USDCAD, in anticipation of additional growth drivers

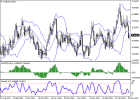

The USDCAD pair tests the level of 1.2500 for a breakout, retreating from local lows of January 20, renewed last Friday, and waiting for additional growth drivers to appear.

The whole picture in the market changes slightly. Traders are still analyzing warning signs from Eastern Europe, trying to assess the prospects for global inflation and economic growth against a special military operation in Ukraine. Further escalation of the conflict significantly increases the demand for safe assets, but investors are increasingly giving their preference to the US currency, as the US Federal Reserve launched a cycle of raising interest rates. Also, as early as May, the rate growth rates may be increased, given the record inflation in the US and the relatively positive situation in the national labor market. The “bulls” are also supported by the escalation of tension between Russia and the West, the imposition of mirror economic sanctions by the states, and the lack of progress in ceasefire negotiations between representatives of the Russian and Ukrainian delegations. The next face-to-face round is scheduled for March 28–30. It will be held in Turkey.

The US macroeconomic statistics released on Friday were negative. Thus, the index of consumer confidence from the University of Michigan in March decreased from 59.7 to 59.4 points, while analysts did not expect changes. The pending home sales fell by 4.1% in February after falling by 5.8% in January. Analysts had expected positive dynamics at 1.0%. Meanwhile, the 10-year US Treasury yield rose by 5.4 basis points to its highest level since May 2019, around 2.54%, which pushed the US dollar index to a two-week high.

Resistance levels: 1.2558, 1.2600, 1.2650, 1.2700.

Support levels: 1.2450, 1.2400, 1.2335, 1.2300.

The whole picture in the market changes slightly. Traders are still analyzing warning signs from Eastern Europe, trying to assess the prospects for global inflation and economic growth against a special military operation in Ukraine. Further escalation of the conflict significantly increases the demand for safe assets, but investors are increasingly giving their preference to the US currency, as the US Federal Reserve launched a cycle of raising interest rates. Also, as early as May, the rate growth rates may be increased, given the record inflation in the US and the relatively positive situation in the national labor market. The “bulls” are also supported by the escalation of tension between Russia and the West, the imposition of mirror economic sanctions by the states, and the lack of progress in ceasefire negotiations between representatives of the Russian and Ukrainian delegations. The next face-to-face round is scheduled for March 28–30. It will be held in Turkey.

The US macroeconomic statistics released on Friday were negative. Thus, the index of consumer confidence from the University of Michigan in March decreased from 59.7 to 59.4 points, while analysts did not expect changes. The pending home sales fell by 4.1% in February after falling by 5.8% in January. Analysts had expected positive dynamics at 1.0%. Meanwhile, the 10-year US Treasury yield rose by 5.4 basis points to its highest level since May 2019, around 2.54%, which pushed the US dollar index to a two-week high.

Resistance levels: 1.2558, 1.2600, 1.2650, 1.2700.

Support levels: 1.2450, 1.2400, 1.2335, 1.2300.