1.2650, 1.2600, 1.2558, 1.2500.