The New Zealand dollar is moderately declining against the US currency during the morning session, testing the level of 0.6770 for a breakdown. NZDUSD develops a "bearish" momentum and returns to the local lows of March 16, updated last Wednesday, which became the most volatile day of the week.

On April 13, the Reserve Bank of New Zealand (RBNZ) raised interest rates by 50 basis points at once from 1% to 1.50%. The indicator was adjusted for the fourth time in a row, but each time the regulator raised it by only 0.25%. In a follow-up statement, the officials noted that such a move is designed to provide additional flexibility in economic policy in the face of high geopolitical uncertainty, as well as to curb high inflation and the cost of living, which is one of the key problems for world economies today. Note that consumer prices in New Zealand rose by almost 6% with while the target range of the RBNZ of 1–3%.

The macroeconomic statistics released the day before managed to provide only little support to the instrument: Business NZ PMI rose from 53.6 to 53.8 points in March, while analysts had expected a more modest value of 53.7 points.

Meanwhile, New Zealand is gradually opening its borders to tourists. Thus, fully vaccinated residents of neighboring Australia will be able to visit the country without having to go through quarantine. Travelers from other visa-free countries will be allowed to enter New Zealand from May 2.

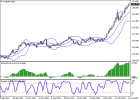

On the daily chart, Bollinger Bands are declining rather actively. The price range is expanding; however, it fails to catch the development of "bearish" sentiments. MACD is preserving a stable sell signal (located below the signal line). Stochastic is still located near its lows, signaling a strongly oversold NZD in the ultra-short term.

Resistance levels: 0.6812, 0.6874, 0.6924, 0.696 | Support levels: 0.6732, 0.67, 0.665, 0.66

On April 13, the Reserve Bank of New Zealand (RBNZ) raised interest rates by 50 basis points at once from 1% to 1.50%. The indicator was adjusted for the fourth time in a row, but each time the regulator raised it by only 0.25%. In a follow-up statement, the officials noted that such a move is designed to provide additional flexibility in economic policy in the face of high geopolitical uncertainty, as well as to curb high inflation and the cost of living, which is one of the key problems for world economies today. Note that consumer prices in New Zealand rose by almost 6% with while the target range of the RBNZ of 1–3%.

The macroeconomic statistics released the day before managed to provide only little support to the instrument: Business NZ PMI rose from 53.6 to 53.8 points in March, while analysts had expected a more modest value of 53.7 points.

Meanwhile, New Zealand is gradually opening its borders to tourists. Thus, fully vaccinated residents of neighboring Australia will be able to visit the country without having to go through quarantine. Travelers from other visa-free countries will be allowed to enter New Zealand from May 2.

On the daily chart, Bollinger Bands are declining rather actively. The price range is expanding; however, it fails to catch the development of "bearish" sentiments. MACD is preserving a stable sell signal (located below the signal line). Stochastic is still located near its lows, signaling a strongly oversold NZD in the ultra-short term.

Resistance levels: 0.6812, 0.6874, 0.6924, 0.696 | Support levels: 0.6732, 0.67, 0.665, 0.66